Acting to Curb Rising Auto Fatalities

By Max Dorfman, Research Writer, Triple-I

After years of steady declines, traffic fatalities in the United States are on the rise, contributing to increasing auto insurance rates. This comes despite declines in the average number of miles driven due to the pandemic. In 2020, 38,680 deaths occurred on U.S. roads, the most since 2007.

In late January, federal transportation officials released a plan to reduce the tens of thousands of road deaths that occur every year, an issue that has become more significant since the beginning of the coronavirus pandemic.

“We cannot and should not accept these fatalities as simply a part of everyday life in America,” said Transportation Secretary Pete Buttigieg. “No one will accomplish this alone. It will take all levels of government, industries, advocates, engineers and communities across the country working together toward the day when family members no longer have to say good-bye to loved ones because of a traffic crash.”

Pandemic’s impact

Roadway safety in the United States had increased for decades before the pandemic, primarily due to enforcement of seat belt laws and vehicle safety features, such as airbags, improved braking, and stability control. Yet, the first year of the pandemic saw a 7.2 percent rise in U.S. roadway deaths from 2019. Some experts saw this rise in reckless driving as due, in part, to the isolation associated with the pandemic lockdowns.

“You’ve been cooped up, locked down, and have restrictions you chafe at,” said Frank Farley, a professor of psychology at Temple University in Philadelphia.

In the early months of the COVID pandemic, insurers were giving rebates for personal auto policies, spurred by reductions in miles driven and anticipation of fewer accidents. However, it quickly became clear that reduced miles driven didn’t automatically lead to fewer deadly accidents. Instead, reckless driving – and fatalities – increased.

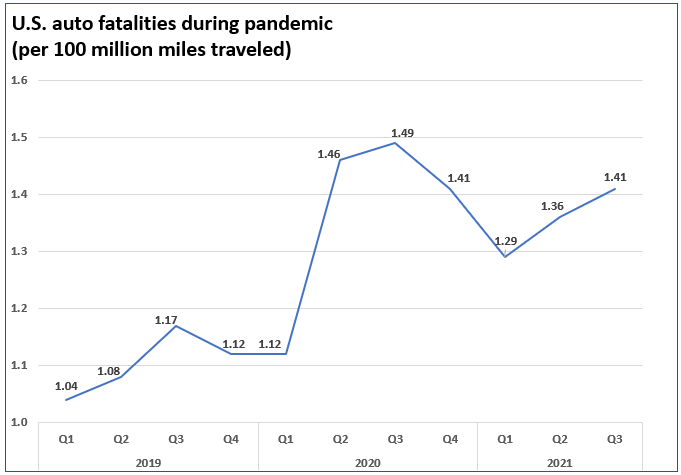

The end of pandemic shutdowns hasn’t helped either, with the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) estimating that 31,720 people died in motor vehicle traffic crashes for the first nine months of 2021, rising about 12 percent from the 28,325 fatalities projected for the first nine months of 2020. In Q1 of 2020, traffic fatalities were 1.12 per 100 million miles driven. By the end of Q3 of 2021, this number had spiked to 1.41 per 100 million miles driven.

What can be done?

The federal infrastructure deal promises to spend more on new safety measures, with the goal of eliminating road deaths. With this in mind, the Department of Transportation is implementing a Safe System Approach, under the premise that fatal accidents can be avoided if individuals understand the need for safe driving and accept that crashes can be avoided. The aim is zero traffic deaths.

Indeed, the Safe System Approach, which has been adopted across several countries in Europe, has seen remarkably positive results. Traffic fatalities fell 50 percent In Sweden and the Netherlands between 1994 and 2015.

“There are communities that have gotten to [zero traffic fatalities] already,” added Buttigieg. “And I’m not just talking about Oslo,” which experienced zero pedestrian deaths in 2019, “but a place like Hoboken, N.J., in the U.S. has seen multiple years with zero deaths.”

Auto insurance premium rates are affected by many factors, and accident and fatality trends are a major ones. Reckless driving trends – combined with increasing auto repair costs associated with safety, efficiency, and comfort – can only continue to put upward pressure on rates. Individual behavior and government policies must converge in the direction of improving responsibility and safety for all drivers.