Get to know the different types of insurance agents

Get to know the different types of insurance agents | Insurance Business America

Guides

Get to know the different types of insurance agents

What do the different types of insurance agents do? If you’re planning a career in the industry, this guide is for you

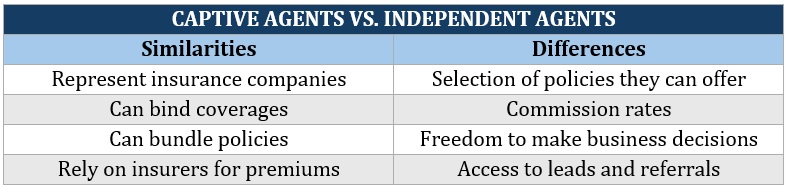

There are two types of insurance agents: captive agents and insurance agents. While both roles have certain similarities, there are also major differences. Insurance Business makes a detailed comparison of these professions in this guide.

If you feel like a career in insurance sales suits you but don’t know where to start, then you’ve come to the right place. In this article, we will give you an overview of the duties and responsibilities of the different types of insurance agents. We will also discuss how you can become an insurance agent and what skills you need to be successful.

We also encourage industry veterans to share this piece with aspiring insurance agents to give them an idea of their career options.

Captive agent versus independent agent – which one suits you? Find out in this guide.

Insurance agents are sales professionals who serve as intermediaries between the insurance company and potential buyers. Depending on the type, they may represent one or several insurance carriers. Their main role is to provide customers with information about their partner insurers and the products they offer.

Insurance agents have signed contracts with insurance companies detailing the policies they’re allowed to sell and how much they can earn for each successful sale. Agents also have the power to bind coverage. This means that they have the authority to confirm that coverage is in place even before the policy has been finalized.

Insurance agents come in two types:

Captive insurance agents

This type of agent represents one insurance company. If you choose to be a captive agent, you can choose to work either full-time for an insurance agency or as an independent contractor. Industry giants such as State Farm, Allstate, and Berkshire Hathway’s GEICO are some of the top brands that work exclusively with captive insurance agents.

Independent insurance agents

Independent agents work with several partner carriers. This allows them to offer customers a wider range of policies because they’re not tied down to just one insurer. Many insurance companies that partner with independent agents also work with captive agents. Some examples are Farmers, Liberty Mutual, Nationwide, and Progressive.

Apart from selling insurance policies, captive and independent agents share several similarities, including:

1. They represent insurance companies.

Both types of insurance agents are obligated to sell the policies of their partner insurers. Because of this, the products they offer are limited to what the carriers provide.

Agents have contracts with insurance providers containing the types of policies they can sell. They also have agreements on how much they earn in commissions for every completed sale.

Insurance agents mustn’t be confused with insurance brokers. While they also act as intermediaries between clients and insurers, brokers represent the insurance buyers. Compared to agents, brokers can also offer a wider selection of policies because they don’t have exclusive agreements with specific insurers.

2. They rely on insurance companies for premiums.

Although it may seem agents can dictate pricing to offer clients the best deal, they have no control over how much insurance companies charge. Insurers calculate insurance premiums depending on a range of personal and financial factors. What they come up with is what insurance agents present to clients.

3. They can bind insurance policies.

Another thing that separates insurance agents from most insurance brokers is the power to bind coverage. Independent and captive agents have the authority to issue insurance binders on behalf of insurers. These documents serve as proof of coverage to protect clients if unexpected situations arise before the formal policy is issued. There are some carriers, however, that also allow brokers to bind policies on their behalf.

4. They can help customers bundle policies.

Bundling policies is a great way for customers to save on insurance premiums. Insurance companies offer discounts to policyholders who purchase multiple policies. Both types of insurance agents can bundle different policies on the policyholder’s behalf. An example would be combining a home insurance policy with auto coverage or a life insurance plan.

There are some aspects of insurance sales where captive agents and independent agents differ. These include:

1. The selection of products they can offer

Independent agents can offer buyers a broader range of insurance products primarily because they work with more partner carriers. This allows clients to pick a policy that matches their coverage needs and financial situation better.

Because captive agents work exclusively with an insurer, they are limited to what their partner providers can offer. Captives, however, often have in-depth knowledge of their partner insurer’s products and guidelines. These include coverage options and claims processing. They may also receive ongoing training from their parent company.

2. The commissions they earn

Captive agents often receive salaries on top of commissions from their partner insurers. As salaried workers, they also receive regular employee benefits.

Generally, independent insurance agents earn higher commissions than their captive counterparts. These are offset, however, by their business expenses. Since independent agents often run their own operations, they are also responsible for their business costs. These include rent, office supplies, and marketing expenses.

3. Business decisions

Captive insurance agents are required to follow the rules and guidelines set by their partner insurer. They have less freedom when making business decisions, even if they’re running their own insurance agency. However, they do receive operational backing from their parent company. This includes office space and administrative support.

4. Lead generation

Captive agents often receive referrals and leads on potential buyers from their partner insurers. But they may still need to generate leads on their own to meet quotas. Insurance companies also take care of advertising and marketing, so captive agents don’t have to worry about these things. This frees up more time for them to do research on clients and build relationships.

Independent agents, on the other hand, are responsible for finding their own leads. Their main advantage is that they have access to a wider selection of policies. Giving clients more options raises the probability that they can get a good deal. A satisfied customer, in turn, is more likely to give a referral.

Here’s a summary of the similarities and differences between these two types of insurance agents.

