10 Things Top RIAs Did to Succeed in 2023: Schwab

What sets the top performing RIAs apart?

From cultivating talent to deploying technology and communicating with clients, these firms are employing a number of strategies to achieve top performance, according to Charles Schwab’s 2024 RIA Benchmarking Study, released Thursday.

“As RIAs seek to grow, many are achieving success by pursuing a multifaceted approach,” Lisa Salvi, Charles Schwab Advisor Services managing director, business consulting and education, noted in the report.

“Firms can jumpstart their organic engine by being intentional in developing outreach strategies. To support growth, upskilling talent and enhanced digital capabilities that offer personalized experiences will help firms serve current clients and attract the next generation,” she said.

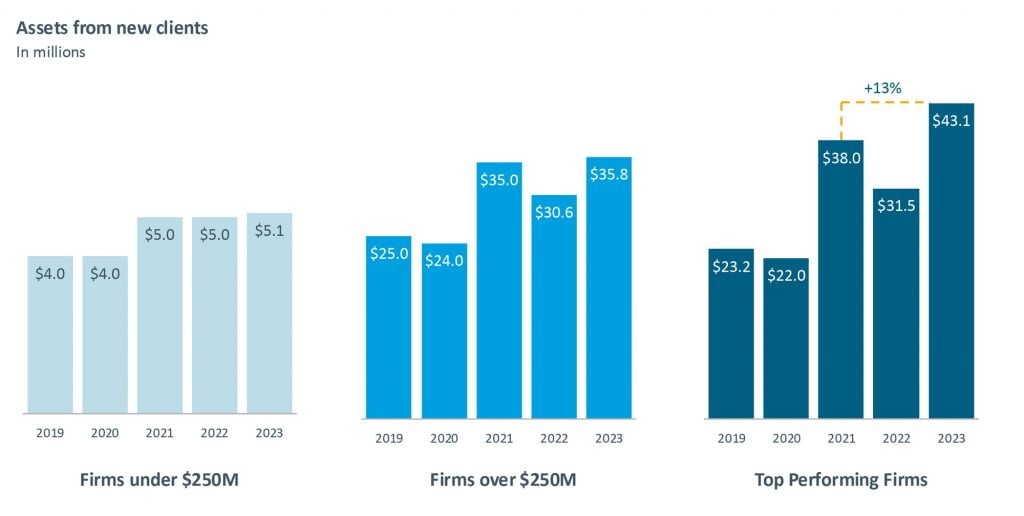

Assets from new clients reached their highest point and assets from existing clients reached their second-highest point over the last five years in 2023, according to the study, which gathered data from 1,304 advisory firms representing $2 trillion in assets under management.

Client retention held steady at its decade-long 97% rate, and AUM for the median firm increased 17.9%, rebounding significantly from 2022, Schwab reported.

Organic growth remained among the key factors in firms’ success, and was driven by “intentional and documented strategies,” such as referral plans, collecting client opinions, developing “ideal client personas,” using digital marketing and tracking marketing results. And many firms have used “inorganic” strategies to acquire talent, boost scale and grow.

Top performing firms are those ranking in the top 20% of a firm performance index that evaluates 15 metrics in key business areas using self-reported data from 1,304 participating businesses. Schwab fielded data for the study from January to March this year.

These firms logged median AUM growth almost eight percentage points higher than other firms, along with higher revenue, clients and net asset flows.

All charts from Schwab.

Here are some ways these firms stood out, according to Schwab.

1. They grew assets from existing clients.

Assets from new clients reached their highest point and assets from existing clients reached their second-highest point over the last five years, the study found.

Existing-client asset growth, excluding investment performance, was 4.5 times higher for top-performing RIAs than for all other firms in 2023.

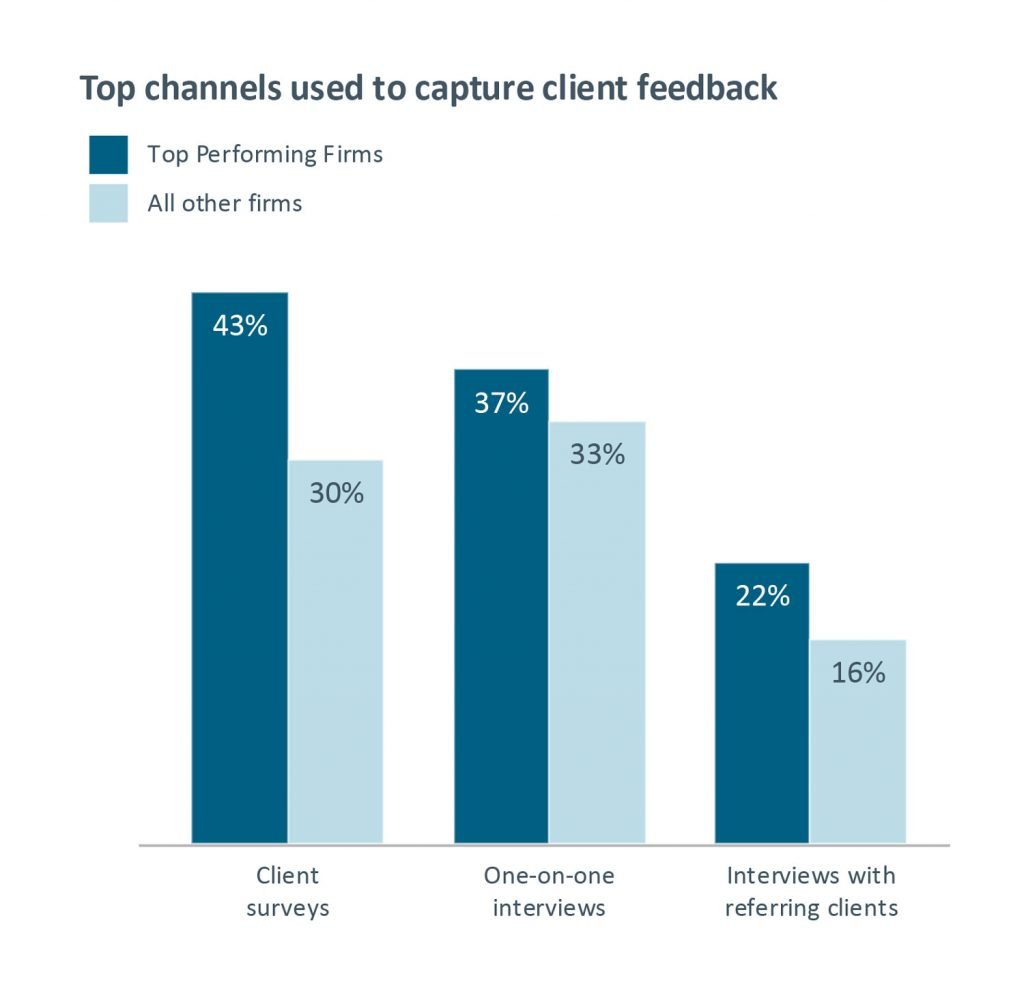

2. They collected client feedback.

Firms with at least $250 million in AUM that collected data from client interviews gained 26% more assets from existing customers in 2023, according to Schwab. Nearly half of top performers also used client surveys, the most popular client feedback channel.

3. They nurtured a new-client growth culture.

The top performers gained 2.4 times more new-client assets than all other firms in 2023. Top-performing firms gained $43.1 million in assets from new clients in 2023, compared with $17.9 million for all other firms.

Nearly 75% of top performers met or exceeded new-client growth goals last year, versus 53% for all firms.