How to Create a Risk Management Plan for Consultants

There’s a relatively common notion that independent consultants spend a lot of their time traveling abroad and doing their work poolside (probably with a pina colada in hand). Sounds like a dream, right? It’s a dream for consultants, too, because it’s far from reality for most.

While that may not reflect the real world for many consultants, there are still plenty of perks to consultancy work. Think: flexible work hours, variety, networking, and, yes, the ability to travel.

But being a consultant also comes with some unique risks that many other professionals don’t encounter. A consultant’s livelihood relies heavily on their client relationships, which could mean financial ruin if those relationships get jeopardized. That’s why every consultant needs to have a risk management plan in place, to successfully tackle the inevitable challenges while also making the most of opportunities for growth and innovation.

With that in mind, we’ve put together this guide with everything you need to create a risk management plan for your consultancy business.

Why is it Important for Consultants to Have a Risk Management Plan?

You may be thinking, “Risk management plans are just for large corporations.”

Think again.

Every business has risks and independent consultants are no exception. Whether you provide consulting services in marketing, IT, HR, financial services, graphic design, or even risk management, there are risks that could compromise your success and reputation. That’s why it’s crucial to be proactive and use all the resources at your disposal to minimize and control the impact of potential and real threats.

Because simply ignoring business risks won’t make them go away.

Consultants are brought in as experts in their field, which means that their clients typically have high expectations for their work. What’s more, competition can be fierce for consultants. In fact, the global management consulting services market is expected to grow from $976.3 billion in 2022 to $1,184 billion in 2027. Having an effective risk management plan goes a long way in helping consultants manage client expectations and stand out from the competition.

What Kinds of Risks Do Consultants Face?

No matter what stage your consulting business is at, it’s essential to know the challenges you may face. While threats can vary based on your specific area of work, there are several risks that all consultants, regardless of their industry, must be ready to tackle.

Unhappy Clients: No one can please everyone all the time, and there are plenty of reasons for unhappy clients in the consultancy world. Think: missed deadlines, cost overruns, failure to meet expectations, misrepresentation, and miscommunication. Even with detailed contracts and clear communication, unhappy clients are inevitable. That’s why this risk should be top of mind for all consultants.

Data Breaches: Most consultants store client data on their computers, meaning a data breach could have devastating financial and PR consequences. Considering that the global average cost of a data breach in 2023 was $4.45 million, a 15% increase from three years prior, it’s easy to see why so many businesses don’t survive a data breach or cybercrime. This isn’t a threat any consulting business can afford to overlook.

Unpredictable Markets and Unstable Income: If there’s one thing that’s certain in consulting work, it’s uncertainty. Most consultants are familiar with the feast or famine cycle. It’s easy to get caught up in that cycle, where all of your attention goes to a current client, followed by a period of no work — and no income. The delicate balance of paying attention to existing clients while finding new ones isn’t easy, but it is necessary.

Scope Creep: You know when a client asks for extra work beyond what’s been agreed upon and included in the contract? That’s known as scope creep, and it can be a tricky situation for consultants to deal with. Those just starting their consulting career may be tempted to complete extra requests as a favor to a client. While you may think this is one way to keep them happy and coming back to you, it can lead to problems like missed deadlines, subpar work, and setting an expectation that is hard to maintain.

How to Start a Risk Management Plan for Consultants

Now that you know some of the risks your consulting business may encounter, what can you do about them? Having a risk management plan will help you stay on top of issues that could threaten your business — it may also help you spot opportunities for growth.

Below are the key steps for creating a risk management plan for your consulting business:

1. Risk Identification

Knowing about a risk means you can plan for it. That’s why the first step to take when preparing a risk management plan is to identify all potential threats to your consulting business. Be sure to look at all aspects of your business. Some threats are obvious, while others may take a bit of research to discover.

At this stage, you may find it worthwhile to start a risk register, where you can document information for all identified risks.

2. Risk Analysis

Once you’ve identified risks, you can analyze them and determine the potential quantitative and qualitative impact each could have on your business. That means figuring out the likelihood of a risk occurring versus the effect it could have.

3. Risk Evaluation and Ranking

This stage is where you ask, “How likely is it that this risk will happen, and what will it take to recover if and when it does happen?” Ranking risks is a vital step as it helps you understand how to prioritize resources to mitigate specific threats. A risk assessment matrix can help you visualize each risk’s likelihood and impact.

4. Risk Response

Once you’ve ranked the risks, the next step is determining how to respond to each one. This could involve mitigation tactics, such as limiting who has access to sensitive information or transferring the risk to a third party with insurance. For example, if you’re concerned about a data breach, you can transfer the associated risk to your insurance provider with cyber liability insurance.

5. Risk Monitoring

There is no such thing as “one and done” with risk management. While new risks are inevitable, eliminating one risk could result in another threat popping up. A risk management plan is a living document that needs to be reviewed regularly and updated as required. You don’t want the plan to end up outdated and irrelevant when you need it.

Want more tips on preparing a risk management plan? For a complete breakdown of how to put together an effective risk management plan, check out our detailed guide.

Insurance for Consultants

Risk is simply a part of doing business. You can’t have one without the other.

And risks will inevitably change over time; new concerns will emerge as your business grows or a project progresses. So, to successfully grow your consulting business, you have to keep on top of threats that could jeopardize your practice.

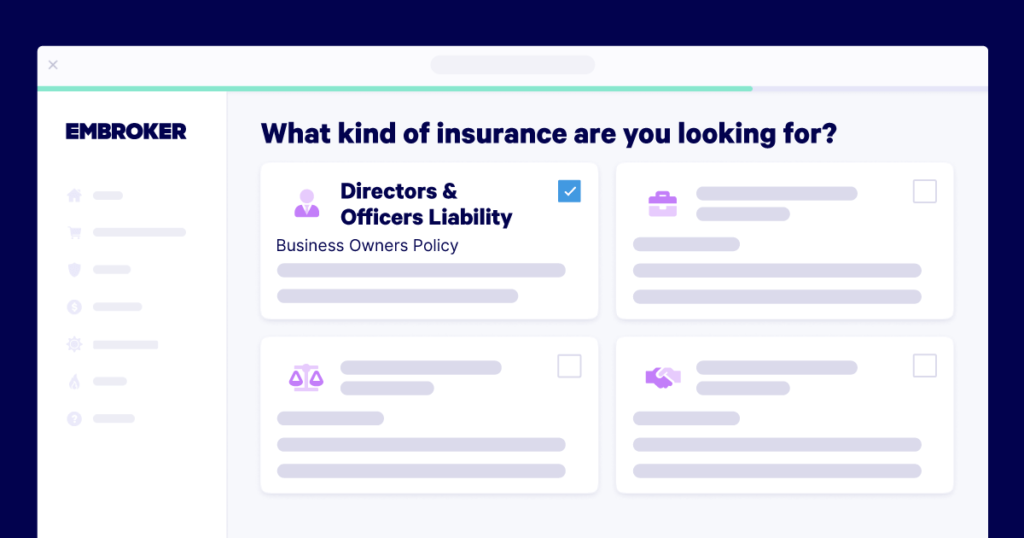

One of the most effective ways for consultants to manage risk is by transferring it to a third party, such as your business insurance provider. With coverage like professional liability insurance, your consulting business will be protected from allegations of errors and omissions, while cyber liability insurance will help your firm withstand a data breach.

To learn more about coverage for consultants, read our recent blog post that outlines everything about the insurance policies consultants need.