Property cat reinsurance rates-on-line down 5% at June renewals: Howden Re

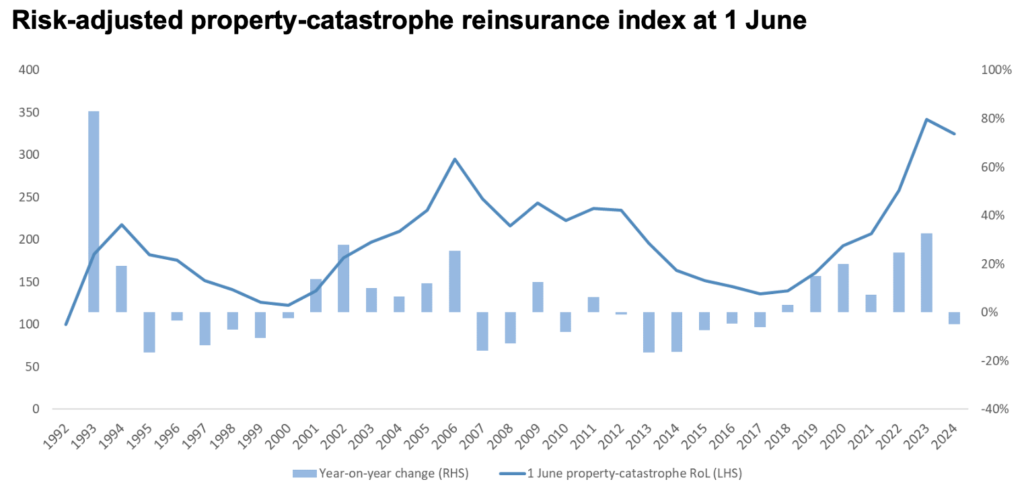

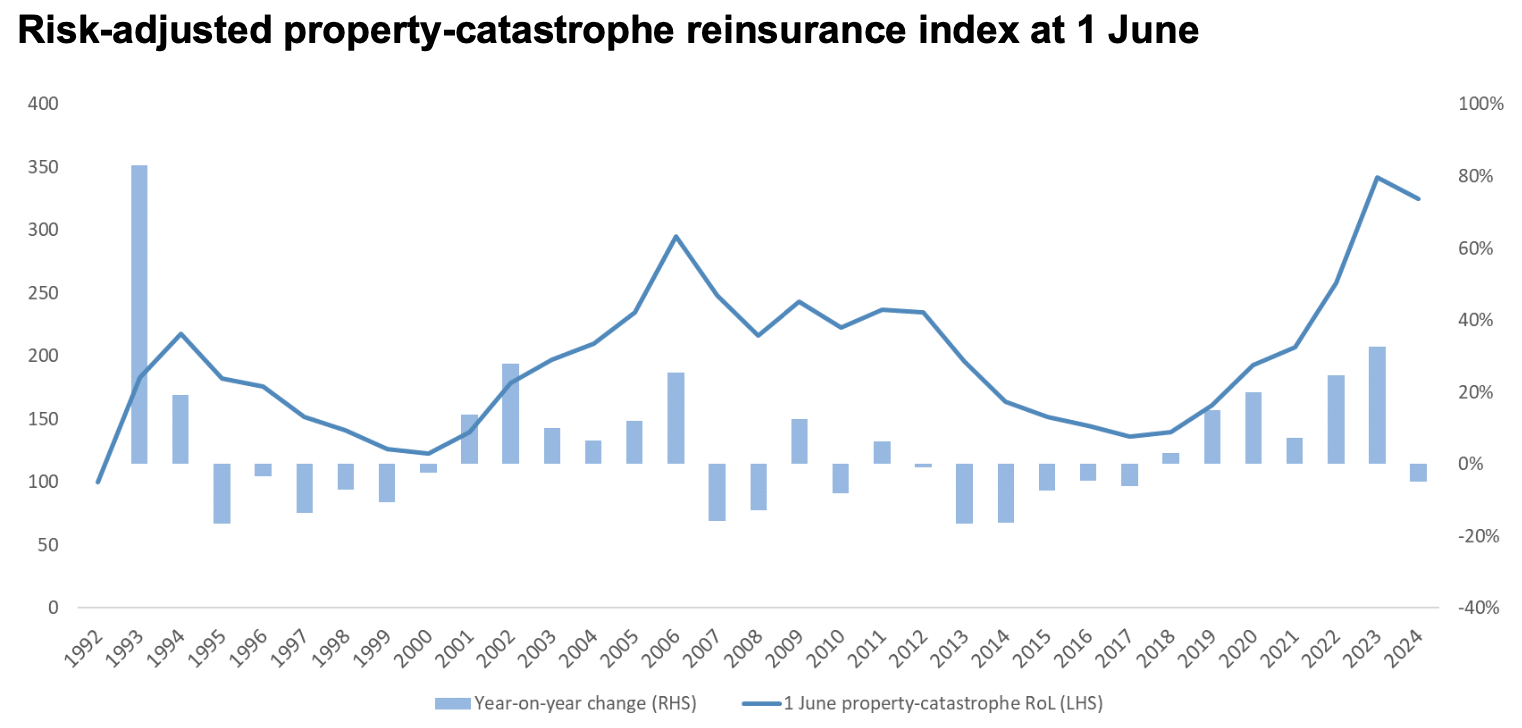

According to Howden Re, the reinsurance broking arm of Howden, property catastrophe reinsurance rates-on-line fell by 5% at the June 1st renewals, with pressure greatest at the upper-layers of towers.

Across the market, Howden Re says that property catastrophe reinsurance renewal rates fell in a typical range of -7.5% to – 2.5%.

Overall, the market experienced what Howden Re terms “a moderation” at the June reinsurance renewals, driven by an abundance of capacity for higher-layer risks.

This “period of adjustment” is due in part to the rebound in dedicated reinsurance sector capital, the broker explained, which it now says exceeds 2021 levels.

Strong ILS market inflows have supported this capital resurgence, Howden Re believes, growing capacity for the top of programmes and driving risk-adjusted rate reductions in higher layers.

It’s interesting to note that this is the first decline in property cat RoL’s in Howden Re’s data set since 2017.

It’s perhaps too early to read into whether this continues and capacity build-up drives further reductions in early 2025 at the renewals.

But commentary from Howden Re, on traditional reinsurer appetite at a time of strong cat bond and ILS growth, does echo what we were hearing over a decade ago before the softening of rates through the early to mid-2010’s.

Interestingly, Howden Re notes that some cedents also secured improved terms as well, at the June renewals.

“Buyers and sellers engaged early in the year, with cedents targeting better terms and conditions to address previous increases in limits and attachments, as well as narrower wordings. Reinsurers exhibited a proactive stance by completing many programmes early, enabling the deployment of increased retrocession capacity as the renewal drew near. This strategic approach enabled some buyers to achieve more favourable terms in what remains a cautious market,” the broker said.

Wade Gulbransen, Howden Re Head of North America, commented, “It is crucial that our clients secure optimal coverage in this rapidly evolving landscape. This means not only finding capacity, but also ensuring it aligns with their risk profiles and financial objectives.

