"It’s an industry problem": Is social inflation reshaping the insurance landscape?

“It’s an industry problem”: Is social inflation reshaping the insurance landscape? | Insurance Business America

Insurance News

“It’s an industry problem”: Is social inflation reshaping the insurance landscape?

Examining the impact of AI and social trends on global insurers

Insurance News

By

Lauren Johnson

Social inflation has been around since 2015, according to research from Swiss Re, with subsequent liability claims costs rising by 16% over the last five years – and by a staggering 57% over the past decade. As social inflation continues to plague firms, questions still remain around the best practices companies can take to tackle any forthcoming challenges.

Speaking to IB, Erich Bublitz (pictured), head of excess & surplus at AmTrust E&S Insurance Services, said that this phenomenon, driven by rising insurance claims costs due to societal trends and legal changes, is especially evident in longer-tail lines of business like general liability and auto liability.

‘No one company can solve the problem. It’s an industry problem’

Here, AmTrust E&S focuses on underwriting complex risks, making it particularly vulnerable to the effects of social inflation.

“By definition, you end up with slightly more complex risks, risks that have some unique aspect to them, and the result of that tends to be more complex claims, more severe claims,” Bublitz added. “No one company can solve the problem. It’s an industry problem. If only one carrier is adjusting rates appropriately, they kind of price themselves out of the market.”

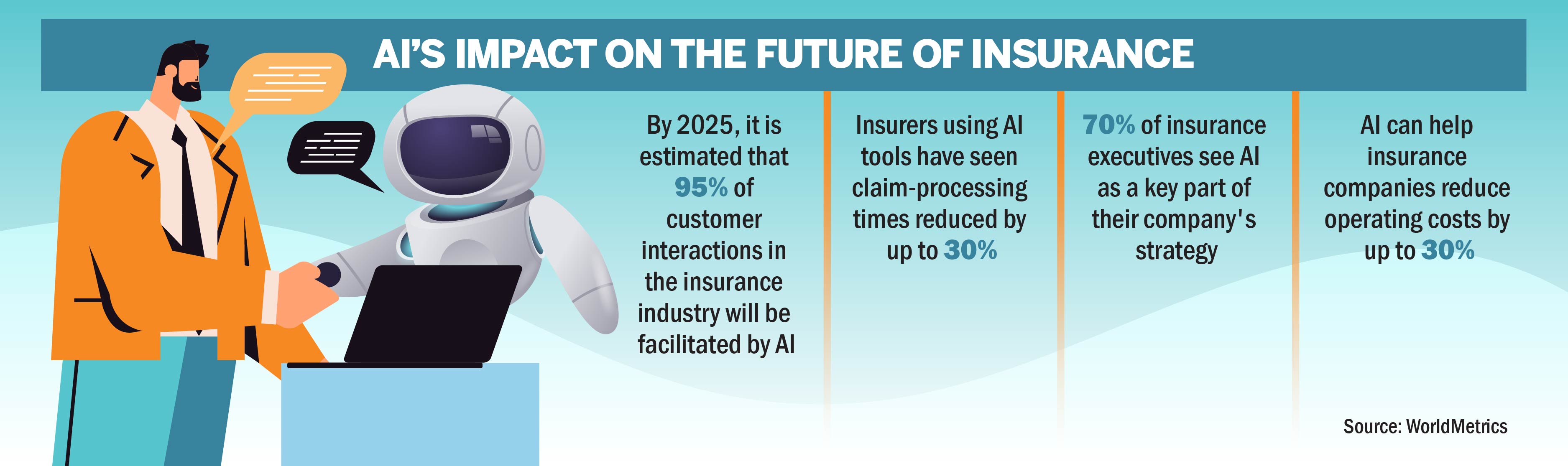

Effective claims management is central to AmTrust E&S’s strategy. And they’re not alone. According to research from WorldMetrics, firms using AI for claims processing have reduced settlement times by 50% and improved claims accuracy by up to 90%.

“Once the claim comes in, how we handle that claim and how quickly we close that claim out can make a difference,” Bublitz said. Prompt and efficient claims handling is essential to prevent the exacerbation of social inflation. Clear communication among underwriters, claims departments, and brokers ensures that everyone understands coverage intentions and limitations.

“Communication is probably one of the bigger things that we can do,” added Bublitz. “Social inflation is largely a factor of severity, not so much frequency. What can we do on a loss control perspective, both that we know what the risks are for our insureds, but also, how do we help the insureds mitigate those risks so that they don’t have a claim, or if the claim comes in, it’s significantly less severe?”

‘We’ve seen no indication that social inflation is slowing down at this point’

Educational initiatives are vital in this strategy. AmTrust E&S provides insureds with resources and sends loss control representatives to assess and mitigate risks.

“It’s education both on a general basis and education on a very specific basis to them, based upon what the loss control comes back,” Bublitz said. These efforts help insureds understand their exposures and take proactive measures to reduce potential claims.

“We’ve seen no indication that social inflation is slowing down at this point. As long as we still have some of this uncertainty over what’s happening, I think we’re continuing to see more social inflation,” he said.

Despite these challenges, Bublitz is optimistic about the industry’s capacity to adapt. Recognizing social inflation and adjusting rates accordingly is a positive step.

“The recognition of social inflation is probably good, because it is helping drive rates up a little bit,” he noted. “It’s about trying to make sure that we are providing the coverage that we anticipate covering and not providing coverage that we didn’t anticipate covering.”

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!