Is long-term care insurance worth it?

Is long-term care insurance worth it? | Insurance Business America

Guides

Is long-term care insurance worth it?

Is long-term care insurance worth it? Who would likely benefit from this type of coverage? What is the policy’s biggest drawback? Find the answers here

Senior-age Americans have around 70% chance of needing long-term care support or services, according to the latest government estimates. Access to these services, however, comes at a steep price. Without the right coverage, the high cost can easily deplete your retirement funds.

Unfortunately, health insurance doesn’t cover these types of expenses. To be protected, you will need to get long-term care insurance.

In this client education article, Insurance Business answers the question, “Is long-term care insurance worth it?” We will discuss the policy’s pros and cons, how much premiums cost, and the right age to get coverage.

If you’re planning for your own care or helping an older loved one, you’ve come to the right place. Find out the answers to the most pressing questions about long-term care insurance in this guide.

There’s a strong likelihood that you will need long-term care services once you turn 65 based on the figures gathered by the Administration for Community Living (ACL).

The agency’s data also shows that men will require long-term care support for an average of 2.2 years, while women will be needing it for 3.7 years. Regardless of gender, a quarter of American seniors may require care services for at least five years.

Without long-term care insurance, you’ll have to pay for these expenses out of pocket – but they don’t come cheap. To give you a picture of how much care support and services cost, here’s a summary from industry giant Genworth.

Average cost of care support and services in the US

AVERAGE COST OF LONG-TERM CARE SERVICES

Type of service

Average monthly rate

Average yearly rate

Homemaker services

$5,720

(44 hours per week)

$68,640

Home health aid

$6,292

(44 hours per week)

$75,504

Adult day health care

$2,058

$24,696

Assisted living facility

$5,350

$64,200

Nursing home facility, semi-private room

$8,669

$104,028

Nursing home facility, private room

$9,733

$116,796

Source: Genworth, Cost of Care Survey 2023

Given the steep costs, long-term care services can eat into your retirement savings very quickly. Purchasing long-term care coverage can help to address this.

You can also get assistance through Medicaid, but there are certain restrictions. One, your options will be limited to nursing homes that accept payments from the government-sponsored program. You will also need to exhaust most of your savings to get coverage. Despite this, Medicaid won’t pay for all your assisted living expenses.