“Our focus remains on providing innovative thinking alongside dynamic placement strategies to meet these challenges head-on.”

In insurance-linked securities (ILS), Howden Re highlights “a notable increase in activity and competition” with increased supply for the higher-layers of reinsurance towers, helped by a growing catastrophe bond market on record-pace, but also by more capacity for retrocession as well.

“Collateralised retrocession capacity has likewise expanded, with capital providers’ assets under management growing significantly,” the broker added.

Further stating that, “The increased level of ILS interest reflects a broader market trend towards diversified alternative risk transfer mechanisms, offering reinsurers and cedents more options to manage their exposures.”

Perhaps a little concerning though, for the future rate discipline of the market, Howden Re also says that, “Some reinsurers have begun to re-focus on property risks, aiming to grow in peak zones including southwest wind.”

Which, for those in the market for more than a decade, will likely sound reminiscent of the early to mid-2010’s when reinsurers grew significantly into US catastrophe risks, at a time of ILS market expansion and growth, and the market became firmly-set into a softening phase.

Howden Re also notes that there could be some short-term rate pressures from the hurricane season and its forecasts for a very active year, rising loss estimates from hurricane Ian, plus the persistent challenges at lower-layers of reinsurance towers.

David Flandro, Head of Industry and Strategic Advisory at Howden Re, said, “The reinsurance market is at a critical juncture. While the recovery of dedicated capital and increased capacity signal a potential softening of rates, the forecasted active hurricane season and other market pressures could counteract these trends. Strategic adaptability and expert guidance are essential in navigating these dynamics.”

We’ve yet to hear of any adjustments to reinsurer appetite after the recent hurricane model update, despite it clearly moving pricing in catastrophe bonds. So that could be an additional interesting dynamic to watch out for, especially if traditional reinsurers are loading up on US wind risk in 2024.

Read all of our reinsurance renewals coverage here.