Beazley adds $290m cyber ILW to its $510m cyber cat bonds, in $1bn cyber cat coverage

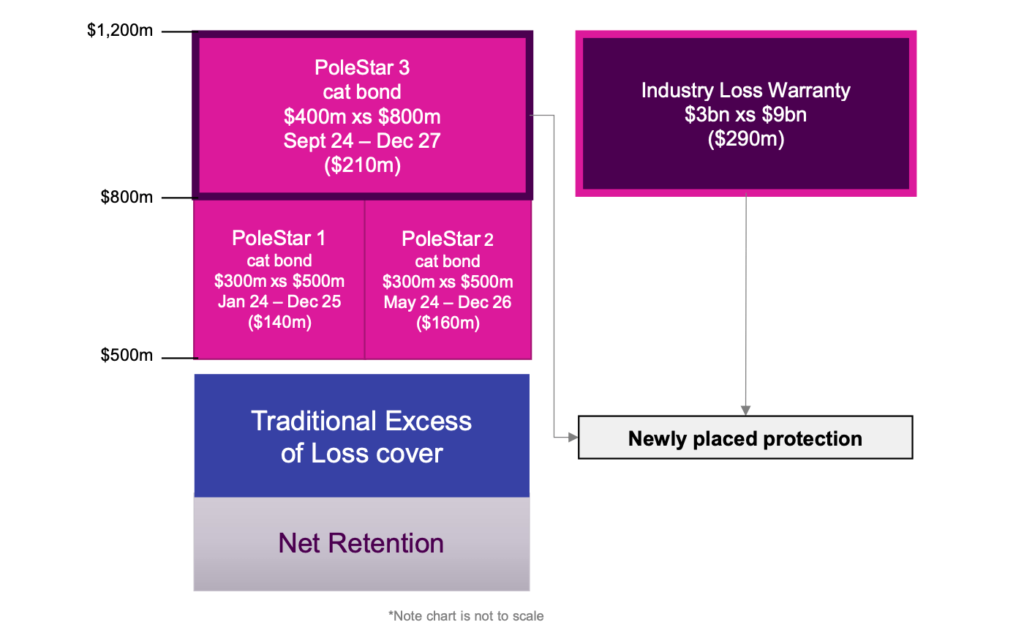

While it has been growing its cyber underwriting business, specialist insurer Beazley has also implemented a robust hedging strategy to control the tail, recently securing a $290 million cyber industry loss warranty (ILW) cover and securing its third PoleStar Re cyber catastrophe bond.

As Artemis reported a few weeks ago, Beazley secured $210 million in cyber reinsurance from its third 144A PoleStar Re cyber cat bond in September.

Now, at a company presentation made yesterday, Beazley’s senior team revealed the completion of a $290 million cyber industry loss warranty (ILW) as well, to provide the firm even more tail risk cover for catastrophic cyber loss events.

Added to the now $510 million of outstanding PoleStar Re catastrophe bonds, it means capital markets are playing a significant role in Beazley’s $1 billion of cyber reinsurance as we understand there to have been some capital market support for the cyber ILW as well.

Beazley has $200 million of traditional cyber catastrophe reinsurance that sits below the cyber cat bonds and cyber ILW coverage, for total cyber cat protection of $1 billion.

The company also has cyber quota share reinsurance coverage as well, so has an element of cover that also works on a sideways basis for it as well.

Beazley explained yesterday that the cyber catastrophe reinsurance covers both malicious and non-malicious events, while it also holds catastrophe margin within the reserves as well.

The purchases of cyber cat bond and cyber ILW coverage have helped Beazley manage its exposure at a time when its cyber premiums have continued to grow, with its aggregate exposure roughly unchanged since 2018 despite cyber premiums almost tripling in the period.

In fact, the company disclosed yesterday that its 1-in-250 probable maximum loss from cyber as of the end of 2023 stood at $651 million, but since the completion of its 144A catastrophe bonds in 2024 and this recent cyber ILW, the 1-in-250 year figure has declined to $461 million, again despite further premium growth.

It’s a positive example of the use of capital markets backed capacity and securitization technology to source excess of loss protection for a cyber portfolio.

The majority of Beazley’s cyber catastrophe XOL reinsurance protection now comes from the capital markets and this is likely to remain the case at least for the foreseeable future, given the appetite appears larger in cat bonds and other alternative capital backed instruments, than among traditional reinsurance firms.

You can read all about Beazley’s latest PoleStar Re Ltd. (Series 2024-3) cyber catastrophe bond transaction in our Deal Directory, where you can analyse details of almost every cat bond ever issued and filter the list by peril to show only cyber cat bonds.