Etiqa secures key role as official fire insurer for Singapore’s HDB flats

Etiqa secures key role as official fire insurer for Singapore’s HDB flats | Insurance Business Asia

Property

Etiqa secures key role as official fire insurer for Singapore’s HDB flats

Homeowners urged to consider additional home contents insurance policies

Property

By

Roxanne Libatique

Etiqa Insurance Singapore (Etiqa) has been appointed as the official fire insurer for the Housing and Development Board (HDB) Fire Insurance Scheme, which provides essential fire insurance coverage for all sold HDB flats.

This new role for Etiqa commenced on August 16, 2024.

Housing and Development Board Fire Insurance Scheme

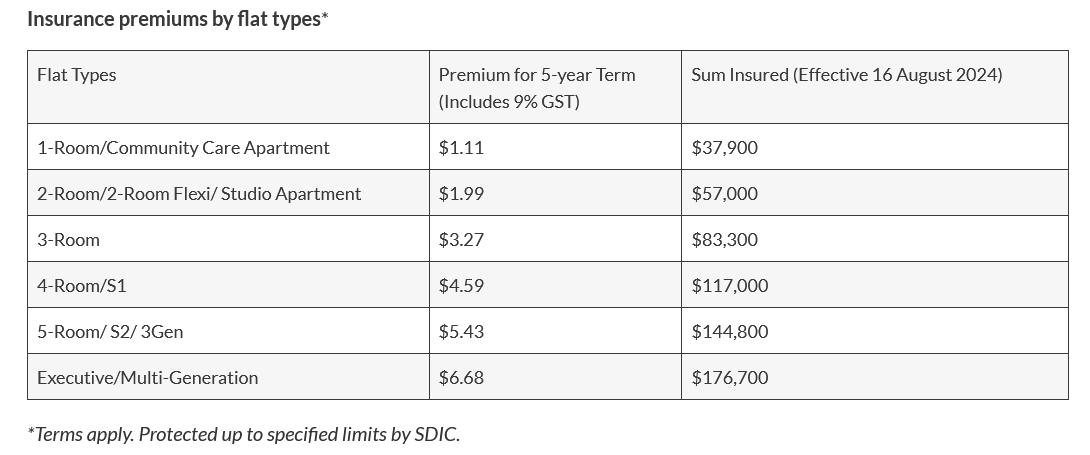

The HDB Fire Insurance Scheme is designed to cover the costs of restoring internal structures and fixtures provided by HDB that are damaged by fire. It also includes coverage for repair work on adjacent properties and for water damage from burst pipes.

Current HDB flat owners with existing policies will continue to be covered by their current provider until the policy’s expiration.

Etiqa Insurance Singapore as official insurer for HDB Fire Insurance Scheme

Raymond Ong, CEO of Etiqa Insurance Singapore, noted the importance of home security in the face of unforeseen events like fires.

“At Etiqa Insurance Singapore, we understand the importance of home security, especially in the face of unforeseen events like fires,” he said.

He reiterated Etiqa’s dedication to providing affordable fire insurance, ensuring that homeowners are financially protected against fire damage to the internal structures and fixtures provided by HDB.

“As the appointed insurer for the HDB Fire Insurance Scheme, we are committed to delivering affordable and comprehensive fire insurance coverage and ensuring Singaporean homeowners have the peace of mind they deserve,” Ong said.

For broader protection, homeowners are encouraged to consider additional home content insurance policies, which can cover items not included under the HDB scheme, such as personal possessions and renovations.

Etiqa Insurance Singapore’s 10th anniversary

The agreement with HDB comes on the heels of Etiqa’s celebration of its 10th anniversary by participating in the NATAS Travel Fair 2024, which took place from August 16 to 18 at the Singapore Expo.

Etiqa offered special promotions at the event, including the chance to win Apple products valued at SG$2,350 and an extra 5% discount on all Travel Infinite insurance plans for those using Maybank cards.

Ong expressed that Etiqa’s commitment to safeguarding Singaporeans during their travels remains strong, particularly given the rising occurrence of unexpected events during travel.

“Over the past decade, Etiqa has remained steadfast in our commitment to safeguarding Singaporeans during their travels. Given the rising frequency of unexpected events such as air turbulence, the necessity of comprehensive travel insurance cannot be overstated,” he said.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!