ACE suggests wide-range in loss outcomes for 2024 hurricane season: Icosa

For the catastrophe bond market, the 2024 Atlantic hurricane season could result in zero impact or significant losses, depending on where storms form, where they head towards, how much they intensify and where they make landfall, while the forecast data suggests a wide-range of possible loss outcomes, catastrophe bond investment manager Icosa Investments has said.

Uncertainty is the name of the game when it comes to hurricane season, with the insurance, reinsurance and insurance-linked securities (ILS) industry particularly exposed to Atlantic hurricanes that make landfall in the United States.

The forecasts are all calling for a very active time over the coming months, as hurricane season progresses, so it’s important investors consider how the data available might translate into a range of loss scenarios, something Icosa Investments has been doing.

As we’ve reported, its not just the forecast storm numbers that are eye-opening, so too are some of the predictions for elevated landfall risk this year.

But, landfalls do not necessarily result in significant insurance market loss, they can be relatively minor, even for the more intense hurricanes.

Location is the most important factor, as even relatively minor hurricanes can still cause significant insured losses if they hit a region of high-exposure, even more so if they hit the coast and stall, exacerbating the effects of wind, rain and surge and driving more financial impacts.

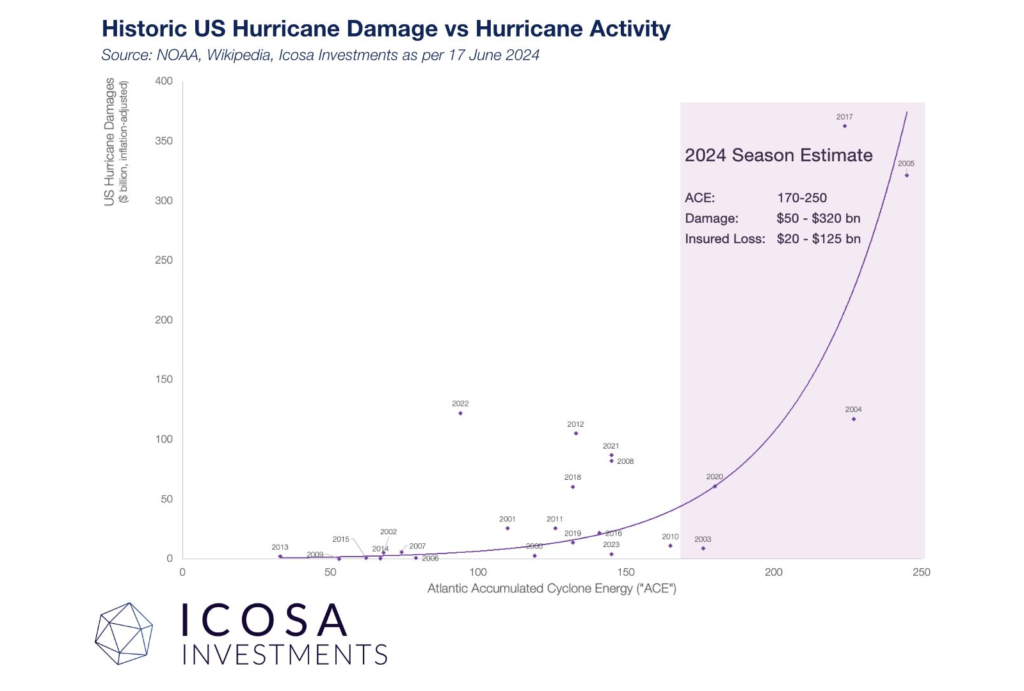

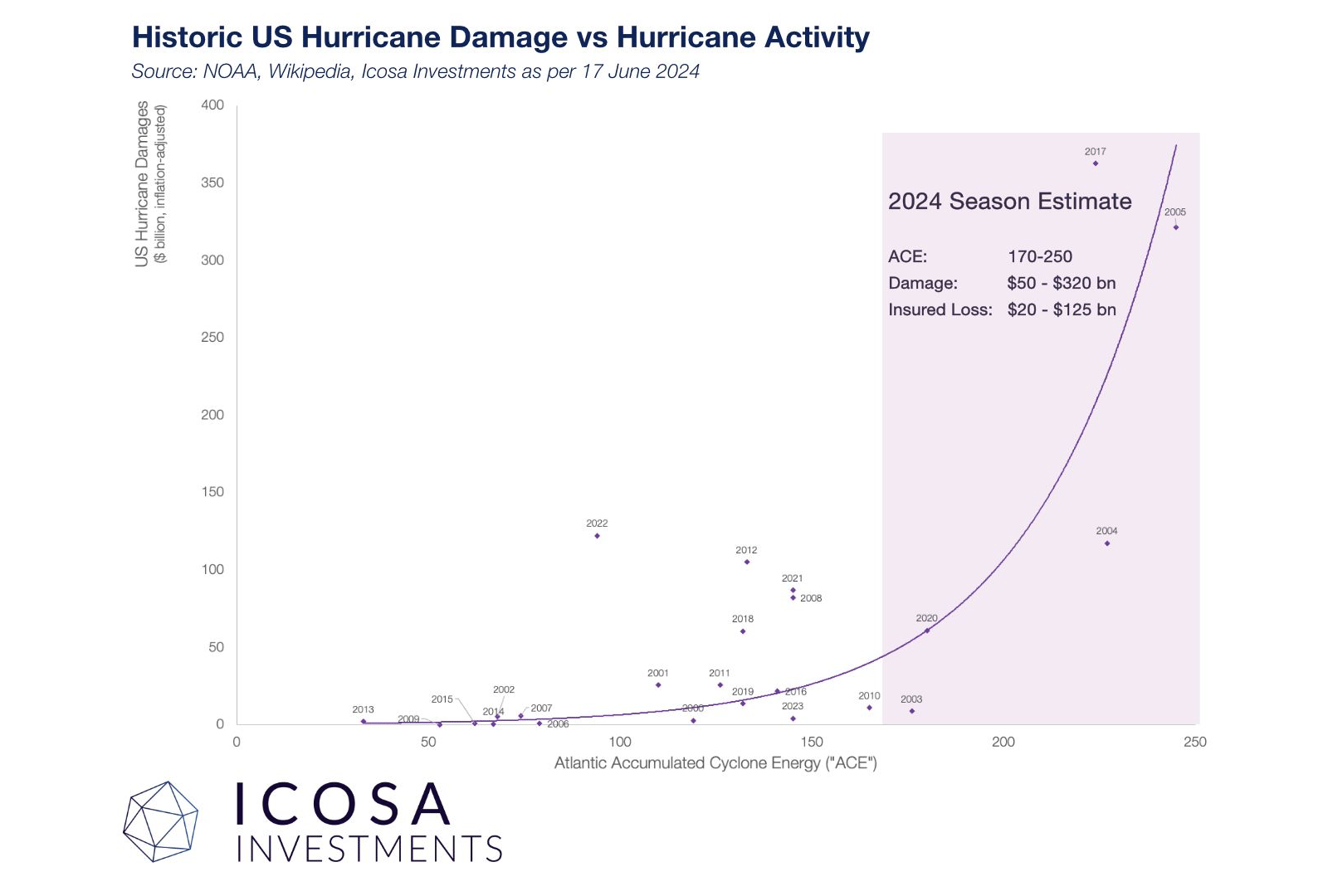

Icosa Investments, the Swiss catastrophe bond fund manager founded by Florian Steiger, has analysed one of the available data points and believes there is a correlation between accumulated cyclone energy (ACE), an indexed figure that represents the energy expelled by a hurricane, so duration of the storm, intensity and size are all important to that, and insurance market losses.

“Essentially all major forecasts predict an extremely active season, with accumulated cyclone energy (ACE) estimates ranging from 170 to 250, compared to a historical average of just over 100,” Icosa Investments explained.

“At Icosa Investments AG, our analysis reveals a significant relationship between damages and Atlantic hurricane ACE.”

Adding, “Based on this relationship, we anticipate insured losses (typically around a third of all damages) between $20 billion and $125 billion from US hurricanes this year.

“While the lower end of this estimate is manageable, the higher end could introduce cat bond market volatility and potential losses, depending on the specifics of the events.”

The investment manager notes that the correlation between hurricane activity and cat bond losses has been quite low historically, but notes that investors should consider how ACE may stack-up against losses in their consideration of the asset class and their research into managers in the space.

The company added that it has structured its cat bond portfolios in light of the outlook, suggesting the manager has taken some active cat bond portfolio management decisions based on the available hurricane season forecast data.

Which Icosa will not be the only manager to do.

In fact we know of some cat bond fund managers that have been selling down certain positions for weeks as the hurricane season approaches, while others in the private ILS and reinsurance investment fund space have been buying hedges such as industry-loss warranties (ILW’s).

