Protect Your Income as Mortgage Repayments Increase

Russell Cain Updated: 20 February 2020

After months of meticulous planning and years of daydreaming youâve finally been approved for a home loan. You move in and start decorating, filling each space with beloved knickknacks. The mortgage repayments are high, but youâve budgeted, you feel confident. Out shopping one morning, a newspaper headline catches your eye: âProperty price surge could lead to mortgage defaultsâ.

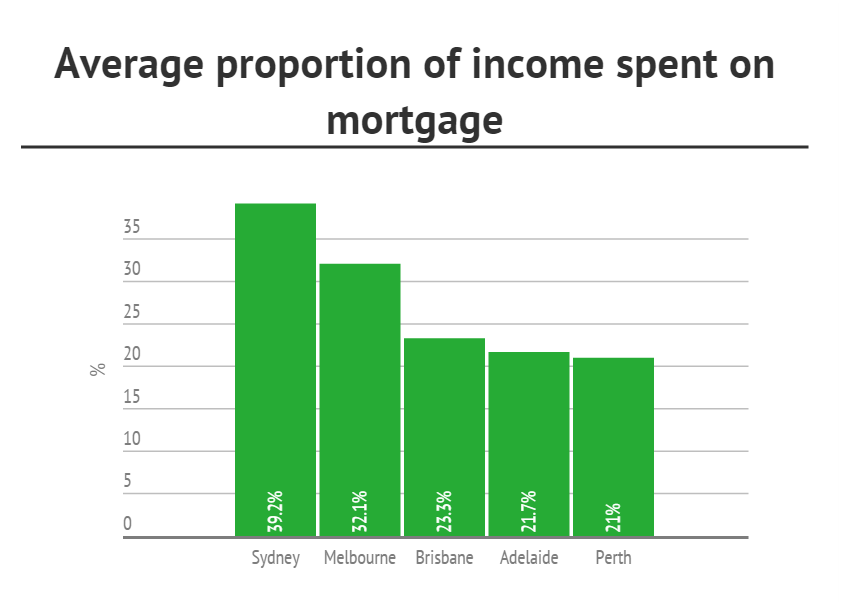

The risk of mortgage defaults are on the rise in Australia due to a drastic decline in housing affordability. Itâs not just Sydney and Melbourne feeling the financial pressure, a wide geographic spread of suburbs across the country are struggling to pay their monthly mortgage with the percentage of income required to meet these increasing repayments.

Image Source: domain.com.au

When the budget starts to get tight or unexpected expenses occur we realise that your first instinct will be to start cutting costs in order to continue making those monthly payments. Thatâs a good idea, however what you sacrifice must not jeopardise your long term personal or financial wellbeing. Life and income protection insurance should never be on your list of luxury items to cut.

An Australian housing and urban research institute found the two main reasons people have difficulty paying their mortgage were due to loss of paid employment and because of illness or disability. âHome owners concerned about defaulting on their mortgage should take out mortgage protection and life and income insuranceâ wrote Jennifer Duke, online writer for Domain.com.au

What is Income Protection (IP)?

This type of insurance covers up to 75% of your salary should you be unable to work due to sickness or an accident. A useful product if you donât want to fall behind with monthly outgoings, such as your mortgage payments.

Creating a buffer of protection against loss of income is essential to you being able to continue paying your home loan. Unfortunately, income protection premiums are also trending up. Understandably, that puts even more pressure on you. To help ease the burden weâve compiled a list of tips for managing your cover premiums.

Protect Your Income while Managing Your Premiums

Tip 1. Increase your waiting period

A waiting period is the amount of time you need to wait before your monthly benefit period starts. Longer waiting periods are generally cheaper, because youâll have to wait longer to start accruing monthly benefits. This might not be ideal, however, itâs worth considering when:

You have a large amount of sick days owing to you,Youâve made several extra repayments on your mortgage, oryou have sufficient disposable funds available, either in your bank account or offset account, to cover you for the extended period youâre without income.

Did you know: Changing your waiting period from 30 to 90 days can reduce your premiums by 30 – 50%, enabling you to afford your monthly insurance premiums and while this option does not suit everyone it is better than having no income protection insurance cover at all & can free up additional funds to assist with other bill while still providing protection to you and your family..

Tip 2. Fund your cover through super

Most life insurance companies will allow your income protection policies to be taken out through your super fund as salary continuance. When taking out cover through this fund, your premiums will be paid for by your super fund, freeing up cash flow and potentially making your cover more affordable.

*Note: Before you take out a policy, make sure youâre aware of the condition of release issues surrounding your monthly benefit, thus ensuring such a policy actually suits your requirements.

Tip 3. Fund part of your cover through super

Splitting your Income protection policy ownership between superannuation and outside super allows for some advantages. Your superfund pays for the majority of the premiums, while the partial and ancillary benefits are funded by you (outside of Super). This helps to reduce the amount you need to pay from your personal accounts while making it easier to access your partial & ancillary benefits, which might not be available had you elected to fund the entire policy though super.

*Note: Before taking up any of the following options ensure you know all the Proâs and Cons of all options and to ensure that you select the option that meets your requirements, everyone is different and you should consider these before deciding which option to consider if you are finding your premiums becoming unaffordable.

Try one or more of these tips to help you manage your premiums and rather be inspired by below cost saving strategies when deciding how and where to cut costs.

Cutting Costs the Right Way

Cutting costs in order to keep paying your monthly mortgage is a great initiative. Here are some ways to trim the fat without having to freeze or cancel important insurance policies:

Purchase non-perishables in bulk. It might not be cool to have a cupboard stocked with toilet paper and baby wipes, but it sure is a great way to save. Buy the unbranded products at supermarket. Theyâre just as good, but their packaging isnât as fancy. Use public transportation and save money on gas, parking, and maintenance over time. Â Alternatively, get your colleagues involved and start a carpool. Loose the takeaway coffee(s). This is a luxury purchase and will taste just as good homemade and poured into a nice flask. Switch to energy-efficient light bulbs. They use two-thirds less energy than normal bulbs and last 10 times longer. Cancel unused subscriptions. This includes those magazines you never read and the TV channels you donât watch. Donât eat out as much. This might sound obvious, but the temptation to grab a quick lunch and catch up with a friend can be very tempting. Go old school and clip coupons. Look in your Sunday papers and search for them online.

Conclusion

We know itâs difficult to forego some luxury items, but your income protection cover should never be one of those items. The probability of a sickness or an accident happening to you is too high, which could well lead to you not being able to continue to make mortgage payments. Donât risk it, it is not worth it!

Get an instant Income Protection quote

Or call us on: