Allstate’s pre-tax catastrophe losses for Q2 reach $2.1bn

US primary insurer Allstate has reported what some analysts are calling lower than expected catastrophe losses for June 2024, with just $230 million announced pre-tax for the month. But the second-quarter 2024 total has now risen to $2.1 billion, which is a relatively heavy start for the annual aggregate year of its catastrophe bonds.

As we reported, Allstate had announced a significant catastrophe loss burden for May, with $1.4 billion in pre-tax losses just for that month.

For April 2024, Allstate had reported $494 million of pre-tax catastrophe losses.

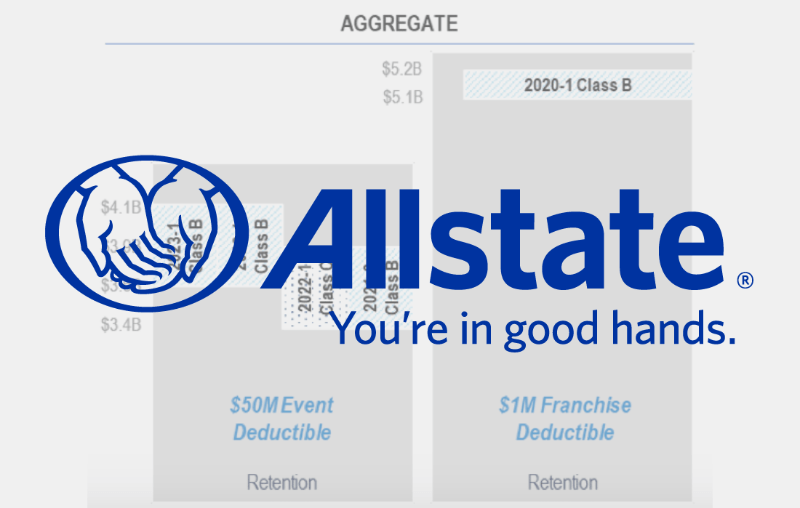

Recall that, Allstate has a number of aggregate catastrophe bond tranches in-force, with the lowest down attaching above $3.6 billion in qualifying losses.

The annual aggregate risk period for those cat bond notes began on April 1st, so all second-quarter catastrophe events have the potential to accumulate under the terms of the deal and potentially erode the cat bond deductibles.

However, those aggregate Sanders Re cat bonds feature a $50 million per-event deductible, so not all of the pre-tax cat loss figure qualifies under them.

Typically it needs bigger events then for a catastrophe to qualify and aggregate towards the cat bond triggers and while June has extended the second-quarter pre-tax loss burden, the fact its losses were spread across numerous events might mean less chance of aggregate deductible erosion.

For June 2024, the $230 million of pre-tax estimated catastrophe losses for the month, or $182 million, after-tax, came from 18 loss events, Allstate explained.

June actually saw Allstate experience $274 million in catastrophe losses across the 18 events, suggesting the company also booked some favourable prior period development in the month.

The 18 catastrophe loss events were “primarily related to geographically widespread wind and hail events,” the insurer said.

It takes Allstate’s total catastrophe losses for the second quarter were $2.12 billion, pre-tax or $1.67 billion, after tax.

However, if you look at catastrophe losses reported per-month, without taking into account any prior period development, Allstate reported $491 million for April, $1.48 billion for May and the $274 million for June, which would imply a second-quarter total slightly higher at $2.245 billion, as reported.

As we always explain, it’s impossible for us to know how much of the second-quarter catastrophe losses have qualified under the terms of Allstate’s aggregate Sanders Re catastrophe bonds given the $50 million per-event deductible in-force in their coverage terms.

But, it does seem safe to assume some deductible erosion after Q2, especially from the larger event losses in May, although nothing to be concerned about for cat bond investors yet. It will however mean any uptick in cat losses for Allstate, perhaps after a hurricane, could raise cause for some concerns as the aggregate deductible erodes further.

Year-to-date, Allstate reported its catastrophe losses were $2.85 billion, pre-tax, or $2.25 billion, after-tax.

You can see details of Allstate’s occurrence reinsurance, that attaches at $500 million and aggregate cat bonds that attach at $3.6 billion of qualifying losses here.