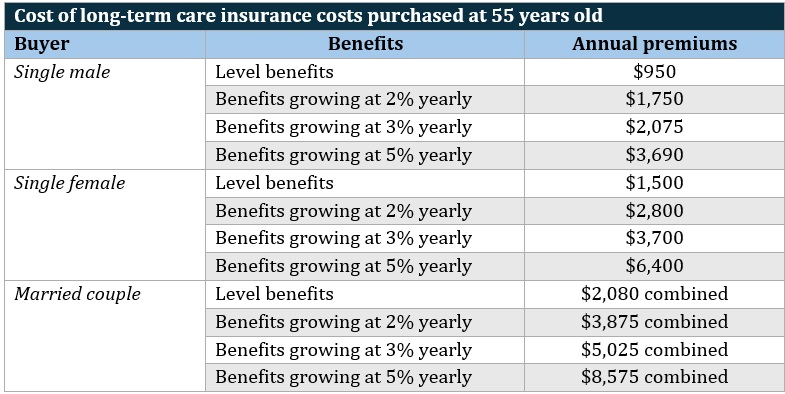

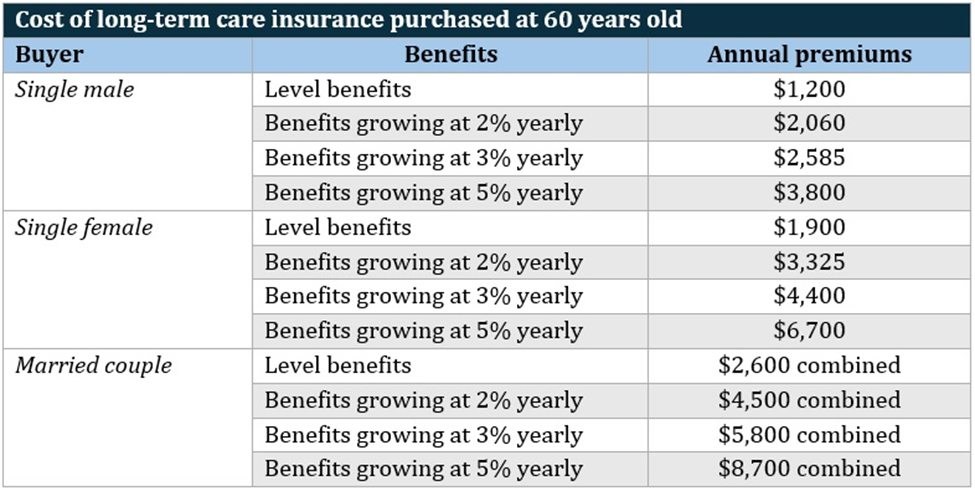

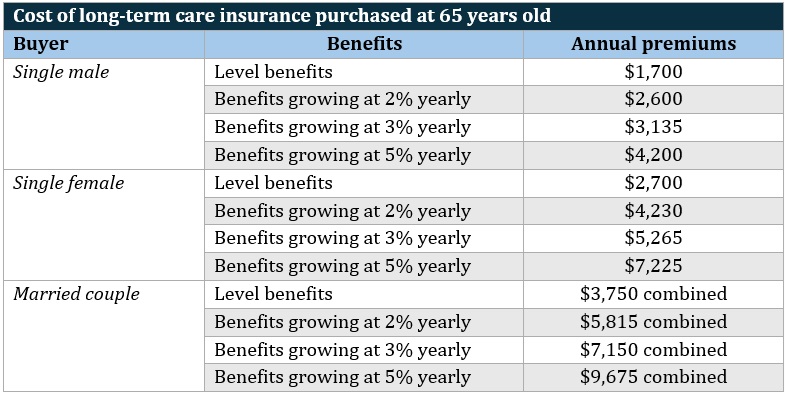

The tables below contain data from the American Association for Long Term Care Insurance’s (AALTCI) latest price index. The figures show how much you can expect to pay in annual premiums for a long-term care insurance policy worth $165,000.

The costs are categorized by age, gender, and marital status. The data also includes the cost of policies with inflation growth provisions.

Is long-term care insurance worth it – cost for policies purchased at 55 years old

AALTCI’s price index shows that the value of the policy can grow to $298,900 once the holder reaches 85 years old for plans with a 2% inflation growth provision. For those with 3% provisions, the value can top $400,500 and $679,100 for policies with a 5% inflation benefit.

Is long-term care insurance worth it – cost for policies purchased at 60 years old

Long-term care insurance coverage can be worth $270,700 on the policyholder’s 85th birthday if the plan has a 2% inflation growth provision. The value increases to $345,500 and $588,750 for policies with 3% and 5% inflation benefits.

Is long-term care insurance worth it – cost for policies purchased at 65 years old

The value of long-term care insurance plans with 2% inflation growth provisions can rise to $245,000 after the policyholder turns 85. The policies can be worth $298,500 and $437,800 if they have respective inflation benefits of 3% and 5%.

The figures above are for “Select” long-term care insurance policies. These are more expensive than “Preferred” plans, according to the AALTCI. The industry non-profit adds that the rates are for seniors living in Illinois. Your premiums can be higher or lower, depending on different factors, including where you live.

Each state has its own criteria on who can qualify for long-term care insurance benefits. Most will require you to get certification that you can no longer perform at least two of the six activities for daily living (ADL). These are:

eating: feeding yourself

bathing: getting in and out of the bathroom to clean yourself

dressing: putting on or taking off your clothes

continence: controlling urinary and bowel movements

toileting: getting on and off the toilet

transferring: getting in and out of a bed or a chair

Those suffering from a debilitating condition may be eligible for coverage. These conditions may include:

Alzheimer’s disease

schizophrenia

dementia

multiple sclerosis

Parkinson’s disease

Lou Gehrig’s disease

One of the biggest myths about long-term care insurance is that it is designed for seniors who need assistance because of age-related impairments.

Krystie Dascoli, voluntary benefits practice leader at Marsh McLennan Agency, notes that anyone can develop conditions or get into accidents that can impact their long-term health. This highlights the need for long-term care insurance across different age groups.

“Long-term care can happen at any time in someone’s life, not just due to old age or chronic illness,” she explains. “This is a great program to complement other financial wellness programs such as term life and disability insurance.”

Some industry experts recommend taking out long-term care insurance while you’re young. This can help you access lower premiums, although you will need to pay for the policy longer.

Dascoli suggests getting coverage while you’re still gainfully employed.

“Rates will go up significantly with age, so buying a long-term care policy early in the working years is ideal,” she says.

If you’re already 65 years old but haven’t purchased long-term care insurance, taking out coverage should still be a consideration, she adds.

