How Are Insurers Changing the Process to Appoint an Umpire in an Insurance Appraisal?

Ed Eshoo, Christina Phillips, and Matt Ponzi gave a command performance at the Insurance Appraisal and Umpire Association (IAUA) seminar in Chicago. They covered 35 different topics from the policyholder and insurer perspectives. Two audience members told me it was the most informative and practical insurance instruction they had ever participated in.

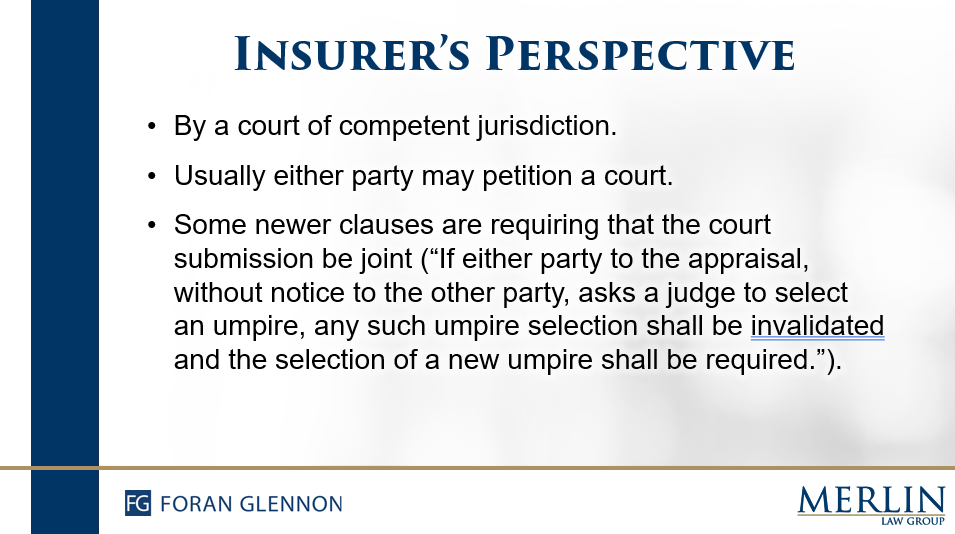

One topic involved the changing language found in some policies on the procedure to appoint an umpire. Here are two slides from their presentation about policy-changing language:

It is obvious that insurance companies have been listening to or reading about the rare circumstance of a unilateral race to the courthouse to get a friendly umpire selected. I noted this concern of the insurance industry eleven years ago by quoting an insurance company attorney in Umpire Selection–Can a Neutral Umpire Really Be Selected?

With almost no appraisals resolved by the appraisers themselves, the appointment of an umpire is a virtual certainty. Most policies specify that if the appraisers cannot agree on the amount of loss, they are to work together to agree on an umpire. Historically, there had been a good faith effort by the two appraisers to reach agreement on a neutral umpire. Or, if such agreement couldn’t be reached, they would jointly ask a judge in a local court to appoint an umpire of its choosing.

That has also changed. Now, it’s a race to the courthouse to get a favorable umpire appointed, often unilaterally and without proper notice to the other party. It is not uncommon for a party to file a motion to appoint an umpire without notifying the other side that it intends to do so. In many jurisdictions, a court can grant such a motion before the other side even has had a chance to respond.

As a result, an umpire in a specific dispute is increasingly not a person agreed to by the appraisers but rather the name submitted by one side in its unilateral motion to appoint an umpire. While this appointed umpire might also be “impartial” as defined by the policy, it should not be surprising that the umpire eventually sides with the party who won the race to the courthouse and obtained their appointment.

The lesson is that once appraisers cannot voluntarily agree upon the appointment of an umpire, the procedure to appoint an umpire by simply filing a lawsuit may now be different depending on policy language. Last year, we noted that one policy required a flip of the coin to determine the umpire in “Heads, I Win, and Tails You Lose! Can the Umpire to an Appraisal Be Selected By a Coin Toss?” I also made this point:

Another lesson is that property insurance policy forms are quickly leaving many of the standard forms we have studied and used for years in the past. People in the property insurance claims business have to read the full policy on every claim. Keep up, or you will be left far behind.

If you are an appraiser or umpire, always ask for the policy and read the full policy. Many newer forms have various clauses that impact how an appraisal is to be conducted, which is far different from the standard appraisal process followed for over 100 years.

Thought For The Day

The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.

—Peter Drucker