Allstate’s Sanders Re II 2020 cat bond marked for losses of up to 70%

It’s become apparent that US primary insurance carrier Allstate is set to make more reinsurance recoveries from its catastrophe bonds for aggregate losses, as the firm has made a small recovery from the $100 million Class B notes of its Sanders Re II Ltd. (Series 2020-1) transaction and the market expects more erosion to that layer.

Allstate has already completely exhausted its $300 million Sanders Re II 2019-1 catastrophe bond transaction.

As we explained last week, Allstate revealed making $1.37 billion of recoveries under its catastrophe reinsurance arrangements during calendar year 2021, $300 million of which came after a full exhaustion of the Sanders Re II 2019 notes.

In addition, the carrier had also made a small $3 million recovery from the Sanders Re II 2020-1 cat bonds Class B notes, which sit on top of the eroded 2019 layer in its aggregate reinsurance tower (see below).

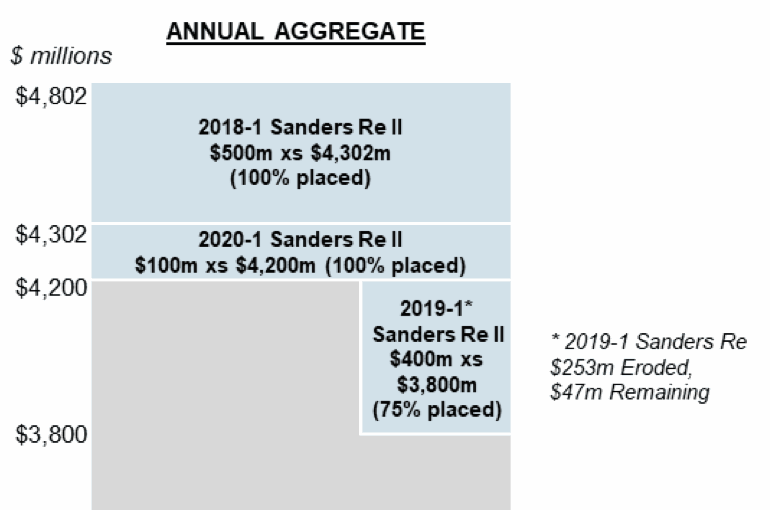

The image above shows the state of Allstate’s aggregate reinsurance tower as of August 2021, when the company reported its reinsurance arrangements.

The 2019-1 layer is the cat bond that has now been fully eroded and is paying out its full $300 million to Allstate, with those notes now marked for a total loss on secondary market cat bond pricing sheets.

However, Allstate has only reported a just over $3 million recovery from the 2020-1 layer above, so far.

But secondary market cat bond pricing sheets from brokers that Artemis has seen, suggest that the losses are likely to continue eating into that layer and the loss to cat bond investors could increase as a result.

One broker pricing sheet we’ve seen has the Sanders Re II 2020-1 Class B tranche of notes marked down for bids of around 30 cents on the dollar, suggesting as much as a 70% loss of principal is anticipated for that layer.

Other secondary cat bond pricing sheets have the $100 million Sanders Re II 2020-1 Class B notes marked around 35 to 40 cents on the dollar.

With the majority of pricing sheets marking the Allstate sponsored cat bond down for at least a 60% loss of principal, it seems likely erosion of that layer is set to continue and investor losses with it.

Given how the aggregate loss year runs to April, we assume the erosion of the Sanders Re II 2020-1 Class B notes is also due to loss creep from winter storm Uri and the Texas freeze, plus some creep from other aggregate year events, which was the driver for Allstate’s aggregate losses eating into the 2019 cat bond as well.

See details of catastrophe bond losses and cat bonds considered at risk of loss in our Directory.