Second Home Insurance: Understanding Personal Liability Coverage

Introduction

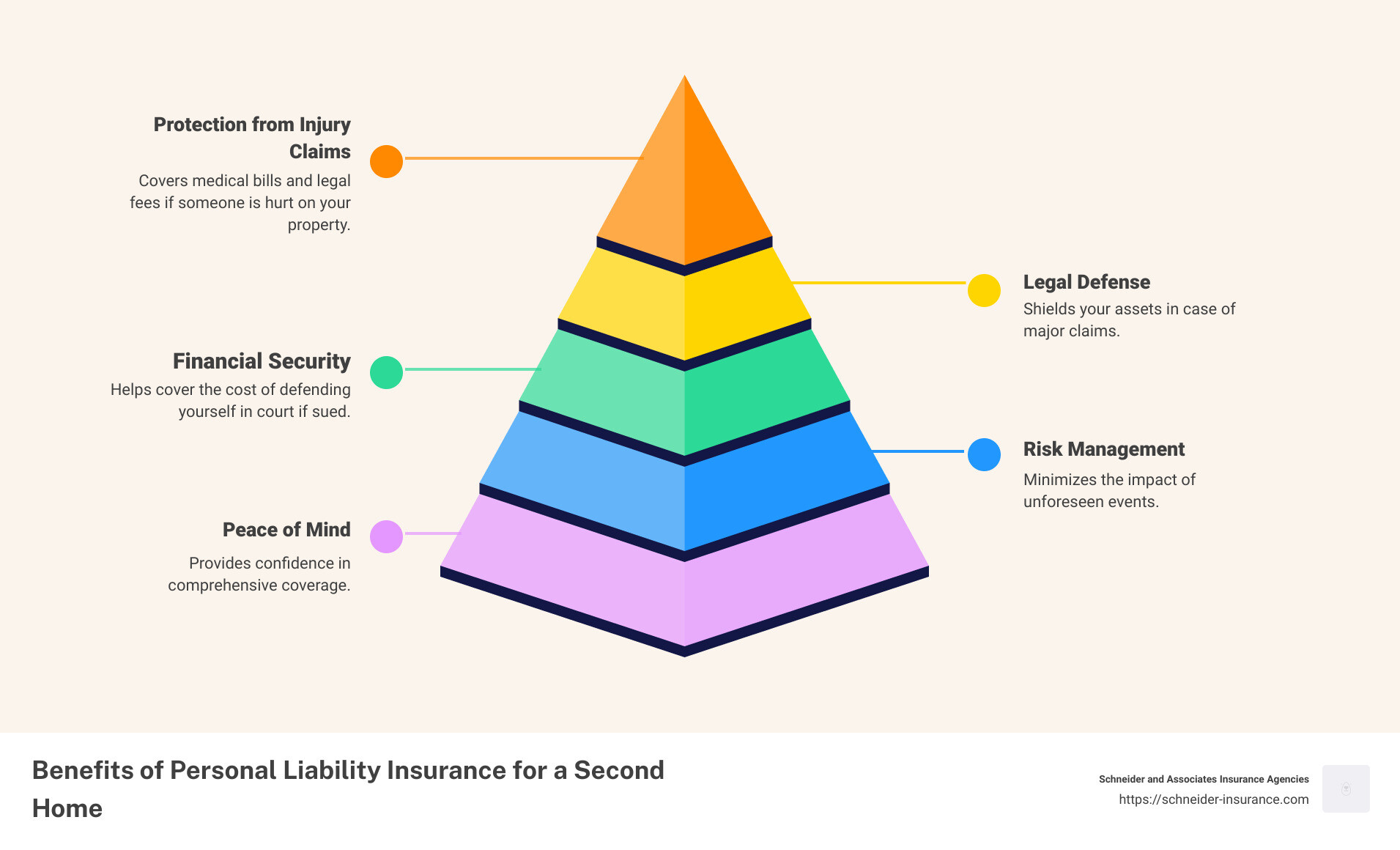

Do I need personal liability insurance for a second home? The short answer is yes. Here’s why:

Protection from injury claims: Covers medical bills and legal fees if someone is hurt on your property.Legal defense: Helps cover the cost of defending yourself in court if sued.Financial security: Shields your assets in case of major claims.

