Mortgage BS Buster

Mortgage Jargon Buster

When you’re buying a house, there’s an awful lot of highfalutin bullshit to wade through.

Plenty of terms that the average Joe just don’t know.

So to help you survive the onslaught, we’ve created a Mortgage Bullshit Buster, or MBB if you will.

Without further ado…

What is a Mortgage Drawdown date?

Your mortgage drawdown date is the day you “draw-down” or cash that big fat mortgage cheque from the bank.

It’s also known as Cheque Issue Date.

In reality, you’re not going to be cashing a giant cheque like a LOTTO winner.

3 numbers would be nice sometime 🙄

Instead, the bank transfers the mortgage funds electronically to your solicitor’s bank account on the drawdown date.

You must have your mortgage protection and home insurance in place before your drawdown date (although we recommend having it in place before you sign binding contracts)

Your drawdown date usually comes just before your closing date.

What is the Mortgage Closing Date?

This is THE BIG DAY.

When you become a homeowner, you get your keys and can move in.

What is a Letter of Indemnity?

This has to do with your home insurance.

If you’re getting a mortgage, you have to take out home insurance just in case the house goes up in smoke.

Your home insurance provider will issue a letter of indemnity naming your lender (the bank) on the home insurance policy.

You give this letter to your bank, and they tick a box.

What is a Confirmation of Assignment Letter?

This is similar to a letter of indemnity but has to do with your life insurance/mortgage protection.

When you get a mortgage, you need life insurance or mortgage protection to clear the mortgage if you die.

What’s the difference between mortgage protection and life insurance?

The bank needs a copy of your policy to prove you have said cover.

They also make you sign a Deed of Assignment, which transfers your policy ownership to the bank.

If anything happens to you, the bank gets the proceeds of the policy (so be careful not to add serious illness cover to your mortgage protection)

Your insurer will issue a Confirmation of Assignment letter to your bank proving ownership has been transferred to the bank.

Your bank ticks another box.

Quick quiz – say you add serious illness cover to your policy – Who gets the proceeds of a serious illness claim?

What is a Mortgage Moratorium?

Now, there’s a fancy word.

All it means is “payment break”.

Let’s say you get a 6-month moratorium at the beginning of your 30-year mortgage.

So you won’t have to pay a cent for six months.

Sounds dreamy – think of everything you could buy from IKEA in those six months.

Of course, the insurer will hike your repayments over the remaining 29.5 years of the mortgage to ensure you pay it off in full.

So maybe it’s not as dreamy as it first sounds.

What’s a Mortgage Protection Waiver?

If you’re:

your bank, at their discretion, may offer you a mortgage protection waiver.

This means you can proceed with your mortgage without having life insurance.

You must sign a declaration stating you understand the consequence of getting a mortgage without life cover.

In plain English, if you die, your partner will have to stump up all the mortgage repayments on their own, or they will lose the house.

What’s Conveyancing?

The legal work involves transferring property ownership from the seller/vendor/property owner to you, the buyer is know as conveyancing.

You shouldn’t need to worry about this.

Pay a competent solicitor, and they will remove all the headaches here.

Best House Purchase (Conveyance) Solicitor Ireland

Don’t go cheap when employing a solicitor, as discount conveyancing may come back to bite you on the arse if the proper checks have not been carried out.

Look for recommendations from friends who have been through the process before.

DO NOT google “cheap conveyancing”.

PRO TIP If you do google it, avoid all the firms you find advertising “cheap conveyancing”.

It’s cheap for a reason, people.

What Costs are Associated with Purchasing a Property?

Legal Fees/Conveyancing

Fees can start at €1,000, not including VAT and outlay.

Get recommendations and shop around.

You’d be crazy to pay less than €1500 for a professional fee.

Remember what I said about cheap.

Valuation:

The standard valuation fee is €130.

Surveyors Fees:

You don’t need a structural survey, but look, you’re paying hundreds of thousands of euros for a gaff.

Isn’t it worth paying €400 to ensure it won’t fall in a few years?

Get House Survey is the best in the business, and they offer fixed prices based on the size of your humble abode.

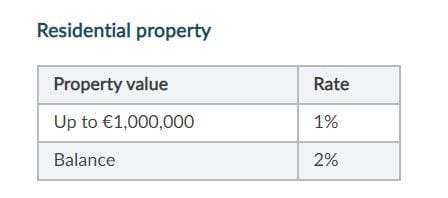

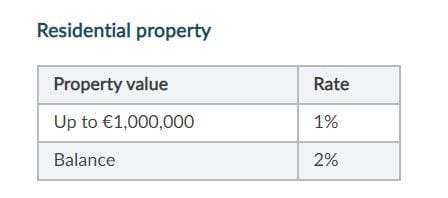

Stamp Duty:

Pretty simple:

If your dream home has a purchase price of €375,000, you will pay 1% of this, which is €3750.

Insurances

Ah, finally, it’s my time to shine 😎

Two types of insurance are mandatory.

House insurance

Shop around for this stuff, or you could pay through the nose.

If you’d like a quote, we can help; complete this questionnaire

Life Insurance/Mortgage Protection

It’s easy to get confused about the type of life insurance you need when getting a mortgage.

Your loan offer says you need life insurance coverage when, in fact, all you need is a type of life insurance called mortgage protection:

Your cover reduces over time (the same way your mortgage reduces as you pay it off).

God forbid you shuffle off this mortal coil unexpectedly. This policy will clear the outstanding balance on your mortgage.

Mortgage protection costs much less than life insurance, so be careful not to be hoodwinked into buying an expensive policy.

You don’t need life insurance when getting a mortgage

Should you combine life insurance and mortgage protection – absolutely not – here’s why

Over to you

Hopefully, that’s made things a little clearer.

Unfortunately, it’s impossible to avoid jargon when you’re getting a mortgage, but if you are ever confused by the terminology, don’t be afraid to raise your hand and ask a question.

Some of us old-timers have been in the job so long that we forget what it was like to know nothing about mortgages.

The Curse of Knowledge is real.

Best of luck buying your new home. If you need any insurance-related help, please complete this questionnaire, and I will email you a no-obligation recommendation on the types of insurance you should consider.

Thanks for reading

Nick

Editor’s Note: We published this blog in 2020 and have regularly updated it.