It stands to reason a hurricane season with high ACE has a greater chance of driving losses to the catastrophe bond market, given it only takes one storm to impact the insurance industry sufficiently to trigger the primary market’s reinsurance arrangements, which include cat bonds.

You can see Icosa Investments’ analysis below:

While forecasting losses is impossible and notoriously difficult even when hurricanes are approaching land, just look at 2022’s Ian and how a 10% cat bond market loss swiftly declined and eventually fell at well beneath half a percent, every data point and analysis is valuable when it comes to considering portfolio management moves that can be taken.

It’s also important to consider all the data in advance, as once the hurricane season gets properly underway and as soon as storms form, the liquidity to trade in and out of hurricane exposed cat bond positions cannot always be relied upon, at least not at acceptable pricing.

Although, it is also worth remembering that catastrophe bonds carrying US wind exposure tend to be the highest-yielding in the marketplace, making them attractive to hold through the hurricane season.

Which is why manager strategy on selecting bonds to hold, how much diversification is required and how to add diversity to a portfolio, are all critical for investors to understand.

The range of possible outcomes, from insurance market losses of US $20 billion right the way up to $125 billion, is particularly wide.

It’s vital to remember that it could take just one storm to drive market losses into the many tens of billions and that storm doesn’t necessarily have to have generated an enormous amount of ACE index points during its lifespan, if one formed at the peak of the season, intensified rapidly and barrelled directly into Miami, for example. It is increasingly feasible, given the rise in exposure values, that a single storm could even eclipse that range.

So, while data points such as ACE can be shown to have a relationship to insurance market losses and so, at the upper-end suggest a greater chance of catastrophe bond market losses, it is by no means a direct correlation and this is why the ILS market watches the Atlantic and every storm that forms so closely throughout the season.

This year will be no different.

Finally, Icosa Investments also highlighted the issue of liquidity drying up during the peak of the hurricane season and said that it intends to focus on effective capacity management, which it believes is critical for delivering strong performance in catastrophe bonds.

The manger said, “Historically, the ability to purchase cat bonds, both in the primary and secondary markets, has often been limited during the peak phase of the US hurricane season, which is when cat bond performance is at its highest. Accepting too much additional capital during this period could negatively impact returns and lead to dilution.

“For this reason, for the 2024 hurricane season and also in future years, the Icosa cat bond strategies will only accept subscriptions from new investors during the peak weeks of the hurricane season if sufficient liquidity is available in the secondary market. We believe that this measure and early communication will significantly enhance the long-term performance of our sub-fund. Naturally, we reserve the flexibility to respond to short-term changes to always act in the best interest of our investors, also outside of the US hurricane season.”