“A big mistake we see individuals make is waiting until after retirement to purchase long-term care insurance. By purchasing long-term care plans during their working years and through their employer, individuals will have the opportunity to buy this insurance without answering medical questions and usually have access to higher face amounts. This is especially important for anyone with pre-existing medical conditions.”

The American Association of Retired Persons (AARP) says your early to mid-60s is the “sweet spot” if you’re single. For married couples, the best time to get long-term care insurance is at 55 years old.

The group adds that premiums may be higher when you buy coverage at this age range than it would have been in your late 40s to early 50s. The benefit is you’ll be paying less premiums overall until you reach 80.

Long-term care insurance is often an expensive form of coverage. So, it may not always be accessible to low-income individuals.

One of the biggest drawbacks of getting long-term care insurance is the risk of losing all the premiums you have paid over the years. If you end up not needing long-term care services, you won’t be eligible for coverage. This means the money you’ve spent for coverage goes down the drain.

“An individual who purchases a standalone long-term care policy has a 50/50 chance of using it,” Dascoli notes. “Standalone or traditional long-term care insurance is a ‘use it or lose it’ type of policy. An insured could hold on to this type of policy for many years and never use it.”

She recommends buying an alternative form of coverage instead, called hybrid life insurance.

“This is a multi-use policy that not only pays a death benefit, but also pays out when the individual is diagnosed with a terminal illness or needs long-term care,” she explains. “We promote the hybrid policies more because, at some point, the individual will use it and it also builds cash value.

“The only real downside to either of these policies is that premiums can be steep, especially the older an individual gets. It is important to purchase a hybrid policy at a young age to offer the most financial protection long-term.”

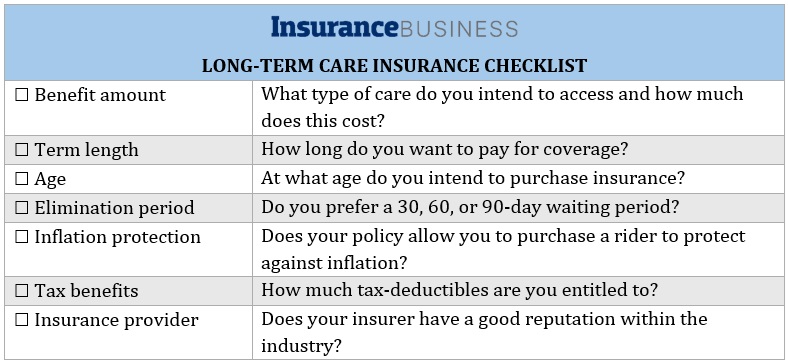

To find the long-term care insurance policy that fits your potential care needs, there are several factors you need to consider:

Benefit amount

Long-term care insurance costs vary depending on the quality of care services and where you plan to access them. Care services from a private nursing facility, for example, cost higher than those for at-home care. Consider the type of care you expect to receive and how much this will cost you.

Term length

Term lengths range from two years to a lifetime. Your medical history is a major determining factor for how long you must pay for the policy. If your family has a history of a debilitating illness, it may be better to choose a longer benefit period.

Age

Buying long-term care insurance at a younger age can help reduce your yearly premiums, although you will need to make payments longer. Getting coverage closer to senior age can raise your annual costs, but with a shorter payment period, you may end up paying less premiums overall.

Waiting period

Insurers impose waiting periods of 30, 60, or 90 days before you can start receiving benefits and reimbursements. This means you will need to cover for medical expenses out of pocket for a certain timeframe. If you choose a longer waiting period, you may be able to access lower premiums.

Inflation benefits

Inflation can cause medical costs to soar. This is why long-term care insurance providers offer add-ons to protect against this. This feature increases your daily benefits to catch up with inflation but pushes up your premiums.

Tax benefits

Many insurers offer tax-qualified policies. These come with tax-free benefits and deductible premiums. The deduction amount varies depending on the taxpayer’s age.

Insurer reputation

It’s important that you practice due diligence when choosing an insurance company. Go with an insurer that is both financially stable and committed to providing clients with the best possible care.

Here’s a checklist of what you need to consider in choosing a long-term care insurance that’s worth it. You can download and print the list for easy reference.

Is long-term care insurance worth it – policy checklist

You can also head to our Best in Insurance Special Reports page if you want to find a long-term care insurance provider that offers top-notch coverage. The companies featured in our special reports have been nominated by their peers. They have also been vetted by our panel of experts as dependable and respected market leaders. By partnering with these insurers, you can be sure that your needs are well taken care of.

Is long-term care insurance worth it? When do you think is the right time to buy coverage? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!