Owning a second home is a dream for many, offering a perfect escape and a solid investment. But with this dream comes the responsibility of properly insuring it, particularly when it comes to personal liability.

Personal liability insurance is essential for second homes. Why? Because these homes often sit empty, increasing the risk of unnoticed damage and potential injury claims. Whether it’s guests getting hurt or accidents involving your property, personal liability coverage acts as a financial safety net, protecting you from costly lawsuits and medical expenses.

For Florida homeowners, the stakes are even higher due to specific hazards like hurricanes and flooding. Ensuring your second home is covered with proper personal liability insurance isn’t just a good idea—it’s vital for complete peace of mind.

What is Second Home Insurance?

Second home insurance is a specialized type of insurance designed to protect properties that aren’t your primary residence. Whether it’s a charming cabin in the mountains, a beachfront condo, or a seasonal rental, second home insurance ensures that your property is covered against various risks.

Coverage Types

Just like your main homeowners insurance, second home insurance typically includes several types of coverage:

Damage to the Structure: This covers the physical building itself, such as walls, roof, and foundations.Personal Property: Items inside the home, like furniture, appliances, and personal belongings, are protected.Personal Liability: This helps with legal fees and medical costs if someone gets injured on your property.

Primary vs. Secondary Residence

While your primary residence is covered under a standard homeowners policy, this coverage does not extend to a second home. Each property must have its own policy because the risks associated with a vacation or rental home are different.

For example, a lake house might be at higher risk for flooding, while a ski cabin might face risks from heavy snowfall and potential roof damage.

Risk Factors

Several factors can affect the cost and coverage needs of second home insurance:

Location: Properties in areas prone to natural disasters will have different coverage requirements and higher premiums.Type of Property: The structure and amenities of the home, such as a pool or a detached garage, can impact insurance needs.Weather Risk: Homes in regions with extreme weather conditions may require additional coverage.Age of Property: Older homes might be more expensive to insure due to potential maintenance issues.Use of the Property: If you rent out your second home, you might need additional coverage for landlord liability.

Case Study: Florida Beach House

Imagine owning a beach house in Florida. Due to its location, it’s at higher risk for hurricanes and flooding. A standard homeowners policy wouldn’t suffice. Instead, a tailored second home property insurance policy would cover these specific risks, ensuring the property is protected even when it’s unoccupied.

Having the right insurance for your second home gives you peace of mind, knowing that your investment is safeguarded against unforeseen events.

Do I Need Personal Liability Insurance for a Second Home?

Owning a second home is a wonderful investment, but it also comes with unique risks. One of the most important protections you can have is personal liability insurance. This type of insurance helps cover costs if someone gets injured on your property or if you are held responsible for damages. Let’s dive into why personal liability insurance is essential for your second home and what you should consider.

Key Considerations for Personal Liability Coverage

Location: The location of your second home can greatly impact your liability risks. For example, a beach house in California might face risks like slip-and-fall accidents on wet surfaces or injuries from water activities. On the other hand, a cabin in the mountains might have risks related to hiking or wildlife encounters.

Property Type: The type of property you own also matters. A single-family home with a pool or extensive landscaping can present more hazards compared to a simple condo. Each feature adds a layer of risk that needs to be covered.

Usage: How you use your second home affects your insurance needs. If you rent it out, even occasionally, you increase the chances of someone getting injured. Rental activities introduce new risks that require additional coverage.

Potential Hazards: Consider the specific hazards associated with your property. For example, if your second home has a trampoline or a hot tub, these can be attractive nuisances that increase the likelihood of injury claims.

Benefits of Personal Liability Insurance

Legal Defense: If someone sues you over an injury that happened at your second home, legal fees can quickly add up. Personal liability insurance helps cover these costs, ensuring you have the resources to defend yourself in court.

Medical Expenses: If a guest is injured on your property, you could be responsible for their medical bills. Personal liability insurance helps cover these expenses, sparing you from out-of-pocket costs.

Peace of Mind: Knowing that you have coverage in place allows you to enjoy your second home without constant worry. Whether it’s a family retreat or a rental property, you can rest easy knowing that you’re protected against unforeseen incidents.

