Commercial builders insurance: the most common questions answered

Commercial builders insurance: the most common questions answered | Insurance Business America

Guides

Commercial builders insurance: the most common questions answered

Commercial builders insurance is essential for everyone involved in construction projects. Find out how it protects construction companies in this guide

From natural disasters to man-made hazards, construction projects are exposed to a wide range of risks. This makes commercial builders insurance an important form of protection for everyone involved. With all the different coverage options available, picking one that best suits your needs can be challenging.

To help you with your decision, Insurance Business explains how commercial builders insurance works in this article. We will answer the most common questions business owners have about this type of policy.

If your business is involved in construction projects, this guide can be useful. If you’re an insurance agent or broker, you can share this piece with clients who may be searching for the right coverage. Find out what you need to know about this crucial form of business insurance.

Commercial builders insurance is a type of policy that financially protects businesses working on construction projects in the event of a claim. This includes property damage, third-party injury, and other construction-related claims. The policy prevents you from paying these steep costs out of pocket.

Depending on the insurer, this form of coverage may also be called builder’s risk insurance or construction insurance. While the names differ, the purpose remains the same. Getting the right policy can help safeguard not only the property in development but also the businesses handling the project.

Generally, commercial builders insurance covers repair and replacement costs resulting from damage caused by insured incidents. It also protects the investments of the builders and helps ensure that the projects can be completed without major financial setbacks and delays.

Every business that operates in the sector needs the proper protection in case an unexpected disaster happens. These businesses include general contractors, subcontractors, home builders, and real estate developers.

While not mandatory, commercial builders insurance is often imposed as a requirement before a client agrees to work with your business on a construction project.

Who is responsible for taking out builder’s risk coverage? It depends on the agreement, but both the project owner and the general contractor can purchase the policy. Regardless of who bought insurance, coverage can be extended to everyone who has a stake in the project. This can be done through an additional insured endorsement. Those who can be named in the policy include:

Different insurers provide varying levels of protection, but generally, commercial builders insurance covers:

the building being constructed or renovated and anything that will become a permanent part of the structure, such as walls, roof, and foundation

fixtures and installations, including electrical and plumbing systems, and built-in appliances

temporary structures such as scaffolding, fences, sheds, trailers, and storage areas

Construction materials and other supplies onsite

Equipment and machinery like power tools, bulldozers, cranes, and excavators (including rentals)

property in transit (much like inland marine insurance)

landscaping, including trees, patios, and gardens

lost income due to construction delays

debris removal caused by insured events

Builder’s risk insurance covers damage caused by:

fire

theft

vandalism

hurricane

hail

explosions

named storms

Floods and earthquakes aren’t typically included in standard policies, but you can purchase coverage as a rider or endorsement. Some insurers allow businesses to add pollutant cleanup, fungus growth, sewer backup, and personal property coverage.

There are also certain instances that construction insurance doesn’t provide coverage for, including:

employee theft

faulty workmanship

damage caused by wear and tear

mechanical breakdowns

rust and corrosion

mold damage

acts of war and terrorism

If you’re searching coverage for incidents not included in a standard construction policy, it may be better to look at other types of business insurance. These include:

General liability insurance

This policy protects you financially against claims of bodily injury and property damage resulting from your business activities. General liability insurance pays for the damages, legal expenses, and out-of-court settlements up to the limits of your policy. Find out how much that costs in this guide on general liability insurance.

Professional indemnity insurance

Also called errors and omissions coverage, this protects your business against claims of financial losses due to alleged or actual negligence while providing a service. In construction projects, professional indemnity insurance covers faulty workmanship.

Equipment breakdown insurance

Unlike tool insurance that covers items that can be transported to different job sites, equipment breakdown insurance provides protection for stationary equipment. This includes:

HVAC systems

Boilers

Generators

computer systems

other infrastructure-related machinery

Workers’ compensation insurance

This pays out the cost of medical care and a part of the lost income of employees who get injured or sick while on the job. Almost all states require workers’ compensation insurance for businesses with a certain number of employees.

The cost of commercial builders insurance depends largely on the size and scope of a construction project. Premiums for a $500,000 residential property will cost a lot less than those for a $5 million commercial building.

On average, you can expect to pay between 1% and 5% of the total cost of the project. For the examples above, the premiums can range from $5,000 to $25,000 and $50,000 to $250,000, respectively.

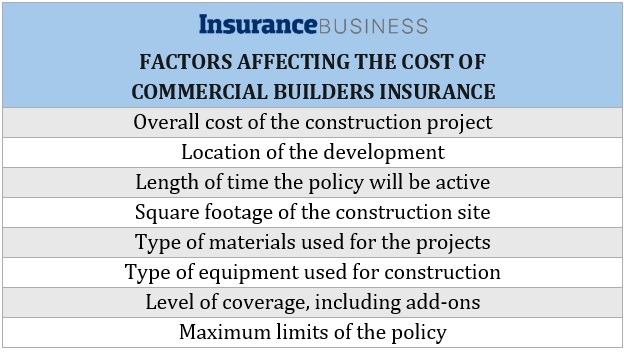

Here’s a list of some of the factors that can influence the price of coverage:

Anyone who could suffer financial losses if something goes wrong in a construction project must take out commercial builders insurance. These include:

Construction businesses

Construction companies are responsible for shouldering the project expenses often until the construction is completed. Getting the right coverage protects businesses from additional expenses resulting from unexpected damage and construction delays.

