Genworth Unit Moves to File New Long-Term Care Policy

What You Need to Know

The stand-alone long-term care insurance business has been through hard times.

Genworth’s CareScout LTC provider network now has relationships with 400 home care organizations.

The new CareScout Insurance LTCI policies would provide a maximum of $250,000 in benefits.

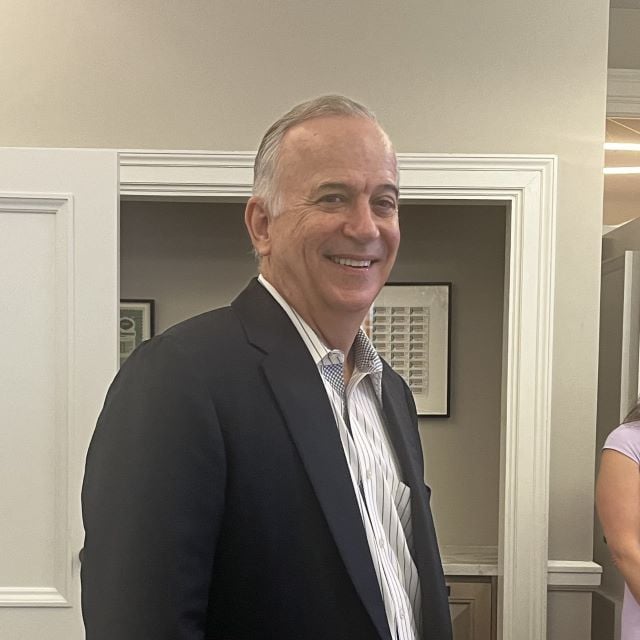

Genworth Financial executives visited the New York Stock Exchange Tuesday to celebrate the 20th anniversary of Genworth becoming a stand-alone public company, ring the NYSE opening bell and talk about the company’s imminent return to the long-term care insurance market.

The company’s CareScout Insurance business is already sending information about a new stand-alone LTCI policy to the Insurance Compact Commission, an organization that processes product filings for 39 states and Puerto Rico, and it hopes to have the policy approved by the end of the year, Tom McInerney, Genworth’s chief executive officer, said Tuesday in an interview.

The first CareScout LTCI policy is expected to have a maximum benefit of $250,000; options for 1%, 2%, 3% and 5% compound inflation protection; extremely conservative investment-return assumptions for the assets supporting the policies; and a strategy of implementing small, frequent premium increases, when increases are necessary, rather than imposing the kinds of 100% and 200% increases facing the holders of many of the LTCI policies sold in the past.

The long-term care insurance industry “obviously got it wrong on the legacy business,” McInerney said. “We think we’ve now got a product that’s priced right.”

What it means: Private companies may be getting serious about reviving efforts to provide long-term care planning options.

The revival may be too late for many baby boomers, who are now all 60 or older, but it could create planning options for Generation X clients and those in younger generations.

The history: Genworth came to life as the insurance arm of General Electric. General Electric turned it into a separate company, with its own New York Stock Exchange listing, in 2004.

Companies acquired by Genworth helped create the modern LTCI market and were also large issuers of life insurance and annuities.

Most of the assumptions that Genworth and competitors made about LTCI coverage turned out to be wrong. Originally, issuers had hoped to avoid imposing any premium increases. But the companies ended up getting regulator approval for increases that ended up doubling or tripling the premiums for many products.

McInerney became CEO in 2013, as the severity of LTCI industry pricing problem was becoming apparent. He has been working to stabilize Genworth’s old LTCI business ever since.

The company tried to stay in the LTCI business, but it stopped selling new policies through brokers in 2019.

Genworth’s Enact Holdings mortgage insurance business has been the only company unit issuing substantial amounts of new business in recent years. But the company still serves about 1 million people insured by its LTCI policies and about 1.5 million holders of its in-force life insurance policies and annuity contracts.

After McInerney became CEO, he saw how caregiving works up close when rheumatoid arthritis limited the abilities of his own mother, who had no LTCI coverage. McInerney’s sisters took turns providing home care, and McInerney provided cash.

“Ultimately, it was very expensive,” he said.