Financial Security: Without personal liability insurance, a single lawsuit could jeopardize your financial stability. This coverage safeguards your assets, ensuring that one accident doesn’t lead to financial ruin.

In summary, personal liability insurance is a crucial component of protecting your second home. It covers legal costs, medical expenses, and offers peace of mind, allowing you to fully enjoy your investment.

Next, let’s explore the additional coverage options available for second homes.

Additional Coverage Options for Second Homes

When insuring your second home, it’s essential to consider additional coverage options beyond standard policies. These options provide extra layers of protection and financial security, especially against unique risks. Let’s dive into some of these essential coverages.

Umbrella Policies

Umbrella policies offer extended liability coverage that goes beyond the limits of your standard homeowners or auto insurance policies. This type of insurance is particularly beneficial for high-net-worth individuals or those with significant assets to protect.

Key Benefits:

– Extended Liability: Provides additional coverage if you exceed the limits of your primary insurance.

– High-Net-Worth Protection: Ideal for those with substantial assets at risk.

– Excess Coverage: Covers incidents that may not be included in standard policies, such as libel or slander.

For instance, if a guest is injured at your second home and the medical and legal costs exceed your basic liability coverage, an umbrella policy can cover the excess amount, ensuring your finances remain intact.

Natural Disaster Coverage

Natural disasters can cause catastrophic damage, and standard homeowners insurance often doesn’t cover these events. Here’s a breakdown of essential natural disaster coverages for second homes:

Flood Insurance

Floods can happen anywhere, even outside designated flood zones. According to the National Flood Insurance Program (NFIP), flood insurance is a separate policy that covers damages caused by rising water levels. With climate change increasing the frequency and severity of floods, this coverage is crucial.

Average Cost: Around $700 per year for single-family homes.

Coverage Includes:

– Building Structure: Repairs or rebuilds your home.

– Contents: Covers personal property inside the home.

Earthquake Insurance

Earthquakes can cause significant structural damage, and standard homeowners policies typically exclude earthquake-related losses. Earthquake insurance is available through specialized providers and offers protection against these unpredictable events.

Key Features:

– Deductibles: Usually 10-20% of the coverage amount.

– Coverage: Includes repairs for cracks, foundation issues, and other structural damages.

– Additional Living Expenses: Covers costs if you need to live elsewhere during repairs.

Windstorm Insurance

Windstorms, including hurricanes and severe thunderstorms, can cause extensive damage to homes. Standard policies may not cover all wind-related losses, especially for high wind speeds.

Coverage Includes:

– Roof and Siding Repairs: Fixes damage caused by high winds.

– Extended Replacement Costs: Ensures you can rebuild even if costs have increased over time.

– Deductibles: Typically 1-5% of the insured value.

Example: Coastal homes, particularly in hurricane-prone areas, benefit greatly from windstorm insurance, offering peace of mind during storm seasons.

In summary, these additional coverages—umbrella policies, flood insurance, earthquake insurance, and windstorm insurance—provide comprehensive protection for your second home. They safeguard against significant risks and ensure financial stability, no matter what nature throws your way.

Next, let’s examine the factors that affect the cost of second home insurance and how you can manage these costs effectively.

Factors Affecting Second Home Insurance Costs

Ways to Reduce Insurance Premiums

When it comes to second home insurance, several factors can influence the cost. Understanding these can help you find ways to reduce your premiums.

Location: The location of your second home plays a significant role in determining insurance costs. Homes in areas prone to natural disasters like floods, hurricanes, or wildfires will have higher premiums. For instance, a beachfront home in Florida is likely to cost more to insure than a cabin in a less risky area.

Property Type: The type of property also affects insurance costs. Single-family homes usually have higher premiums compared to condos or townhouses. This is because condos often have shared security features and maintenance, which reduce risks.

Weather Risks: If your second home is in an area with high weather risks, such as flood zones or wildfire-prone regions, you will likely face higher insurance costs. Separate policies for flood or earthquake insurance might be necessary, adding to the overall expense.

Age of Property: Older homes typically cost more to insure due to the higher likelihood of structural issues and outdated systems. Newer homes, built to modern standards, often result in lower insurance costs.

