Japan’s Noto quake claims hit $571m. Hyogo hailstorm costs at $355m

According to the latest data release from the General Insurance Association of Japan, insurance claims for the January 1st M7.5 earthquake that hit near the Noto Peninsula in Ishikawa prefecture now stand at around US $571 million, while a hailstorm event in Hyogo prefecture in April has driven US $355 million in claims so far.

Claims from the New Year’s day earthquake in Japan are up by around 16% since we last reported on this loss event in April.

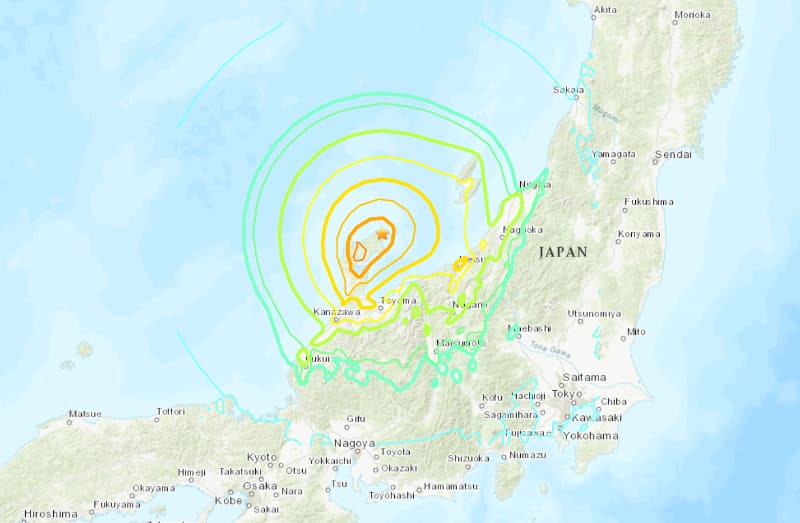

The so-called Noto Peninsula Earthquake struck on January 1st and caused severe impacts to some towns across the four Japanese prefectures of Ishikawa, Niigata, Toyama, and Fukui.

Significant property damage was experienced and as the insurance and reinsurance market loss estimates began to emerge, it was clear the event was a relatively significant one for the domestic insurance industry, with the potential for some minor global reinsurance effects as well.

The General Insurance Association of Japan (GIAJ) put the total claims paid from the quake at over JPY 74.44 billion as of March 31st 2024, but has now raised the total to over JPY 90.97 billion as of May 31st.

At today’s exchange rates, that total equates to roughly US $571 million.

Which still stands well-below the industry loss estimates, including the most recent which was Cresta saying it was a $1.9 billion catastrophe insured loss event.

Recall that, the first industry loss estimate to be released for this Japanese earthquake was from modelling firm Karen Clark & Company (KCC), which put the insured losses from the quake at an estimated $6.4 billion.

The next to issue an insurance market loss estimate for the Japanese earthquake was CoreLogic, which said it is likely to be below $5 billion.

Then, Verisk’s Extreme Event Solutions business unit put the insurance industry loss at between JPY 260 billion (US $1.8 billion) and JPY 480 billion (US $3.3 billion).

Finally, Moody’s RMS estimated it to be between JPY ¥ 435 Billion to ¥ 870 Billion (US$3 Billion to US$6 Billion).

As ever, the true cost to the economy and the global insurance and reinsurance market is hard to derive from these estimates.

The GIAJ has also reported on another recent insurance market loss event in Japan, a severe hailstorm event that struck Hyogo prefecture on April 16th.

Almost JPY 56.5 billion in insurance claims have been filed and paid for this event already, which equates to roughly US $354 million.

Auto insurance claims from the hailstorm in Hyogo made up roughly US $197 million of that total, with fire insurance that covers properties another US $155 million, and the remainder other casualty insurance lines such as personal accident covers.

The majority of both these catastrophe losses have been retained in the primary insurance market, with reinsurance shouldering a much smaller proportion than would be seen in the case of larger events.