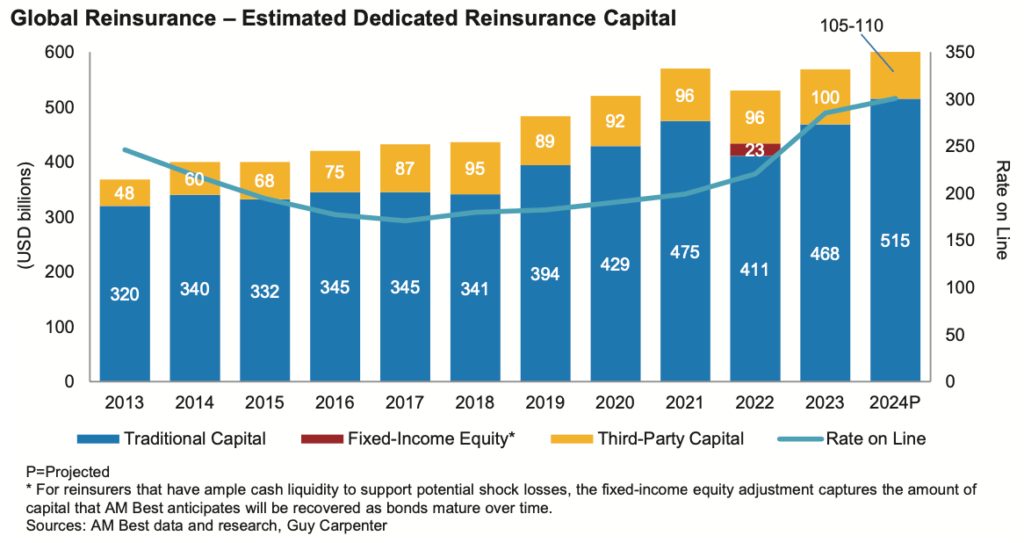

Third-party capital in reinsurance could grow 10% to $110bn in 2024: AM Best, GC

Third-party capital in reinsurance, including that from catastrophe bonds and insurance-linked securities (ILS), could grow by as much as 10% in 2024, with AM Best and broker Guy Carpenter projecting it will be at $105 billion to as high as $110 billion by year-end.

Industry capitalisation remains high, but still rating agency AM Best believes the pricing environment will prove to be more sustainable this time around.

With reinsurance capacity being provided for capital protection more than earnings protection, the reset in price, attachments and terms is expected to remain largely sticky and companies are expanding into the improved reinsurance market conditions, while investors are appreciating the improved returns and risk-sharing arrangements.

Which has resulted in some new capital, although still not in start-up reinsurer form and AM Best does not expect that to come back with any kind of vengeance, even though reinsurance market conditions are still so strong.

“Capital has become more nimble and opportunistic, focused either on already well-established and successful rated balance sheets with a proven track record or on short-term insurance-linked securities (ILS) vehicles.

“Higher interest rates have contributed to this behavior, given the availability of investment alternatives much more attractive on a risk-adjusted basis than in the past,” AM Best explained.

The rating agency also said, “AM Best believes that, following the corrective measures taken in the last few years (combined with current market and economic conditions), profit margins, albeit unlikely to be repeated at such high levels, will be sustainable over the medium term. Higher return expectations from investors, both to make up for previous lackluster years and to match higher yields from competing alternatives, plus the lack of new disruptors should support ongoing hard market conditions.”

Orderly and disciplined is how AM Best expects the reinsurance market to behave and dedicated capital continues to expand in reinsurance to support this, with ILS taking its share, as can be seen in the chart below.

Working with reinsurance broker Guy Carpenter, AM Best puts out estimates for traditional dedicated reinsurance capital and third-party reinsurance capital, which is really in the main the cat bond and broader ILS market.

The pair see traditional reinsurance capital rising 10% to $515 billion by the end of 2024, but also see the ILS market keeping pace.

They expect the ILS and third-party capital reinsurance pool to reach between $105 billion and $110 billion by the end of the year, which could match the traditional market’s 10% growth rate.

Overall, that would put dedicated reinsurance capital at a new high, of as much as $625 billion by AM Best and Guy Carpenter’s measure.

But, of course, demand for reinsurance has been rising steadily as well and this capital is being soaked up, so we are not yet at a stage in the cycle where excess capital is going to pressure rates significantly, it appears.

The number itself is less important than the growth being seen, as Aon already had alternative capital in reinsurance at $110 billion as of the middle of this year.

For us, the three most important and notable pieces of information are, that reinsurance capital is growing overall, that the ILS market is keeping pace and taking its share, and that despite this the supply-demand equilibrium remains in place and so we aren’t seeing any return to meaningful softening at this time.

That all bodes well for continued attractive reinsurance returns (loss activity allowing) for the shareholders of major reinsurers and for the investors backing cat bond and ILS fund structures and strategies.