Usage: How you use your second home affects your insurance needs. If it’s a vacation home that stays vacant for long periods, it’s at higher risk for theft and unnoticed damage, increasing insurance costs. Renting out your property, even part-time, usually requires additional coverage, such as landlord insurance.

Bundling Policies: One effective way to save on insurance premiums is by bundling your second home insurance with your primary residence policy. Insurers often offer discounts for bundling, making it a cost-effective option.

Security Systems: Installing security systems can significantly lower your insurance premiums. Alarm systems, smoke detectors, and carbon monoxide detectors reduce risks and can lead to discounts from your insurer.

Smart Home Devices: Using smart home devices can also help mitigate risks and lower premiums. Water leak sensors, smart locks, and motion detectors provide additional security and can alert you to potential issues before they become major problems.

Strategic Property Choice: Be strategic about the second home you choose. Opting for a location with fewer risks or a home that is part of a homeowners association (HOA) can qualify you for savings. HOAs often have collective security measures that reduce individual insurance costs.

By considering these factors and taking proactive steps, you can effectively manage and reduce the cost of insuring your second home.

Next, let’s explore some frequently asked questions about second home insurance.

Frequently Asked Questions about Second Home Insurance

Is insurance on a second home more expensive?

Yes, insurance on a second home is generally more expensive than insuring your primary residence. This is because second homes are often seen as riskier by insurance companies. They tend to be vacant for longer periods, which increases the risk of burglary, vandalism, and unnoticed damage.

For example, if your vacation home is in a location prone to natural disasters like Florida’s swamplands or California’s earthquake zones, your premiums will likely be higher. The Insurance Information Institute notes that homes in these high-risk areas often need additional coverage, such as flood or earthquake insurance, which can further increase costs.

Does an umbrella policy cover a second home?

Yes, an umbrella policy can cover a second home, but it primarily focuses on liability claims. This means it provides extra liability protection beyond what your standard homeowners policy offers. If someone gets injured on your property and sues you, the umbrella policy can cover the additional costs once your primary policy’s limits are exhausted.

The National Association of Insurance Commissioners suggests that an umbrella policy is a good idea if you have significant assets to protect. For example, if your homeowners insurance covers up to $500,000 in liability but you’re sued for $700,000, your umbrella policy would cover the remaining $200,000.

What is the difference between general liability and personal liability insurance?

General Liability Insurance is often used by businesses to cover claims of bodily injury or property damage caused by business operations. It typically covers:

Injuries that occur on business premisesDamage caused by the business’s productsLegal fees associated with defending against such claims

Personal Liability Insurance, on the other hand, is included in homeowners insurance policies and protects individuals against claims of bodily injury or property damage caused by personal activities. It typically covers:

Injuries that occur on your propertyDamage you or your family members cause to others’ propertyLegal fees associated with defending against such claims

Understanding these differences can help you ensure that you have the right coverage for your second home, whether you need protection for personal activities or business operations.

Next, let’s explore the additional coverage options you might need for your second home.

Conclusion

Owning a second home can be a wonderful investment and a source of joy, but it also comes with its own set of risks. As we’ve discussed, having the right second home insurance is crucial to protect this valuable asset.

Importance of Comprehensive Coverage

Comprehensive insurance coverage is not just a luxury—it’s a necessity. It ensures that you are protected against a range of potential issues, from natural disasters to liability claims. With the right coverage, you can enjoy your second home without constantly worrying about what might go wrong.

Personal liability insurance is particularly important. It protects you from financial losses if someone gets injured on your property or if you accidentally damage someone else’s property. Legal fees and medical expenses can add up quickly, and having this coverage can save you from significant financial stress.

Schneider and Associates Insurance Agencies

At Schneider and Associates Insurance Agencies, we understand the complexities of insuring a second home. Our approach is to offer tailored coverage that considers your unique situation. Whether your second home is a cozy cabin in the woods or a beachfront property, our team is dedicated to providing you with the right coverage.

We pride ourselves on our local touch. Our agents are familiar with the specific risks and requirements of different areas, allowing us to give you expert advice and support. We’re here to help you navigate the complexities of insuring a second home, so you can enjoy your property with peace of mind.

Ready to protect your second home? Get a quote today and let Schneider and Associates Insurance Agencies take care of your insurance needs.