Industry-loss cat bond spread decline necessitates portfolio rethink: Icosa

Spreads for industry-loss index trigger catastrophe bond instruments have declined or tightened so much in recent months that indemnity cat bonds now look relatively more attractive for the first time, which necessitates a rethink about how cat bond portfolios are constructed, according to Florian Steiger, of Icosa Investments.

Steiger formed Icosa Investments as a new catastrophe bond focused asset manager and became its CEO at the start of the year and has shared his views on a number of key developments in the cat bond market.

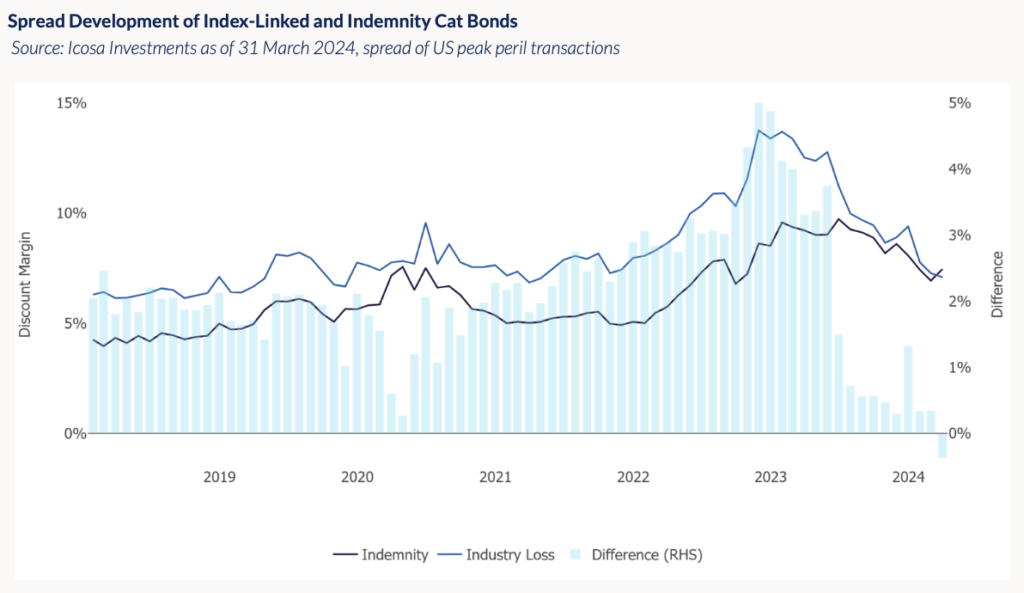

First, he has examined developments in spreads for the industry-loss index trigger cat bonds and compared them to indemnity.

While, in recent years, industry-index cat bonds have been relatively more attractive, Steiger does not believe this to be the case now their spreads have tightened more and faster than has been seen with indemnity cat bonds.

He explained that, “In the first quarter of 2024, the cat bond market reached a decisive turning point: Alongside a high volume of new issuances, the spread of indemnity cat bonds exceeded that of index-linked instruments for the first time in many years.

“This development signals a major turning point with regards to relative value within the asset class and necessitates a rethink in portfolio construction.”

You can see how spreads have moved for industry-loss index and indemnity cat bonds in the chart below, from Icosa Investments, with indemnity cat bonds rising above index in recent weeks:

While the surplus liquidity or cash in the catastrophe bond market through the start of the year pushed up cat bond prices, which is a movement atypical for the time of year, Steiger notes that the movements seen in industry-index cat bonds was “particularly striking.”

These industry-loss triggered instruments now, “frequently yield less than their indemnity counterparts covering US hurricane and earthquake risks,” Steiger said.

Adding that, “This shift challenges our longstanding preference for index-linked transactions, prompting a strategic pivot in our investment approach to favour more attractive market opportunities.”

Industry-index, or industry-loss catastrophe bonds have been offering higher spreads than US indemnity cat bond transactions consistently since hurricane Irma in 2017, Steiger explains.

This was primarily due to a lack of retrocessional reinsurance capacity caused by significant losses and outflows in private ILS strategies and other structures, but over the last six months industry-index cat bond spreads have “significantly decreased and now pay less than comparable indemnity bonds,” he continued.

Steiger notes that since 2017, it has been the indemnity cat bonds that took the majority of market losses, but that this changed with hurricane Ian and more index-linked transactions were affected then and since.

“Despite this increase in realised losses of index-linked transactions, the market has experienced a significant repricing, leading to strong price gains for index-linked cat bonds in the short term, but ultimately also implies lower expected returns in the future,” he explained.

Adding that, “This repricing raises questions about the relative valuation within the cat bond segment.”

Previously, Steiger saw the higher returns of index-linked cat bonds a welcome opportunity from a portfolio management perspective, which had led him to target a tactical overweighting of these deals in the cat bond funds he managed.

But, now he feels the negative aspect of tail-risk exposure, as industry-index trigger cat bonds tend to reference the same indices, when catastrophe events are large enough they could “all fail together”, means a change in portfolio strategy is required given the lower yields these industry-loss cat bonds are supplying.

Which is particularly relevant in a year where the hurricane season forecasts suggest very high levels of activity.

Previously, Steiger says the pricing of these industry-loss index cat bonds was sufficient to more than compensate for the tail-risk exposure and correlation that can be seen across them.

“But with tighter spreads, that picture has changed drastically in recent weeks,” he explained.

Which can put larger cat bond funds in a more challenging position, as it can be difficult to respond to changing market conditions when you need to invest in almost as many deals as possible.

In addition, because secondary market liquidity for these cat bonds is relatively low, it can be a challenge to reduce the size of positions.

“It is nearly impossible for them to significantly reduce their share of index-linked cat bonds without massively moving the market,” Steiger said.

Further explaining that, “Here at Icosa, thanks to our much smaller strategy size and a portfolio that is in the process of being built, we have an advantage: Hence, we are positioning our strategy much more cautiously than we have in past years and no longer aim for such a significant overweighting of index-linked cat bonds.”