Understanding treaty reinsurance – and the factors that influence it

Understanding treaty reinsurance – and the factors that influence it | Insurance Business Canada

Reinsurance

Understanding treaty reinsurance – and the factors that influence it

Why do insurance companies buy treaty reinsurance?

Reinsurance

By

Mia Wallace

Offering ‘Industry Insight on Reinsurance’ in a recent webinar, senior leaders from across reinsurance broking giant Guy Carpenter came together to examine the treaty reinsurance market. Starting with the very basics of what treaty reinsurance is and where it sits in the risk transfer value chain, Simon Liley (pictured), managing director at Guy Carpenter, outlined that it is effectively, “insurance for insurance companies”.

Understanding where treaty reinsurance sits in the risk transfer value chain

The reinsurance treaty market falls into two key buckets – reinsurance and retrocession. The reinsurance market provides insurers with capacity and capital. The retrocession market is the next leg down and provides capacity and capital to the reinsurance market in order for them to manage their business. Looking at the characteristics of each of the key players involved in the ecosystem, he said it’s interesting to see that the insurance market is dealing with granular underwriting information on a risk-by-risk basis.

“This is particularly important for construction business, where often project policies or master builders risks are broked into the insurance market by a broker with lots of good information on loss history, risk management, types of risk experience, etc.” he said. “Typically, the teams in an insurance company can be quite vast. We’re talking about construction underwriting teams of 200/300 people.

“When you look at the treaty market, we are dealing with larger numbers and we’re dealing with consolidated portfolio data. It’s much more of an actuarially driven decision, and it’s a lot more long-term. The insurance market will be making decisions on a sort of derivative basis, on a very small case by case [basis], whereas the reinsurers are making long-term decisions on 1,000s of policies in one-go.”

Why do insurance companies buy reinsurance?

Having offered this snapshot into the characteristics of the value chain of the insurance and reinsurance markets, Liley addressed the question – why do insurance companies buy reinsurance? Insurers have valued stakeholders, they have shareholders, and they have funds to support, he said, and all of these stakeholders have significant expectations in order to produce a return on their investment.

To meet these, insurance companies develop their own underwriting plans and strategies, deciding which products to write in order to provide each area of their business with a clear requirement regarding delivering a return on equity. “So, when an insurance company purchases reinsurance, what they’re doing is allowing themselves a better chance, a more steady chance, of achieving their goals, of delivering a better return, of achieving their stakeholder’s planned expectations.

“Reinsurance, in some ways, is exactly the same as why an insured would buy car insurance, it’s to spread risk. It allows an insurance company to increase its capacity beyond what it would normally be able to do if it was just writing insurance on its own and it provides additional security to that company. Importantly, as a public-listed company, it increases stability in the results.”

Buying reinsurance is a great softener for taking out volatility and creating much more stability in your margins, he said. It also has implications for cash flow, considering that running an insurance company can be a very expensive business and so reinsurance serves as an extremely cash flow advantageous route to setting up an insurance company. “Insurers will develop a lot of the capital they need in order to exist, sometimes from shares, sometimes from funds, but more importantly, reinsurance is a very important part of the capital underpinning that insurance company’s life.”

What are the market conditions impacting the treaty reinsurance market?

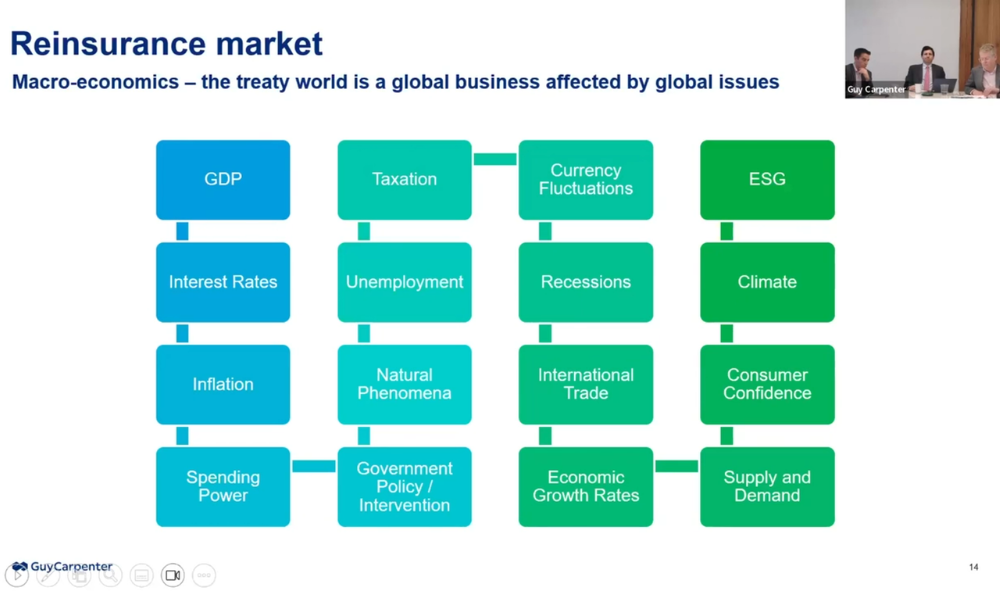

Broadening the discussion to look at rate, market trends and the pressing challenges facing the market, the team at Guy Carpenter emphasized the important capital and volatility protection that treaty reinsurance offers insurers. They also pointed to how the price and scope of treaty reinsurance are impacted not just by the profitability of a given sector but also by wider market conditions.

Examining some of the factors that impact a reinsurer, Liley highlighted that an insurer has the flexibility to quite quickly change their products, improve their pricing, open up new offices and explore new products. “The treaty market doesn’t have as much flexibility,” he said. “It supports its cedents, it supports insurance companies on a long-term basis, and it supports them on solid products that have been around for many years. Therefore, when they have that kind of larger, long-term nature, their flexibility is less.”

On the financial side of the equation, he noted that reinsurers are impacted by changes to interest rates as, if they can’t make as much money on the significant funds which they hold that will, in turn, significantly impact the margins that they make. Reinsurance companies can certainly manage risks like fluctuation and potentially natural phenomena, he said, but these are not immediate controls they can introduce.

Reinsurers have their own stakeholders and among these, there is an increasing focus on climate change, ESG and sustainability agendas. As such, at this point, reinsurers are trying to speculate where the industry may be in five or so years’ time with regards to the risks written in 2024. That means questioning whether they have enough information on the portfolios they’re insuring today to satisfy the demand for clarity from their stakeholders and investors in 2030.

“All of these issues are a concern of the reinsurers,” Liley said. “They affect them in their day-to-day trading, but none of them is something which the reinsurance companies can quickly fix. [Rather] it’s something they look to manage through their pricing.”

Keep up with the latest news and events

Join our mailing list, it’s free!