Insurance agents can make a decent living selling policies, but this entails hard work and dedication. Regardless of the type, insurance agents can make money in several ways, including:

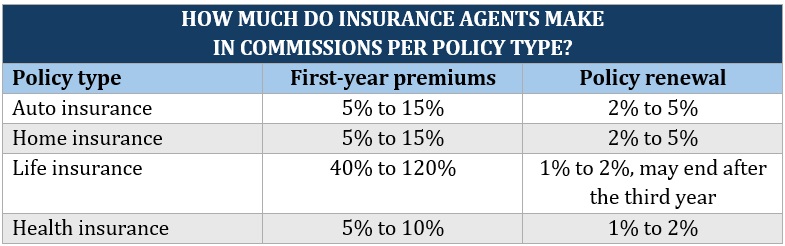

1. Commissions

The most common way for insurance agents to make money is through commissions. The amount they earn, however, depends on different factors, including:

what type of agent they are

the type of policy they sell

the number of sales closed

whether the policy is new or a renewal

For home and auto insurance policies, captive agents receive between 5% and 10% of the total premiums paid for the first year. Independent agents earn about 15%. Home and auto insurance commission rates for renewals range from 2% to 15%, regardless of the type of insurance agent.

Life insurance agents get front-loaded commissions of 40% to up to 120% of a policy’s first-year premiums. This is the highest in the industry. Commission rates for renewals, however, dip to 1% to 2%. Some agents don’t receive commissions anymore after the third year.

Commission rates for health insurance agents differ depending on their partner carrier. The industry average is 5% to 10% of the total first-year premiums. Agents selling group policies earn slightly lower commissions of between 3% and 6%. Group plans, however, are often purchased by businesses for their staff. This means that for a single employer, agents can earn up to four or even five figures, depending on the number of employees.

Here’s a summary of the commission rates for the different types of insurance policies.

2. Salary

Many captive insurance agents work as full-time salaried employees for insurance companies. Depending on their contract, they may receive commissions apart from their fixed wages. Salaried insurance agents only earn an amount they have agreed to with the insurer or their agency for the year. Their performance, however, still depends on how many sales they close.

3. Profit sharing

Some insurers have profit-sharing programs for their partner agencies if they reach certain revenue targets. Insurance companies often reward these agencies a portion of their written or earned premiums as a bonus.

Whether you’re a captive agent or an independent agent, your success depends largely on the kind of relationship you build with clients. Here are some practical tips on how the different types of insurance agents can grow their careers:

1. Practice excellent customer service.

Quality customer service is important if you want to build and maintain trust with your customers. If you want to succeed as an insurance agent, you must learn to understand each client’s unique needs. This will allow you to deliver outstanding service consistently.

2. Develop empathy.

Your clients are often already aware that they need financial protection. What they find challenging is figuring out which types of policies can address their needs. Empathy allows you to place yourself in their shoes and identify the coverage that matches their needs.

3. Play the long game.

Trying too hard to close a sale is the fastest way to ruin a client’s trust. Focus on building good relationships instead. By being patient, you’re more likely to secure a long-term client who may be willing to refer you to other customers.

4. Leave a professional impression.

Be conscious of the way you dress and communicate. These are important if you want to be taken seriously in the industry. When meeting clients, choose an attire that exudes professionalism. The choice of venue also plays a key role in helping you establish a professional impression. Talk to clients respectfully and communicate important concepts clearly and free of jargon.

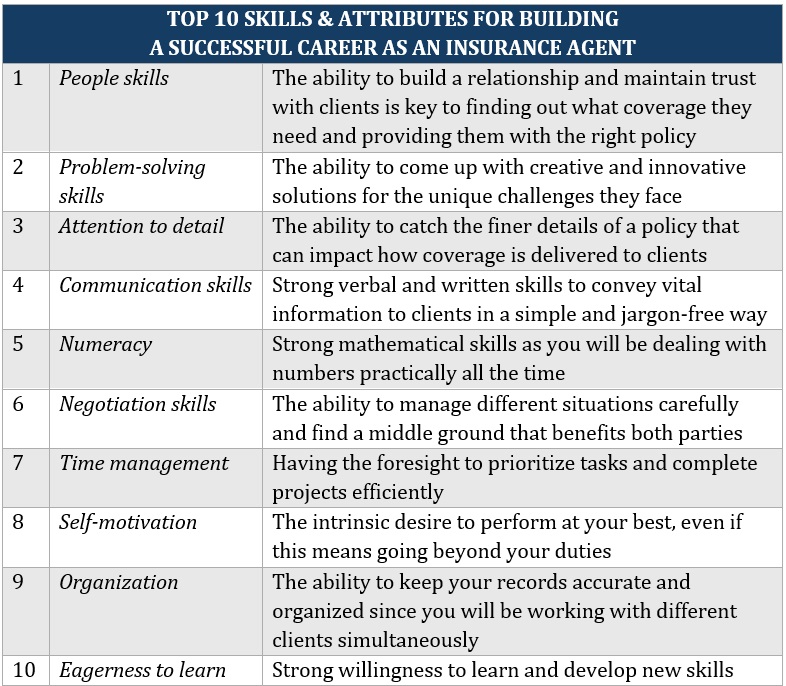

Having the right combination of hard and soft skills is also essential for a successful career as an insurance agent. The table below sums up some of the skills and attributes you need to thrive in this profession.

We recently unveiled the five-star awardees for the Hot 100 Leading Insurance Professionals in the US. These industry professionals were handpicked by their peers and vetted by our panel of experts as trusted and dependable market leaders. Take the time to learn more about these talented individuals. This way, you can find out what they did to rise through the ranks and become among the most respected players in the industry.

Did you find this article helpful in giving you an idea of what the different types of insurance agents do? Feel free to share your thoughts below

Keep up with the latest news and events

Join our mailing list, it’s free!