Subcontractors

Subcontractors can be named as additional insureds on a construction insurance policy. This limits their liability risks. The policy must also state clearly whether these specialty contractors are required to pay a share of the insurance deductible and by how much.

Other industry professionals

Architects and engineers can also be added as named insureds in a policy. This ensures that they are still paid even if their work – including blueprints – is damaged due to a covered incident.

Building owners and developers

Getting proper coverage is an important part of the risk management strategy of owners and developers. This is because a builder’s risk policy transfers the potential financial risks from property damage to the insurance companies.

Homeowners

For homeowners renovating or expanding their properties, taking out construction insurance is also important. Because the property is already under their names, they will be on the hook if an unforeseen event damages the home. Having builders risk coverage protects them financially if disaster strikes.

Because each construction project comes with its unique share of risks, there is no one-size-fits-all commercial builders insurance policy that can cater to every need. When choosing which policy matches your project, it’s important to consider these factors:

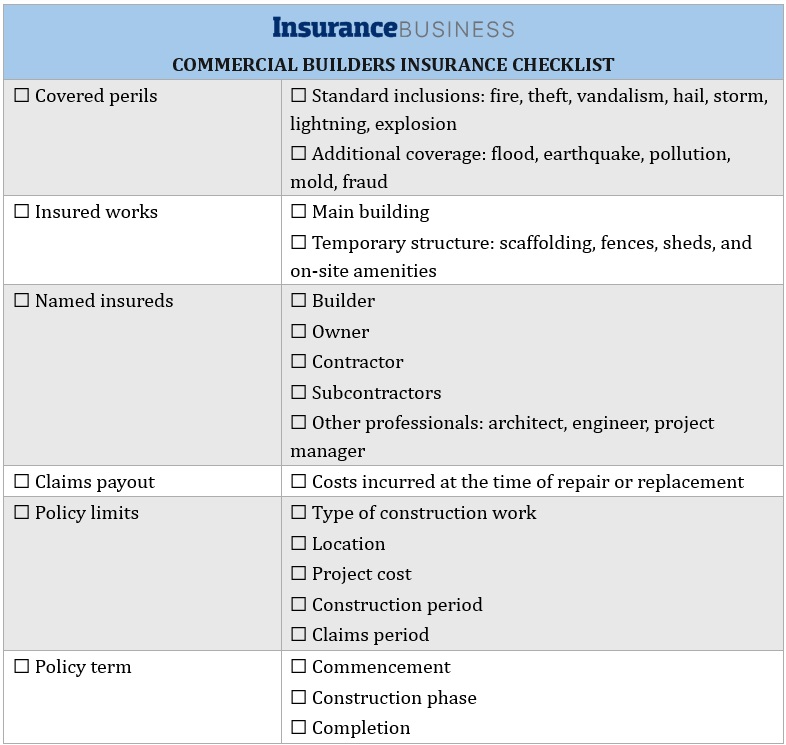

Covered events

Standard policies provide coverage for loss or damage due to fire, theft, vandalism, explosions, lighting, hail, and storms. Floods and earthquakes are not typically included. That’s why if the project you’re working on is in an area prone to these events, it pays to purchase additional coverage.

Insured works

Construction insurance should cover all structures related to the property being built. These include temporary works, including scaffolding, sheds, and on-site amenities.

Payout

The policy should cover the costs incurred at the time of repair or replacement, not when the damage occurred. It should also allow for a reasonable margin to be added to the cost of damages claimed.

Named insureds

Commercial builders insurance should cover the builder, owner, contractors, and subcontractors. Architects, consultants, engineers, and project managers can be added if required under the building contract.

Policy limits

Some policies limit the types of construction work that are insured. That’s why it’s important to check if the project fits within the terms of the policy. You should look at:

limits on scope and type of work

location

project cost

construction period

claims validity

Policy term

The policy should cover the construction project from start to finish.

Here’s a checklist of what you should consider when searching for a commercial builders insurance policy that fits your business’ needs. Feel free to download and print the checklist for easy reference.

Our Best in Insurance Special Reports page is the place to go if you want to find the best commercial builders insurance providers in the country. Here, we feature insurance companies that have been nominated by their peers and vetted by our panel of experts as trusted and respected market leaders.

Recently, Insurance Business unveiled our five-star awardees for the Best Construction Insurance Companies in the USA. By choosing these providers, you can be sure that you’re partnering with companies that can assist you in your construction project from start to finish.

Do you think getting commercial builders insurance is worth it? Let us know in the comments

Keep up with the latest news and events

Join our mailing list, it’s free!