Major solar storm could drive bigger insured loss than Katrina: Bloomberg

Analysis from Bloomberg Intelligence suggests participants in the insurance and reinsurance industry should be seriously considering how they protect themselves against the risks of losses from major solar storms, with the peril having the potential to be as costly as major hurricanes.

“A major space storm could cost insurers even more than a hurricane like Katrina ($55 billion in 2005, or $90 billion today) given the capacity to interfere with radio communications, power grids, spacecraft and satellite navigation,” Bloomberg Intelligence states.

Warning that the recent space storm from May 10th to 12th “may just be a taste of what’s to come, with the current solar cycle forecast to peak in 2025.”

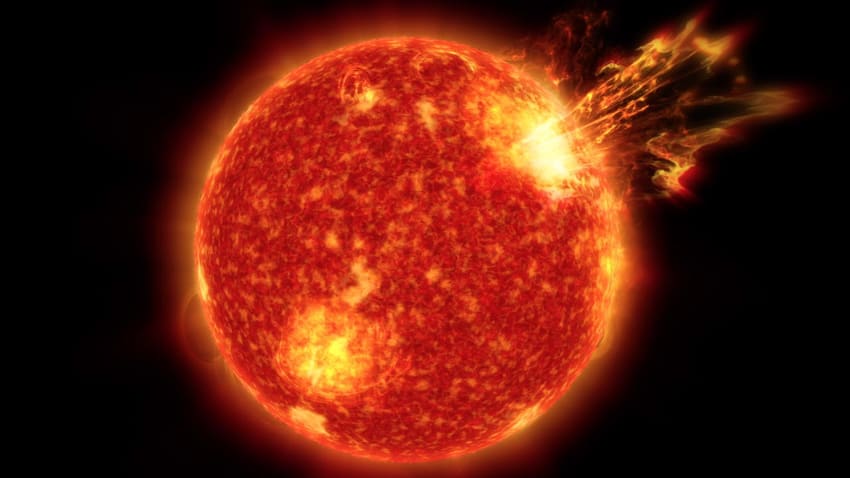

The outbreak in May saw a series of strong solar flares, a number of which – with their associated coronal mass ejections (CMEs) – were headed toward earth.

These explosions of plasma and magnetic fields from the sun’s corona can cause magnetic storms on earth and have the potential to affect technology and infrastructure in near-earth orbit, as well as on the planet’s surface.

These solar storm effects have the potential to impede communications, electric power grids, navigation, radio and satellite operations, Bloomberg Intelligence explained.

It is said that the May solar storms are the most extreme level G5 geomagnetic storm since 2003. That 2003 event led to power outages in Sweden and damaged transformers in South Africa, BI explained.

Charles Graham, BI Senior Industry Analyst – Insurance, commented, “Evidence from May 10-12 suggests the level of disruption caused by the solar storm on this occasion was relatively modest. There were no significant power failures, though extreme deviations in electrical wave patterns were widely observed across the US. Elon Musk’s Space X Starlink internet constellation reported a degraded service, but it quickly returned to normal.

“The storm was also sufficient to result in navigational errors in tractors and other equipment relying on GPS and drove some farmers in the US and Canada to halt planting. Aircraft were also diverted to reduce the exposure of passengers and crew to radiation.

“The outcome could nevertheless have been much worse, which explains why the UK regards space storms as one of the highest priority natural hazards in its National Risk Register.”

Graham added that technology is helping to forecast these solar storms more accurately, providing early warnings, “NASA is using artificial intelligence to analyze spacecraft measurements of solar wind to predict when an impending solar storm might strike. The technology could provide 30 minutes notice of where a geomagnetic storm is likely to occur anywhere on earth, enough time it is hoped for power grids and other critical infrastructure to take preventative measures.”

Solar storms have long been highlighted as a significant threat to the global insurance and reinsurance industry.

A study from back in 2016 included a stress test scenario that showed the insurance industry could face losses of as much as $334 billion, from extreme space weather events.

The recent geomagnetic storm event has refreshed analysts memories and could lead to more exploration within this industry of how financial solutions to hedge solar storm risk could be structured.

The re/insurance industry is definitely aware of the threat these events pose, with geomagnetic storms categorised alongside other major natural catastrophe events as one of the top-five threats in an industry backed report back in 2020.

However, given these are rare events that see their most extreme versions far out in the tail of occurrences, few take them seriously enough to buy insurance, let alone reinsurance, for them.

But, with the world becoming increasingly reliant on digital technology, satellites and electronics that could be affected by major solar storms, there is likely to be a growing focus on financially protecting assets against the potential impacts of major events.