Florida Citizens secures $1.1bn of reinsurance with new Everglades Re cat bond

Citizens Property Insurance Corporation, the property insurer of last resort for the state of Florida, has now finalised its new catastrophe bond, in the end securing $1.1 billion of reinsurance from the Everglades Re II Ltd. (Series 2024-1) deal, so the size fell slightly short of its upper-target, Artemis has learned.

Florida Citizens in the process of buying its biggest reinsurance program ever for the coming 2024 hurricane season and catastrophe bonds will continue to play a very significant protection role for the insurer.

This Everglades Re II 2024-1 catastrophe bond issuance was first marketed to investors back in April, with Citizens initially targeting a dual-series issuance, one of two-year and one of three-year notes, with a goal to secure at least $850 million of fully-collateralized reinsurance.

As we later reported, the two-year notes series were dropped from the issuance as the focus shifted to only securing three-year reinsurance with the latest Everglades catastrophe bond deal.

At the same time, the target size across the 2024-1 notes was lifted, with between $950 million and $1.25 billion in reinsurance then being sought by Florida Citizens.

However, as we also reported yesterday, Florida Citizens has a maximum budget to spend on its $5.5 billion of reinsurance for this coming wind season, which was lifted from an earlier placeholder and expectations are that the average rate-on-line across the tower would rise as well.

Which has meant Florida Citizens is as price sensitive as ever and will buy its reinsurance in the formats that provide the greatest cost and coverage efficiency for 2024.

As a result, it’s perhaps not surprising to now learn that this Everglades Re 2024-1 catastrophe bond has now been priced and finalised to provide Florida Citizens $1.1 billion in reinsurance, so below the upper-target it had previously set.

Artemis has learned that two of the tranches have come in below their upper-target sizes, while the riskiest tranche actually priced below the bottom-end of their size target.

Which shows Florida Citizens clearly reacting to market price, it would seem and after the widening of secondary cat bond spreads and higher price being demanded on primary issues, is again not that surprising.

As a result, this new Everglades Re II Series 2024-1 catastrophe bond issuance will provide Florida Citizens with a $1.1 billion source of fully-collateralized annual aggregate named storm reinsurance for losses in the state of Florida, on an indemnity trigger basis over a three-year term.

What was originally a $150 million Class A tranche of notes with a base expected loss of 1.24% and were then updated to target between $350 million and $450 million in size, have now been priced at the upper-end, for $450 million of protection.

The Class A notes were initially offered with price guidance in a range from 9.5% to 10.25%, which rose to updated guidance fixed at 10.5% and that is where the notes have now priced.

What was a $150 million Class B tranche of notes with a base expected loss of 1.51% are were updated to target between $350 million and $450 million in size, have now been priced to provide $425 million in protection, we understand.

The Class B notes were initially offered with price guidance in a range from 10.5% to 11.25%, which was updated and fixed at 11.5%, which is where the notes have now been priced.

The final Class C tranche were initially targeted at $125 million in size with a base expected loss of 1.91% and updated to target between $250 million and $350 million, but we’re told have now been priced to provide $225 million in cover, so below the updated range.

The Class C notes were initially offered with price guidance in a range from 11.5% to 12.25%, which was later updated and fixed at 12.75% and this is where the coverage was eventually priced.

The fixing of the price guidance at a single figure for each tranche, when the size targets were updated to ranges, may show that Florida Citizens had a maximum price appetite for securing this coverage, to which it stuck and so the issuance size was relinquished in favour of securing the spreads at the level the insurer of last resort was willing to pay.

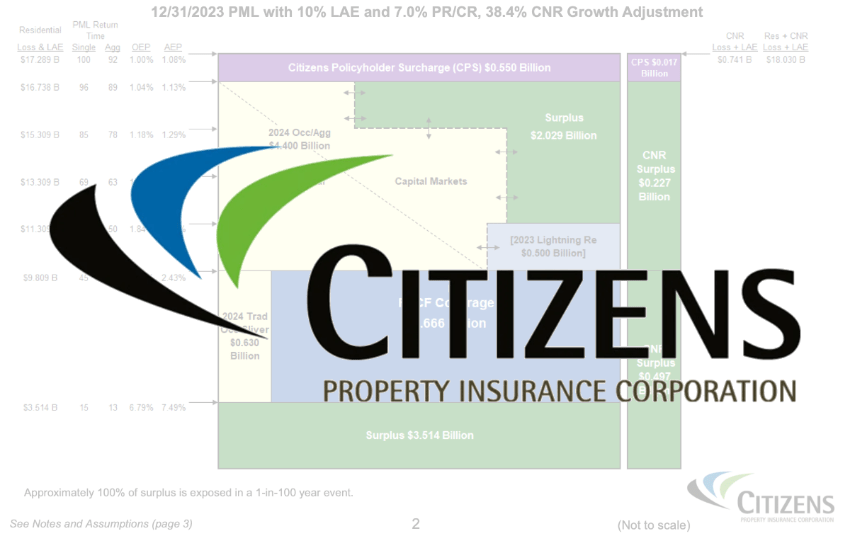

All of which means that, as things currently stand, Florida Citizens will go into the 2024 Atlantic hurricane season with $1.1 billion of Everglades indemnity cat bond cover, $500 million of industry-loss based cat bond cover from Lightning Re, while the rest of its $5.5 billion risk transfer tower, so $3.9 billion, will be from traditional and collateralized reinsurance markets.

That will be the most reinsurance Florida Citizens has ever purchased and its cat bond cover, as a percentage of the total tower, will actually have shrunk it appears.

A year ago, Florida Citizens went into the hurricane season with over $2.4 billion of outstanding catastrophe bond backed cover in-force.

So, at $1.6 billion for 2024, the catastrophe bond market’s position in Florida Citizens reinsurance tower has shrunk, although we do expect ILS fund managers will take significant shares of its traditional reinsurance placement again this year.

You can read all about this new Everglades Re II Ltd. (Series 2024-1) catastrophe bond from Florida’s Citizens Property Insurance Corporation and view details of more than 1,000 other cat bond issuances in the extensive Artemis Deal Directory.