The Importance of a Feasibility Study

This post is part of a series sponsored by TSIB.

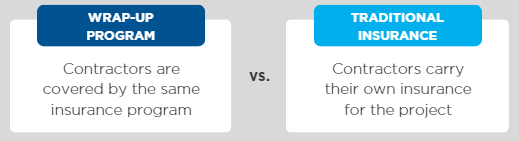

A key factor when considering a CIP or Wrap-Up is having the broker conduct a feasibility study for the Wrap-Up Sponsor. A feasibility study is a tool that is used to compare the costs between implementing a

Here we will discuss the importance of feasibility studies in the evaluation of a potential Wrap-Up, the data used to create them, and guidance on what to look for in a prospective Wrap-Up project.

Besides being a great risk management tool, a major selling point for using a Wrap-Up is for those projects meeting a certain criterion, the cost to insure the project with a Wrap-Up is in most cases cheaper than the traditional insurance method.

Insurance Costs

With traditional insurance, the cost is a simple calculation. This is the sum of the insurance each contractor includes in their contract price, plus any funding for deductibles that apply to those insurances.

Wrap-Up costs are measured similarly. The costs are the premiums paid to the program carriers, plus the cost of losses within the Wrap-Up deductible and any collateral that may be required.

The feasibility study estimates these costs, allowing the Wrap-Up Sponsor to compare them and make an informed decision on whether to move forward with a Wrap-Up program. Due to the important role feasibility studies have in the decision-making process, the data that goes into them is equally important.

Data Points

When conducting a feasibility study, several data points are collected, including:

budget estimates for the project

project schedule

payroll estimates are broken down by WC class codes

insurance cost rates for the various trades involved in the project

Wrap-Up rates

estimates for project loss picks

collateral cost estimates

Unfortunately, most of this information isn’t something you can simply look up. Not all Brokers or Consultants have this data either. That’s why it’s important to work with a Broker who has the breadth of knowledge, actual experience with Wrap-Up placements, and Wrap-Up management in multiple jurisdictions. It’s especially important to work with a Broker who has implemented/managed a Wrap-Up program in the same jurisdiction your project is in. A good Broker/Consultant will not only have quality data to use in the feasibility study but will be able to evaluate good Wrap-Up prospects.

Project Criteria

Not all projects are a good fit for a Wrap-Up program. At the beginning of the process, a good Broker will evaluate the project to make sure it is a good fit for a Wrap-Up. This prevents stakeholders from being too invested in the program and wasting their time/money on a program that doesn’t make sense for their project.

When evaluating this, it’s important to look at the Wrap-Up variety as there are 2 main varieties: single project programs and rolling programs.

Single Project Programs

Single project Wrap-Ups tend to yield the best financial results for projects that are over $250M in construction volume. Larger projects have a greater economy of scale where carriers get to charge higher premiums, making the placement more attractive to them. However, their cost is far more likely to still be cheaper than what the contractors would charge for their own insurance.

On smaller projects, the Wrap-Up carriers would likely run into minimum premium requirements potentially making their program cost equal to or higher than the traditional cost of insurance.

The only exception to this rule would be when utilizing a GL-Only Wrap-Up. These programs are placed almost exclusively in the Excess and Surplus lines market and can accommodate single project programs as small as $50M in almost any jurisdiction.

Rolling Programs

Rolling programs are the answer to that “smaller project problem.” Wrap-Up Sponsors with a steady flow of work but generally smaller projects can opt for rolling all of their work into a Rolling Wrap-Up. These work best for projects under $150M with a total annual enrollment of at least $350M.

Whether you’re a project owner, general contractor, or broker that needs help deploying a Wrap-Up for your client, TSIB can help. TSIB has placed Wrap-Ups with a combined total of $120B in construction volume and enrolled over 39K contractors into our Wrapworks portal. We are a highly specialized insurance services firm that focuses on the construction industry and Wrap-Up placement. We have the market reputation and experience to assist you with any Wrap-Up prospect you’re considering.

Interested in learning how partnering with TSIB can help your upcoming project? Speak with one of our Wrap-Up Consultants and schedule a free feasibility study.

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter