A guide to insurance prelicensing courses

A guide to insurance prelicensing courses | Insurance Business America

Guides

A guide to insurance prelicensing courses

Insurance prelicensing courses can be your ticket to passing your state’s insurance license exam. Know more about these courses and some good options here

Guides

By

Ramon Berenguer

To start your career as an insurance agent, there are several requirements to fulfill. One of the most crucial prerequisites is going through a prelicensing process. This typically involves taking the appropriate courses, then taking and passing their state exams.

The prelicensing process is required of aspiring insurance agents because there’s a lot of insurance information, regulations, and terms to know. As insurance is mostly concerned with the health and property of your clients, there are many rules and ethical practices to navigate. That’s why it’s essential that insurance agents have a wide body of knowledge and ensure they practice their trade with competence, diligence, and in an ethical manner.

So, what options do you have for an insurance prelicensing course? How much is it? What are the best insurance prelicensing courses? To answer questions that would-be insurance agents might have about the prelicensing process, Insurance Business provides insight into these and more.

An insurance prelicensing course is a class that teaches you, the aspiring insurance agent, everything you need to know about the type of insurance license you want to get in your state.

There are state-specific requirements for how to become an agent for a particular kind of insurance in their location. In some cases, the state may not even have any prelicensing requirements and set other prerequisites instead. However, even if you are in a state that doesn’t require taking prelicensing courses, it’s usually best for would-be insurance agents to take them – more on this below.

Eligibility requirements

To be eligible for even trying to get a state insurance course and make a license application, candidates must be:

at least 18 years old

successfully pass a background check

hold a valid driver’s license and have no violations

You need an insurance prelicensing course to get familiar with the terms, rules, and regulations of the type of insurance you wish to specialize in.

Simply put, taking a prelicensing course for your chosen line of insurance can give you an edge and increase your chances of passing the exam. It’s not unusual for aspiring insurance agents who take a prelicensing course to pass the insurance licensure exam on their first try.

The passing score can vary across different types of insurance license exams, but typically you’d need a test score of 70%.

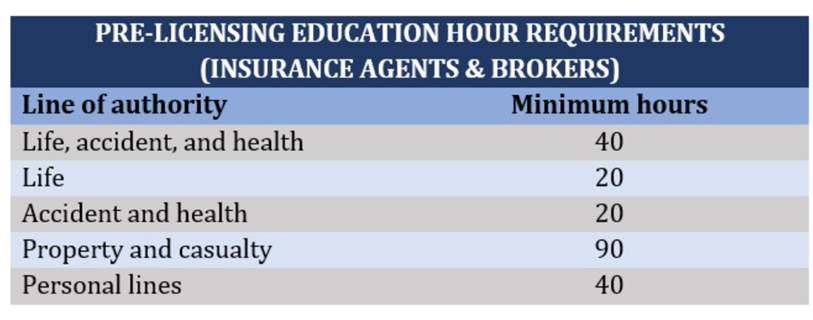

The total length of time can vary by state and type of insurance license. It’s not unusual for prelicensing courses to take up as much as 90 hours of study time due to the large volume of course content. That many hours is typical for Property & Casualty (P&C).

The minimum study time for a prelicensing course is around 20 hours. Here’s a table that shows how many hours it would usually take to study for different insurance types:

In general, state insurance licensure exams take about 2 to 3 hours to complete. Some states allow taking more than one insurance license exam on the same day, but this is not advisable as the allotted time will not change.

If you’re wondering whether industry veterans can shorten the time to take additional insurance licenses, the answer is yes. Industry veterans can get exemptions if they already have certain designations.

There are states that let you skip pre-licensing courses and take the licensure exam if you have the Chartered Life Underwriter (CLU) designation. In this case, you will only be required to take the Life & Health Laws and Regulations exam.

If you hold Chartered Property Casualty Underwriter (CPCU) designation, you will only need to take the Property & Casualty Laws and Regulations exam.

In your efforts to become an insurance agent, you’ll need the best prelicensing courses you can find. Here’s a small selection of the best insurance prelicensing courses you can take:

1. Securities Training Corporation Review (STC Review)

Renowned for their FINRA study materials, the STC Review also offers a comprehensive preparatory course for those who want to make life insurance their specialty. STC Review offers study materials that include flashcards, video lectures, and study manuals.

STC’s online prelicensing course is especially suited for candidates who prefer visual learning. Their On-Demand Training consists of pre-recorded videos of different topics.

If you prefer a more hands-on, direct learning approach, you can call their instructor hotline to ask teachers your study questions or sign up for their Premier Plus plan that offers live classroom sessions.

You can download PDF files of their study materials, then print them out and learn in the comfort of your home. But for a more immersive experience, you can always sign up for their practice tests of interactive final exams.

What might be very helpful for you is STC’s recommended schedule in its study manual, offering state-specific certification exams when they’re required by the laws of your state. Plus, STC review provides you with a tracking page to let you know how far you’ve progressed in your studies.

Bear in mind that STC Review’s plan pricing is state-specific; meaning, prices will vary from state to state. For instance, you can expect higher prices for prelicensing courses for California than Alabama.

There are three plan tiers that give you 6 months of access to the online licensing courses, giving you a significant window and plenty of time to learn and study at your own pace. Their basic package includes course materials like the study manual, final exams, and the necessary certification tests for your state.

