What disqualifies you from long-term care insurance?

What disqualifies you from long-term care insurance? | Insurance Business America

Guides

What disqualifies you from long-term care insurance?

What medical conditions disqualify you from long-term care insurance? What are your options if you get coverage denied? Find out the answers

One of the biggest misconceptions about long-term care insurance is that it’s only for seniors who need assistance due to age-related impairments. Regardless of age, people can develop conditions or get into accidents that can take away their ability to care for themselves. This highlights the need for long-term care coverage across different age groups.

Not everyone who requires help with daily activities, however, is eligible for coverage.

In this client education article, Insurance Business explains what disqualifies you from long-term care insurance. If you’re preparing for your future care needs or helping a loved one, this guide can be useful. Read on and learn more about the factors that can make you ineligible for coverage and how these can be avoided.

Long-term care insurance covers the cost of medical and non-medical services for people who have lost the ability to care for themselves. To qualify for coverage, you will need to present proof that you can no longer perform at least two of these six activities for daily living (ADLs):

bathing: getting in and out of the bathroom to clean yourself

continence: controlling urinary and bowel movements

dressing: putting on or taking off your clothes

eating: feeding yourself

toileting: getting on and off the toilet

transferring: getting in and out of a bed or a chair

Most insurers accept certification only from reputable health services providers, so be mindful of where you get the certificate.

Some insurance companies also offer coverage for debilitating illnesses. These include Alzheimer’s disease, multiple sclerosis, and dementia. Such conditions, however, must not have existed when you took out the policy.

If you put off purchasing coverage until you already have health issues, there’s a strong chance that your application will be denied. Here are the biggest reasons that can disqualify you from long-term care insurance coverage:

1. Your age

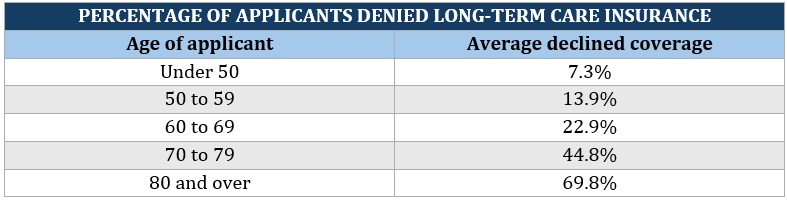

Data from the American Association for Long-Term Care Insurance (AALTCI) below shows that your chances of qualifying for long-term care insurance decrease as you get older. This is because the risk of developing health issues increases as you age. Some insurers also impose age cut-offs – usually 80 or 85 – for those wanting to get coverage.

What disqualifies you from long-term care insurance – percentage of applicants denied coverage, AALTCI

Krystie Dascoli, voluntary benefits practice leader at Marsh McLennan Agency, suggests buying long-term care insurance while you’re still young and gainfully employed.

“A big mistake we see individuals make is waiting until after retirement to purchase long-term care insurance,” she notes. “By purchasing long-term care plans during their working years and through their employer, individuals will have the opportunity to buy this insurance without answering medical questions and usually have access to higher face amounts.”

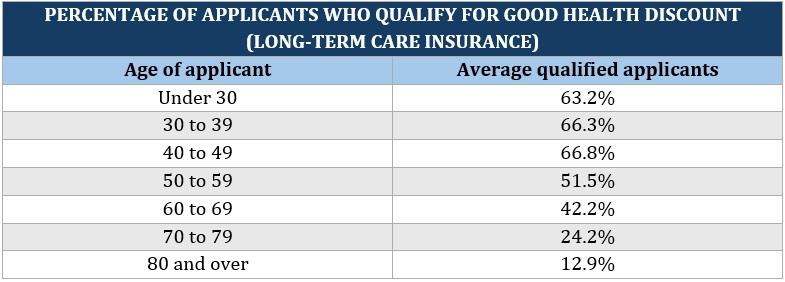

Another benefit of getting coverage while younger, according to AALTCI, is that you can qualify for a good health discount.

“Your good health can get you preferred health discounts that will save you significant dollars,” the industry non-profit explains on its website. “Plus, you lock them in. You can’t lose your good health status even if your health changes at a future date.”

Here are the figures from the organization’s previous research:

What disqualifies you from long-term care insurance – percentage of applicants who qualify for good health discount, AALTCI

2. Pre-existing conditions

Insurance providers evaluate each applicant’s health status before approving coverage. The requirements differ but having a pre-existing condition makes it almost impossible for you to get long-term care insurance.

What conditions can disqualify you from long term care insurance? Here’s a list from the AALTCI:

AIDS or HIV infection

Alzheimer’s disease

amyotrophic lateral sclerosis (ALS)

ankylosing spondylitis

bipolar disorder or other mental illnesses requiring antipsychotic medications

cancer

cardiomyopathy

cerebral atrophy (paralysis)

cerebral palsy

Cushing’s syndrome

cystic fibrosis

dementia

hemophilia (other than Von Willebrand disease)

hepatitis C, or non-A, non-B, or autoimmune hepatitis

Huntington’s disease

kidney failure

liver cirrhosis

memory loss

mid- to advanced multiple sclerosis

muscular dystrophy

myasthenia gravis

Parkinson’s disease

post-polio syndrome

schizophrenia

scleroderma

sickle cell anemia

significant stroke (cerebral vascular accident)

spinal cord injury

systemic lupus erythematosus

There are a few insurers that offer coverage for those with existing illnesses or disabilities, but the rates are often significantly higher.

If you have a pre-existing medical issue, your best choice may be to get a health insurance policy. Check out the different affordable health insurance options available in this guide. A health insurance plan, however, doesn’t usually cover long-term care services.

