Low Income Car Insurance Guide

Key Takeaways:

Insurance rates are not based on income but do factor in things that imply income levels, such as credit score, education level, and whether you own your home or rent.There are some good ways to save money, like buying an older car or finding alternative transportation for your daily commute to keep mileage to a minimum.Using a Telematics system can lower your insurance by allowing you to demonstrate safe driving skills.

Car insurance is a must in today’s world. Without it, you expose yourself to financial and legal problems that can be life-altering if you get into an accident.

The problem is finding coverage you can afford when you have a low income job or lifestyle.

As a general gauge, low income is considered a single person making less than $25,000 per year or a household of four making less than around $39,000. This level of income can make car insurance feel like a luxury, but it should really be treated as a necessity.

Where to Find Low Income Auto Insurance

It pays to shop around! Today, quotes are easily available online to ensure you find the cheapest car insurance. All you have to do is fill in some basic information and you get leads to insurance companies that fit your needs (but more about that later).

As a general rule, it’s a good idea to stay with the big national insurance companies where you know you can count on their trustworthiness. There is no shortage of cheap, local insurance that promises low prices, but they may also feature low quality coverage and bad customer service.

It’s better to be safe than sorry when it comes to car insurance for low income individuals. You can’t afford to take a chance on a low income car insurance program.

How Your Income Impacts Car Insurance for Low Income Families

For any insurance company to ask your actual income would be seen as discriminatory. So, they don’t.

What they do is look at socioeconomic factors that give them an idea of whether you’re a good risk and whether you’ll be able to make premium payments.

Each insurance company uses a hyper-complex set of criteria using a variety of variables to develop ‘insurance scores’ and we can only guess at the exact methods they use. What we do know is that these factors play a big role in determining your cost for car insurance.

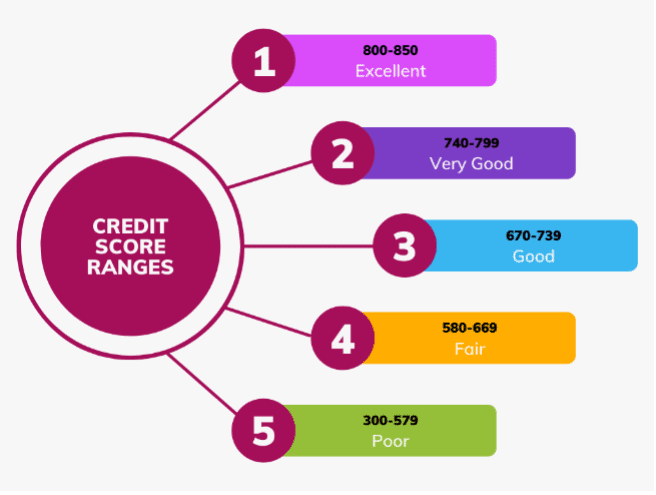

Your Credit Score and Report

Just like in most financial situations whether applying for a loan or renting an apartment, the higher your credit score the better. In fact, those with a low credit score will pay more for the same insurance as someone with a score in the excellent range.

While there is considerable debate about whether credit scores are an accurate predictor of claim frequency or ability to pay, the Insurance Information Institute (III) concluded that it is commonly used when determining risk and price.

If you don’t know what your credit score is, you can get a free credit report from each of the three credit agencies annually. It’s always a good idea to check your reports each year to make sure there are no mistakes, omissions, or evidence of identity theft.

Your Education Level

For insurance companies, your last completed grade in school tells them a lot about your income and earning power. Those with a bachelor’s degree or post-graduate work will usually have a lower rate for their car insurance. But don’t panic if you didn’t complete high school — the difference is usually less than $25.

Your Overall History of Insurance Coverage

When considering car insurance for low income individuals, insurance companies want to see a strong history of continuous coverage. Breaks in coverage are often attributed to a loss of employment or driving without insurance — both negative factors when deciding cost.

Also, beware of non-standard carriers. Insuring your vehicle with a non-standard insurance company can leave you with a host of problems like unpaid claims and disappearing companies.

Your Home – Do You Own or Rent?

Owning your own home tells the insurance company that you are financially stable. There is also historical data that shows renters file more claims than homeowners. Buying a home may be cost prohibitive, but at least be aware that it will impact your insurance costs.

Your Zip Code

Insurance companies collect data on everything and where you live tells them a lot about what they can expect from you in terms of claims. If you think about it, your neighborhood and zip code tell a lot about what’s happening around you and your home, like:

Number of claims from the surrounding areaOverall road conditionsSize of the populationHigh claim rates for car theft or property damageWeather-related catastrophes

In short, insurance companies know a lot about you without ever asking your income!

Ideas on Ways to Save on Car Insurance for Low Income Drivers

Don’t lose heart — there are a number of ways to save money when shopping for low income car insurance. Here are some things to consider:

Buy an Older Car

Older cars cost less and that means they will cost less to insure. According to Car and Driver Magazine, the cheapest used cars to insure include old standards with excellent safety ratings like:

Subaru Outback and ForesterJeep Cherokee and WranglerHonda CR-V and OdysseyFord EscapeFord F-150 TruckToyota RAV4 and Tacoma

Do You Need Full Coverage?

A good rule of thumb is if your car has less than $4,000 in value, you should consider liability only insurance. That means you can drop the comprehensive and collision coverage which covers damage to your car and only carry the coverage that protects others.

