Too early to assume ILS inflows will have major impact on reinsurance rates: Morgan Stanley

Equity analysts at investment bank Morgan Stanley have said that they believe it is too early in 2024 to assume that inflows of capital to catastrophe bonds and more broadly insurance-linked securities (ILS), will have a major impact on reinsurance pricing.

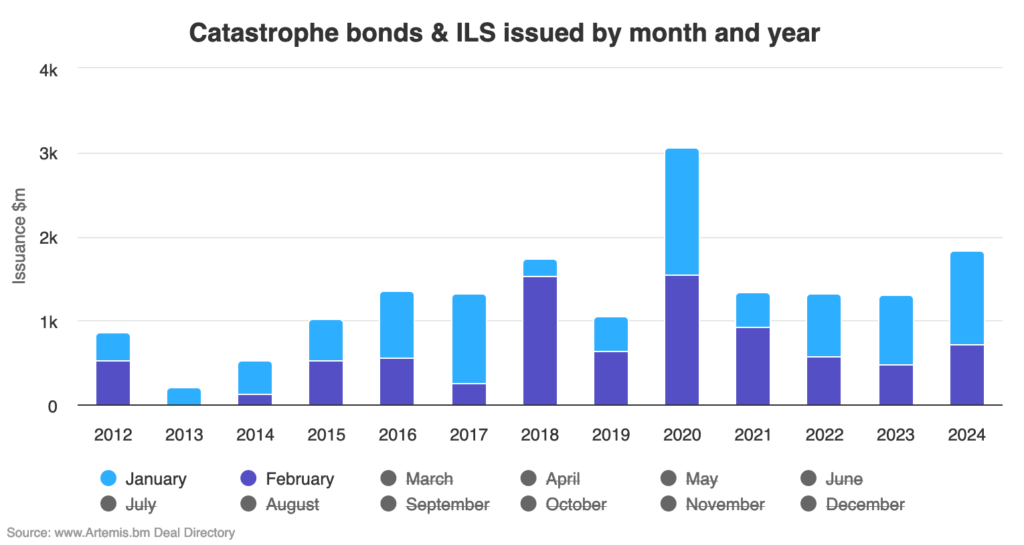

In a report sent to their investor base and community, the Morgan Stanley analysts utilise Artemis’ range of charts that detail and break down catastrophe bond issuance, to help explain that they believe reinsurance rates can still hold up better than in previous times of ILS market growth.

When it comes to reinsurance, investors on all sides are incredibly focused right no on the level of capital inflows to the sector and whether these will rapidly soften the opportunity and eroded the returns possible in the sector.

On the ILS side of our investor community, there is less fear of inflows in general, with a more sanguine recognition that some softening is likely as the ILS capital base grows and this is desirable, but at the same time a strong desire to see discipline, attachment points and contract terms hold.

On the more equity investment focused side, there seems to be more nerves over inflows damaging the opportunity and, interestingly, just as much if not more determination to see the status quo sustained, with no return to the soft market terms and pricing of the past.

Morgan Stanley’s analyst team note that they are being asked specifically about capital inflows to the cat bond and ILS space.

“Although issuance YTD is relatively high, it is too early to assume the overall capital inflow will have a major impact on reinsurance pricing,” the analysts state, pointing to Artemis’ chart where you can analyse cat bond issuance by month and compare how 2024 is running so far, versus prior years.

Using this chart you can include or exclude certain months by clicking on them, to reduce it down to just an analysis of January and February.

As the image below shows, 2024 is now running second in terms of issuance through the first two months of the year. Click the image to access the interactive chart.

The analysts also note that the average cat bond spread has declined somewhat year-on-year as well, which they say “could reduce investor appetite when compared to other investment alternatives under the current market conditions.”

The analysts then ask whether there can be any more upside in reinsurance from here?

Saying, “Given the slower pricing environment when compared to 2023, and the strong performance for reinsurers in 2023 and so far in 2024, some investors naturally asked if we continue to favor the reinsurers going forward.

“For now, yes, but we will re-evaluate as we get closer to hurricane season.”

Adding, “From our perspective, reinsurers continue to generate strong ROE, with solid underwriting and steady premium growth. Relative to other sub-sectors of insurance, we believe reinsurers continue to have a solid path.”

As we reported earlier this week, there are suggestions that with a burgeoning pipeline and growing interest from the investors, catastrophe bond issuance could approach close to $20 billion in 2024.

But, as we also explained this week, reinsurance demand is clearly still rising, evidenced by a number of major players renewals being revealed this week (such as AXA and Zurich), with more limit being purchased at higher levels in towers, the perfect location for cat bond risk capital.

That continued demand surge, at a time when inflationary effects continue to boost exposures and a number of the large residual markets could purchase their biggest reinsurance programs ever, all suggests there is plenty of room for the catastrophe bond market to record another stellar year of growth without overly affecting reinsurance pricing, even if ILS continues to be the main source of new industry capital.

The one wildcard remains the levels of competition in the industry and if reinsurers and ILS managers go head-to-head on price for select layers of risk, then a degree more of softening is inevitable.

But the determination among investors to sustain higher returns from reinsurance-linked investments of all kinds is palpable and they are unlikely to relinquish too much, without starting to question their allocation strategies.

Also read: Reinsurance in focus for investors, with length of hard market key: Berenberg.