Course

Price

Standard Plan (state specific) 6-month access

$79

Premier Plan (state specific) 6-month access

$139-151

Premier Plus Plan (state specific) 6-month access

$189-201

Online Flashcards (subject specific) 6-month access

$25

Insurance Continuing Education – 1 year access

$35

2. ExamFX

ExamFX is one of the more affordable online insurance prelicensing courses and is a popular choice among those who have gone on to establish successful insurance careers. This course offers standard flashcards, video lectures, and practice exams.

Exam FX only offers would-be insurance agents 60 days of access. Although this time window might be sufficient for full-time students, it may not be favorable for those who have nine to fivers or have other demands on their daily schedule.

What is beneficial about this course is that a lot of it is in the form of audio lectures. This format allows you to multi-task and take lessons in your idle time, like while on a long commute, for instance. You should still devote much of your study time to the other study materials to ensure you retain the information.

Apart from the audio lectures, another unique feature of Exam FX is what they call their Guarantee Exam. This is designed to mimic the exam you will take and serves as an excellent “dress rehearsal”.

This mock exam is meant to be taken right before your exam date. Should you pass the Guarantee Exam, ExamFX claims that you will have the same performance and results in the real exam.

Course

Price

Self-Study Package (60-day access)

$149.95

Video Study Package (60-day access)

$239.80

Live Online Package (60-day access)

$369.95

Live, In-Person Package (60-day access)

$389.90

Insurance Continuing Education (1 year access)

$6.95-$39.95

3. Kaplan University Insurance Review

Thanks to its flexible purchasing options (you get to pick only the materials you need) and thorough study programs, Kaplan University has become a popular choice for life insurance exam preparation.

While the on-demand courses are available throughout the US, the in-person courses are only offered in 12 states:

Colorado

Connecticut

Georgia

Illinois

Massachusetts

Michigan

Minnesota

New York

Pennsylvania

Tennessee

Texas

Wisconsin

Unfortunately, no live online classes are offered at Kaplan. But what is unique about this online insurance prelicensing course is that it uses an effective Prepare, Practice, Perform learning strategy. Should you choose to take their in-person classes, expect four full days of intensive learning for life insurance and health insurance.

Within these four days, you can have 31 hours total of getting your questions answered, doing practice problems, and reviewing essential insurance concepts. However, if you only need to study life insurance, you can go for the short 2.5-day life insurance course.

For those who want to self-study, Kaplan offers these three self-paced courses:

Basic Online Course – consists of an online, on-demand course with online textbook

InsurancePro Qbank – includes two full-length practice exams, state law supplement, and performance tracker

Basic Print Course – same as the online course but in print format

Kaplan also offers their Essentials Course. It includes materials from the Basic courses, along with access to a video library and video review section. While most of these materials can be purchased singly, it’s more cost-efficient to buy them as a bundle.

All courses have free updates during your access period and email support for your questions.

4. CompuCram

CompuCram is probably the most cost-efficient online insurance prelicensing course on the market, since their packages do not go over $90 but still give users 9-month access. More than 85% of students passed their license exams after using CompuCram.

One of the unique features of CompuCram’s courses is that their lessons focus on industry buzzwords. This can be advantageous for those who want to become insurance agents, since being familiar with the industry jargon can increase their credibility with potential clients and employers.

Like ExamFX, this course also offers a mock test to assess the student’s readiness. Another good thing about this course’s pricing is that even though some prelicensing course providers have state-specific pricing, Compucram does not charge more than $90 across the board.

Course

Price

Life Insurance Exam Prep (state-specific with 180-day access)

$69

Life & Health Insurance Exam Prep (state-specific with 180-day access)

$89

Before you sign up for any of these courses, consider these key factors first. Taking the right insurance prelicensing course can mean the difference between passing the state insurance exam or failing and having to take it again. Here’s what you should consider when choosing a prelicensing course:

1. Licensing and accreditation

Make sure that the course has the approval of the relevant authorities in your state. The course should also meet your state’s licensing requirements for insurance.

2. Curriculum and course content

The course should cover all the relevant topics and teach you the skills necessary to succeed in your career. Consider also that some courses may not offer Continuing Education (CE) credits.

3. Accessibility and flexibility

Choose only the course that allows you to study and learn at your own pace and doesn’t take up too much of your time. Check that the online classes don’t put undue strain on your daily schedule. Better yet, choose one that has on-demand videos of lessons. Also, choose a course that gives you a significant access period. Some courses provide access for as few as 90 days while others offer as long as 6 months.

4. Reviews and reputation

To get a better picture of the quality of the course materials and overall learning experience from the course, check online reviews from those who took the course.

Here’s a useful tip: it pays to choose among the best and most popular insurance prelicensing courses as they will have a lot of reviews. Some of those who took these courses may also offer some advice on what to expect, what to study, and how to pass these courses. Here’s an example: watch this video of an insurance agent who took the Kaplan University course:

5. Cost and benefits

Although cost is important, consider the value you get from the course. Is it worth the price in exchange for passing the exam for your state’s insurance license? Does the course offer other benefits like Continuing Education credits or customer service via email or phone?

While there is no formal requirement for taking prelicensing courses, for some it can be standard practice to take them. This is especially true for those who are not insurance professionals or industry veterans and lack the educational or professional background in insurance.

Which of these insurance prelicensing courses will you consider taking? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!