340B costs Medicaid $32b per year

The 340B Drug Pricing Program is a federal initiative designed to help certain healthcare providers, known as “covered entities,” stretch their resources to better serve vulnerable and underserved patient populations. Created in 1992, the program requires pharmaceutical manufacturers to sell outpatient drugs at significantly discounted prices (typically 25% to 50% off) to eligible hospitals, clinics, and health centers that care for a large number of uninsured and low-income patients. These covered entities can then use the savings from these discounted drug purchases to provide more comprehensive services, reach more eligible patients, and offer additional programs that enhance patient care and access in their communities. Proponents of the 340B program claim that it improves access to care for underserved populations without using taxpayer money (since all funding comes from mandatory discounts from drug manufacturers).

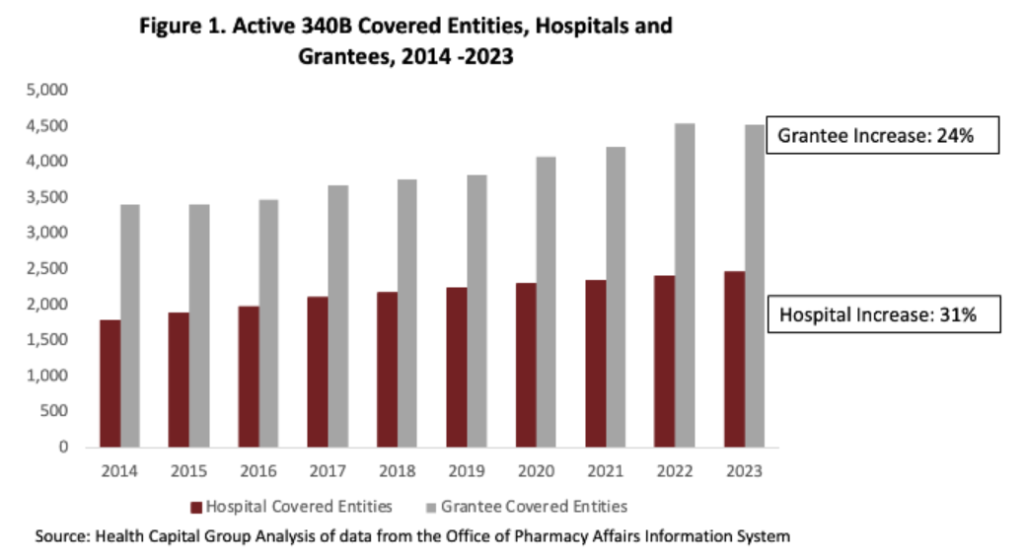

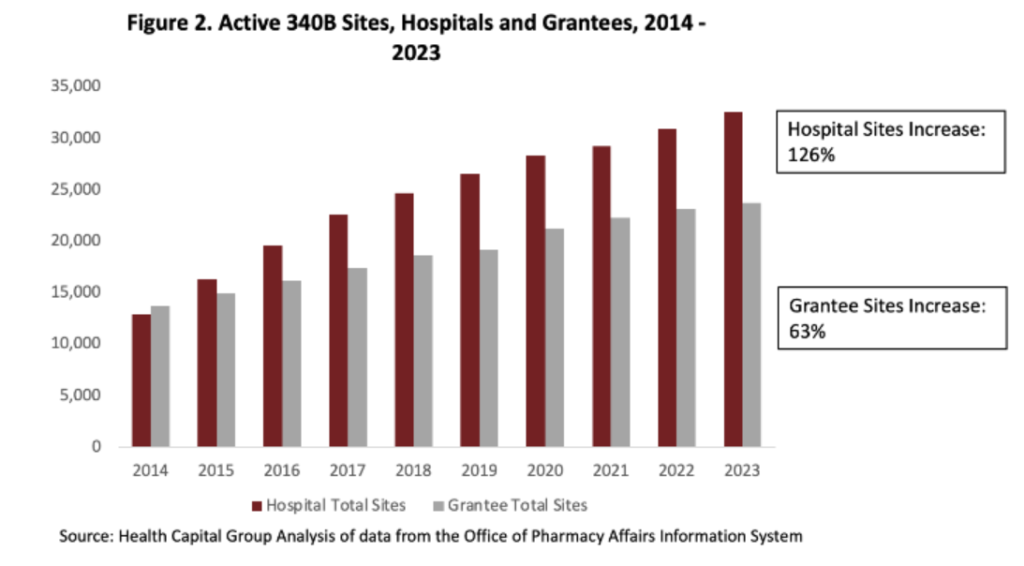

While the 340B program was targeted to covered entities treating underserved populations, in recent years the size of the program has grown. According to a report by Masia (2024), the number of hospitals participating in 340B has increased by 31% in the last decade. While this may seem like a large number, each grantee now is more likely to expand their reach by operating a number of sub-sites or sub-grantees. Using this definition, hospital sites increased by 126% (grantee site increased by 61%) over the last decade. There are now nearly 200,000 340B contract pharmacies in the US.

https://www.healthcapitalgroup.com/340b-and-total-medicaid

https://www.healthcapitalgroup.com/340b-and-total-medicaid

https://www.healthcapitalgroup.com/340b-and-total-medicaid

Masia then examines the impact of 340B on Medicaid cost:

Our regression estimates suggest that the increase in 340B hospital and grantee participation from 2014 to 2021 increased overall Medicaid spending by $391 per enrollee, or over $32 billion per year. This suggests that 340B-driven spending may account for roughly 10% of overall Medicaid spending, significantly increasing the cost of the program to taxpayers.

Why would 340B increase cost? The author posits that 340B-driven market consolidation, site of care choice, choice of therapy could all be impacting the results. For instance, 340B hospitals may prefer to prescribe branded as compared to generic medications under 340B since the profit they make off branded drugs is much larger. While 340B covered entities get discounts for these drugs, payers reimburse the covered entities at full cost.

You can read Neal Masia’s full paper here.