Meet the insurtech: Openstream.ai

Customer service chatbots using stock answers are a familiar punching bag for consumers, but can a chatbot be created that understands the user’s human subtleties?

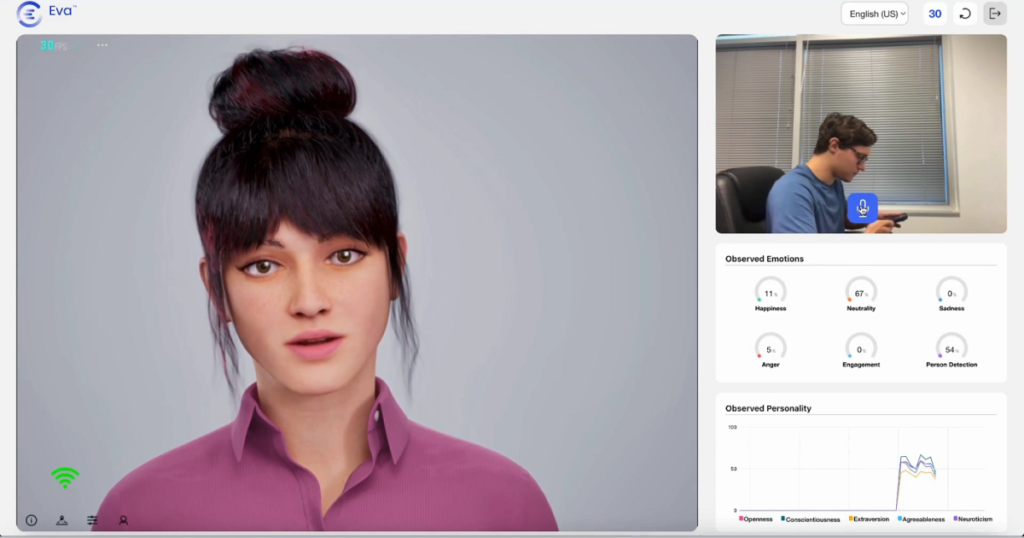

Openstream.ai, an AI avatar company that serves insurance and other industries, has one that does. The company launched in 2014 with a first version of “Eva,” which it then relaunched in 2020 as part of a new suite of supporting technology. Eva can now interact via video chat with policyholders for their claims.

Raj Tumuluri, founder, CEO and chief technology officer of Openstream.ai

Building and enhancing Eva has three elements, according to Raj Tumuluri, founder, CEO and chief technology officer of Openstream.ai. First is acquiring knowledge about a claim. Second is managing interaction with the policyholder, which involves reasoning in context and managing the context of a conversation. Third is showing empathy and engagement with the policyholder’s circumstances, demeanor and tone.

Tumuluri came from a background as an inventor and author of standards for multi-modal and speech systems. Openstream.ai serves both property and casualty and the health insurance spaces.

Some of the algorithms Openstream.ai developed can assess someone appearing on video chat to evaluate their mental health, including depression and anxiety, and personality. To some extent, the technology can also detect these traits from just audio.

Tumuluri demonstrated the technology with footage of a sample claim interaction with Eva, in which the claimant had their car broken into and a cellphone stolen. Eva began by saying, “Sorry that happened. I would like to help you with that,” before asking if the phone was in plain view in the car.

When the claimant asked, “Why is that important?” Eva responded, “I need to determine whether your policy covers the theft of your mobile phone,” to which the claimant responded that the phone was in the glove compartment, so the loss was covered.

Eva and claimants, Tumuluri said, “observe each other and have shared context, and therefore are able to engage better based on what the user is saying. A lot of things are conveyed through verbal and nonverbal behavior.”

Openstream.ai tracks the nature of claims events and the nature of interaction between Eva and claimants, so if they are discussing a loss, the tone does not go abruptly from empathy to “zing in the voice, saying ‘I can help you with claim processing,'” Tumuluri said. “You want to have that somber attitude maintained throughout, because the context of the interaction is not something that is very pleasant, so you have to be neutral or show some emotional empathy or engagement, and that is something that is maintained.”

Aside from improving interaction with insurance claimants, Openstream.ai also helps support underwriters by providing data relevant to their work, according to Tumuluri.

“The bulk of [their] time is actually spent in gathering the information about the insurance,” he said. “What they should look for is anomalies, the insurance loss rate, the loss runs and other things.”

Openstream.ai’s technology has agents for these items and the effectiveness of other agents. “We are able to gather or prepare a document for them that they can quickly glance over and then decide what their pricing should be,” Tumuluri said, adding that can also be translated into natural language instruction for underwriters or insurance agents about what action to take regarding coverage.