Be sure to include uninsured or underinsured motorist coverage with a liability-only policy to guard against the 12.6% of the population that doesn’t carry auto insurance.

The downside of liability only insurance can come if you ever have an accident or total your car — you have no protection to cover repairs or replacement.

Opt for a Higher Deductible

You can save money on low income auto insurance by choosing a higher deductible. Most insurance companies offer $500 and $1,000 deductibles that can save you a chunk of money.

The downside, like liability only insurance, can come when you need to pay a deductible. It’s a good idea, if at all possible, to keep cash matching the deductible amount in the bank.

Pay Damage Out of Pocket When Possible

This sounds impossible, right? It can be expensive, but every violation or accident increases your premiums. So, if you can avoid filing a claim and paying for the damage directly, it’s your best bet to keep your premiums low.

Don’t Let Your Policy Lapse

We’ve already talked about policy lapses, but it’s worth saying again. Any lapse in policy or time without insurance when you are a licensed driver will cause your insurance premium to go up.

Avoid Getting a Ticket or Moving Violation

Everybody speeds once in a while or rolls through a stop sign, but insurance companies think tickets are a problem and will increase your rates the next time your policy renews. This goes double for accidents and claims. For people with a low income car insurance program, this can price them out of the market.

Discount Options for Low Income Drivers

When looking for low income auto insurance, remember that every insurance company offers discounts to ‘sweeten the pot’ in the highly competitive insurance marketplace. Be sure to review a new or existing policy to make sure you are taking advantage of every possible allowance.

Multi-Policy Discount — Why not get a discount by bundling your insurance needs together. If you own your home, you can bundle your homeowners and auto insurance to get a discount. If you rent, many companies offer renters’ insurance and will offer discounts to bundle that with your car insurance policy. Same for motorcycle insurance, RV insurance, and boat insurance.Good Driver Discount — Insurance companies will reward drivers with good driving records. Be sure to find out what is on your driving record and when it will be off, then ask for a review.Discounts for Anti — Theft EquipmentDefensive Driver Discount — Take the course!Auto Payment Discount — Signing up for autopay can save you 1% to 2% annually.Career or Profession Discount — Certain professions, like police officers, teachers, and care providers, are less likely to file claims, so they get a special discount.Good Student Discount — That includes college students, so if you’re in college even part time, it’s worth asking your insurance agent.

What About Coverage Based on Use?

Many national insurance companies are offering usage-based discounts that take into account your driving speed, stopping habits, and daily mileage (among other things). Through the use of Telemetric systems that are easily installed tracking devices, real-time information can be relayed to your insurance company to report vehicle metrics.

Through this data, insurance companies can determine if you routinely speed (remember, it’s a GPS system too – they know where you are and what the prevailing speed limits are in that area), if you forcefully break too frequently (do you often follow to close?), or how far your daily commute really is.

While not everyone is crazy about being monitored, it can save you money and, once installed, you don’t even realize it’s there. In 2021, only about 6% of Americans were using a Telemetric device, but that should increase rapidly if, or when, insurers make it mandatory.

Read More: Pay Per Mile Car Insurance – How Does It Work?

States that Offer Low Income Car Insurance Assistance

If you live in one of the following states, you may have assistance available as a low income driver:

California

California residents can participate in the California Low-Cost Auto Insurance Program (CLCA). Participants have to meet a number of criteria (household income, a good driving record, over 19 years of age, etc.).

Opting in allows people to purchase insurance with limits well below the state requirements. While this is a good option for low income drivers, the limits are exceeding low and not well-received by the general public.

Hawaii

The program in Hawaii benefits those with disabilities who receive car insurance for free if they meet certain criteria, i.e., physical or mental disability, terminal health condition, some one who lives with or care for a beneficiary of the program.

The program is administered by the Hawaiian Department of Human Services, Aid to the Aged, Blind, and Disabled Program (AABD).

Maryland

Now independent of the state government, the Maryland Automobile Insurance Fund was created by the state legislature to provide liability insurance for people unable to purchase insurance on the open market. They offer reduced rates for drivers with bad credit, poor driving records, and lapses in insurance coverage.

New Jersey

If you live in New Jersey, check out the Special Automobile Insurance Policy (SAIP) that provide medical-only coverage for Medicaid participants at a cost of about $365 per year (or a dollar a day).

New Jersey requires liability insurance, but does not require uninsured motorist, comprehensive, or collision insurance. SAIP is an addition to the liability insurance.

Summarizing Low Income Car Insurance Coverage

Insurance companies say they don’t use income as a contributing factor when pricing a car insurance policy. However, there are certainly ways for them to find socio-economic indicators that can negatively impact your cost for low income car insurance.

When shopping for car insurance, use some of these proven tips, like buying an older car, choosing a higher deductible, and investigating all the discounts being offered. And don’t forget to stick to the national companies to avoid being surprised by unpaid claims or dropped coverage for no reason.

Compare rates today with einsurance.com and find cost effective low income car insurance today.

![]() Kathryn has a background as a small business owner and currency trader. Kathryn also enjoyed a career as a Regional Director and COO in healthcare, specializing in operations, third-party insurance reimbursement, and revenue cycle management.

Kathryn has a background as a small business owner and currency trader. Kathryn also enjoyed a career as a Regional Director and COO in healthcare, specializing in operations, third-party insurance reimbursement, and revenue cycle management.