Windstorm Ciarán (Emir) industry loss lifted another 5.5% to €2.043bn by PERILS

The insurance and reinsurance industry loss estimate for European extratropical windstorm Ciarán from November 2023 has been raised by a futher 5.5% to reach €2.043 billion by PERILS.

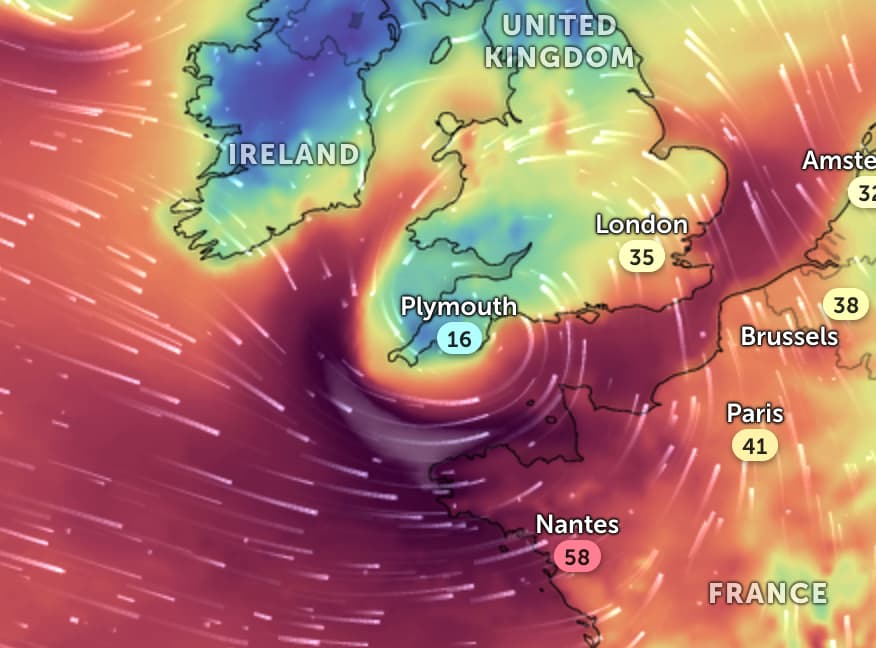

Windstorm Ciarán (also known as Emir) affected France, Belgium, the United Kingdom, and the Netherlands between November 1st and 2nd 2023 and saw some of the strongest wind gusts experienced in Europe for years.

It represents the highest insurance market loss caused by a European windstorm event, rather than a cluster, since Kyrill in 2007.

Losses that flowed to the insurance industry are said to have been typical for a European windstorm, with a large number of smaller claims, mostly from non-structural property damage, adding up to a significant total

In its first estimate, PERILS pegged the insurance market loss from the windstorm at just under €1.89 billion.

Then, PERILS updated the estimate and increased the total by nearly 3% to just under €1.94 billion.

Now, six months after the windstorm impacted Europe, PERILS has updated the total again, lifting the insurance market loss estimate by 5.5% to $2.043 billion, which is approaching US $2.2 billion.

The industry loss estimate is solely based on the property line of business and gathered through loss data collected from the affected insurers.

The majority of the insurance industry loss came from damage to properties in France, at EUR 1.738 billion, followed by the United Kingdom, Belgium and the Netherlands.

PERILS noted that windstorm Ciarán’s industry loss was not unusual as impacts of this magnitude can be expected to occur once every four years, but for France it was a rarer windstorm event with the loss level generated by Ciarán expected to be reached or exceeded once every twelve years.

It’s notable, once again, that the initial estimates of insured losses for windstorm Ciarán from risk modellers fell far below where the industry total has now risen. Verisk had initially pegged the storm at between €800 million and €1.3 billion and Moody’s RMS had put it at between €900 million and €1.5 billion.