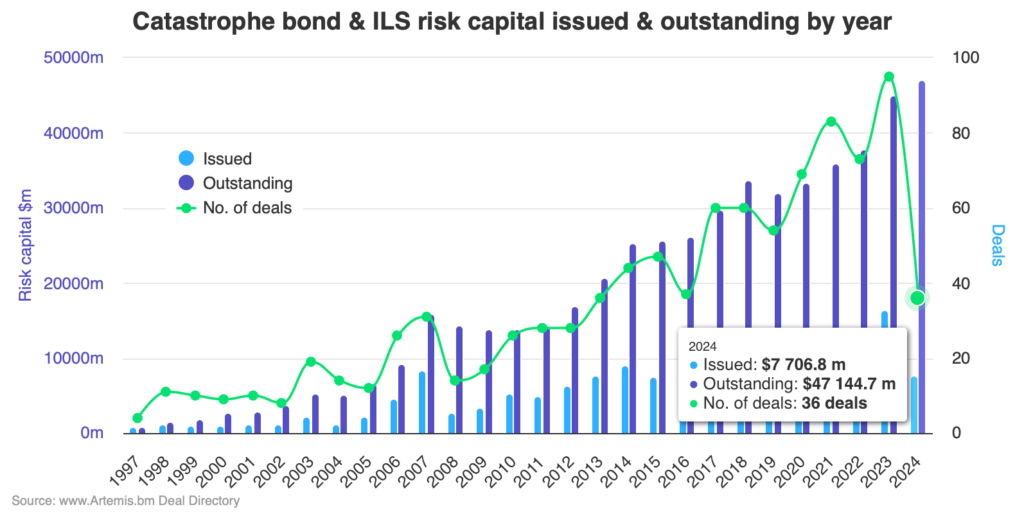

Cat bond & related ILS market hits record size at over $47bn, up 5% so far this year

According to Artemis’ Deal Directory data, which tracks issuances of catastrophe bonds and related insurance-linked securities, the outstanding market has hit a record high of more than $47 billion in risk capital outstanding, having already risen by 5% since the end of last year.

As of today, issuance of new 144A catastrophe bonds and the few private cat bonds Artemis tracks has reached over $7.7 billion in 2024 so far.

The catastrophe bond market is running at a record-setting pace again in 2024 and with a number of large cat bond deals expected and the pipeline still looking strong, we’re now anticipating a new half-year record for issuance could be set.

With the settlement this week of a number of new catastrophe bonds, issuance tracked by Artemis has reached $7.7 billion and our measure of risk-capital outstanding for the market is now at almost $47.2 billion.

It’s the first time the outstanding catastrophe bond and related insurance-linked securities (ILS) market has been above $47 billion in size, a new milestone for this market.

The outstanding cat bond and related ILS market was just under $45 billion in size at the end of 2023, so has grown by almost 5% since then, which given a significant amount of maturities earlier this year is testament to investors and cat bond fund managers reinvesting cash earned and raising new capital to support the bumper pipeline of deals.

Impressively, the outstanding cat bond and related ILS market is now over 24% larger than it was at the end of 2022, reflecting the strong issuance and growth in capital earned through returns from risk premium and collateral over that period.

Most impressive data point though, is the fact that the market had shrunk through the first-quarter of this year (as our report detailed), so just since the end of March it has now expanded by almost 6%.

Looking ahead, if all new cat bonds we have listed in our Deal Directory settled as they are listed today the first-half would already be the fourth largest on record.

But with a number of other cat bonds, some particularly large anticipated, we feel it’s safe to call for a new record for first-half issuance in 2024, unless something were to derail the market’s trajectory.

There are just under $1.7 billion of cat bond maturities to come before the end of the first-half of this year, but already roughly $1.7 billion left in our Deal Directory to complete.

So, with more deals to come and a chance of some of those already listed upsizing, it seems highly probable the outstanding market will grow even further by the end of the first-half of 2024.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.