3. Cognitive impairments

Applicants already showing signs of cognitive decline are often disqualified from getting long-term care insurance. Those with mild cognitive impairments (MCI) aren’t necessarily excluded from coverage but may need to pay higher premiums.

4. Terminal illnesses

Long-term care insurance pays for the cost of care support and services for those who need assistance in doing basic daily living activities. The policy isn’t designed to cover end-of-life care.

You can get coverage for palliative care through Medicare and Medicaid. Your private health insurance may also help cover the costs.

5. Recent hospitalizations and surgeries

If you experienced a major health issue before applying for coverage, insurance companies may deny your application. A cancer diagnosis or a stroke, for example, may disqualify you from long-term care insurance, especially if it happened within a certain timeframe before getting coverage.

Recent hospitalizations and surgeries can also prevent you from accessing a long-term care policy. Some insurers, however, won’t necessarily reject your application but may impose waiting periods before providing coverage.

6. Substance abuse

Most long-term care insurance providers view individuals with a history of substance abuse as having a higher risk of needing care support and services due to health issues. Past alcohol or drug addiction can disqualify you from long-term care insurance or significantly raise your premiums.

7. Non-health-related factors

You can also be denied long-term care insurance coverage due to non-medical or health-related reasons. Some insurers don’t offer coverage to individuals with a criminal history, especially those with felony records.

Applicants who fail to disclose relevant health information or those who deliberately provide false information are disqualified from coverage. They can also face legal consequences.

If your medical or financial situation is preventing you from getting long-term care insurance, you have several alternatives:

1. Medicaid

Medicaid is a joint state and federal program catering to low-income families. It pays for the cost of medical care and some types of long-term care services. One drawback is that Medicaid has strict eligibility criteria, which vary between states.

Medicaid doesn’t cover board and lodging expenses in assisted living facilities. Several states, however, provide Medicaid waiver programs to help pay for on-site therapy, medication management, and other care services provided in your home.

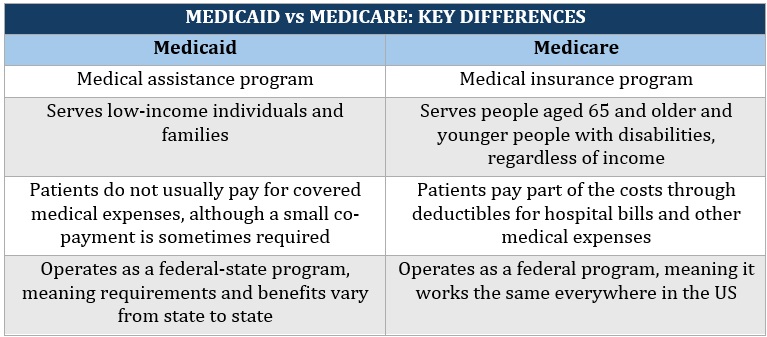

Medicaid mustn’t be mistaken for Medicare, which is an entirely different program. Because of their similar-sounding names, people are often confused about what each program covers. Another factor that adds to the confusion is that in some situations, you may be able to apply for both.

Here’s a summary of the key differences between these two government-administered programs.

2. Veterans’ benefits

Military veterans and their spouses who receive pensions through the Veteran’s Administration (VA) may qualify for aid and attendance benefits. These can help cover the cost of long-term care services.

To be eligible, pensioners must meet certain service, asset, and income requirements. They also need to provide certification stating that they can no longer perform at least two of the six ADLs without substantial assistance.

3. Hybrid life insurance policy

A hybrid life insurance policy provides a death benefit if you don’t get to use the long-term care payouts. The premiums are often higher but are guaranteed to remain the same over the life of the policy.

Like whole life insurance, a hybrid plan lets you receive a cash value if you surrender the policy. Some policies provide a partial refund of the premiums you’ve paid.

“An individual who purchases a standalone long-term care policy has a 50/50 chance of using it,” Dascoli explains. “Standalone or traditional long-term care insurance is a ‘use it or lose it’ type of policy. An insured could hold on to this type of policy for many years and never use it.

“A hybrid life insurance policy, on the other hand, is a multi-use policy that not only pays a death benefit but can also pay when a person is diagnosed with a terminal illness or when the individual needs long-term care. We promote the hybrid policies more because, at some point, the individual will use it and it also builds cash value.”

4. Life insurance rider

If you have a life insurance policy, you can buy a rider to access long-term care coverage. This add-on lets you use a portion of the policy’s death benefits to pay for care support and services. Learn more about how life insurance works in this guide.

5. Self-funding

If your retirement savings are more than enough to pay for your long-term care expenses, then you can go without coverage. Same goes if you have a source of income or pensions that can cover your care costs.

Your age and health status are the biggest factors that can impact your eligibility for long-term care insurance. Some industry experts recommend getting coverage at a younger age as you are least likely to have major health issues and more likely to access lower premiums.

You can also take proactive steps to ensure that you qualify for coverage by maintaining a healthy lifestyle and minimizing health risks.

Different insurance providers, however, also have varying criteria for those eligible for coverage. When choosing a long-term care insurance policy, it’s best to shop around and compare insurance companies to ensure that you’re getting a great deal.

Now, the question is: where can you find the right insurers to cater to your unique needs?

Our Best in Insurance Special Reports page is the place to go if you’re searching for long-term care insurance companies that provide top-notch coverage. The insurers featured in our special reports have been handpicked by their peers. They have also been vetted by our panel of industry experts as trusted and reliable market leaders. By partnering with these companies, you can have peace of mind knowing that no matter what happens, you will be getting the best care possible.

Do you agree with our list of what disqualifies you from long-term care insurance? Are there other reasons that we might have missed? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!