Detroit automakers splurge on shareholders with big stock buybacks

General Motors, Ford and Stellantis are engaged in a race that investors are cheering now, but may look back on as foolish within a few years.

The three spent a combined $22.7 billion buying back their shares and paying dividends last year. It’s a remarkable sum for companies that were pleading poverty only a few months ago, when the United Auto Workers union was demanding — and eventually won — costlier labor contracts.

It’s also a curious use of cash, considering how far these carmakers have fallen behind in the shift to electric vehicles. Even as Tesla and China’s BYD lap them, the Detroit Three increasingly are hedging their bets on battery-electric models. While their early wagers have been big money-losers thus far, paring investments back while splurging on shareholders puts their long-term futures at risk.

GM carried out much of its binge toward the end of last year, when CEO Mary Barra announced the company’s biggest-ever buyback plan and boosted the dividend by a third.

It would be one thing if GM had money to burn from having pulled off the “breakout year” for EVs that Barra predicted in early 2023. But that wasn’t meant to be.

GM missed its EV production goal by a mile. Its battery joint-venture plants were plagued by persistent manufacturing issues, and as the year came to a close, buggy software left the company with no choice but to stop sales of the new electric Chevrolet Blazer shortly after launch.

Ford also didn’t have the year it was hoping for with EVs. It was forced to cut prices of its Mustang Mach-E sport utility vehicle and F-150 Lightning pickup in an effort to keep up with competitors led by Tesla. By year-end, the company halved its weekly production plan for the plug-in truck.

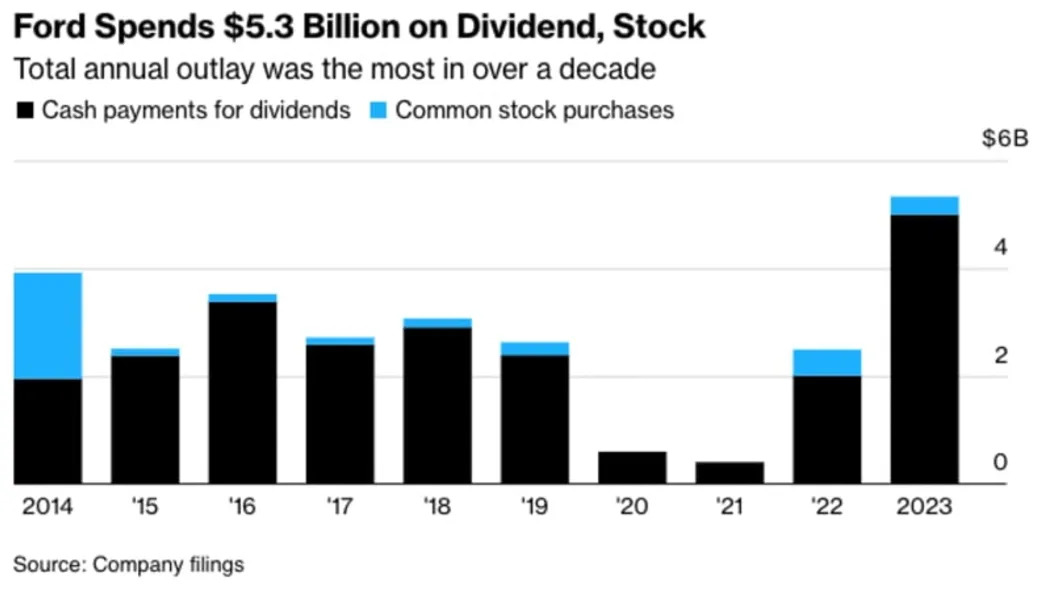

Ford’s EV business ended up losing $4.7 billion for the year, and has forecast at least a $5 billion deficit for 2024. The company nonetheless spent roughly that amount paying dividends, a stream of income that’s particularly important to the Ford family.

Whereas GM and Ford have swung at Tesla and largely missed, Stellantis has barely picked up a bat in the US. That will change this year, with the company planning to launch eight battery-electric models bearing Jeep, Ram, Dodge and Fiat badges, but those EVs will have a lot of catching up to do.

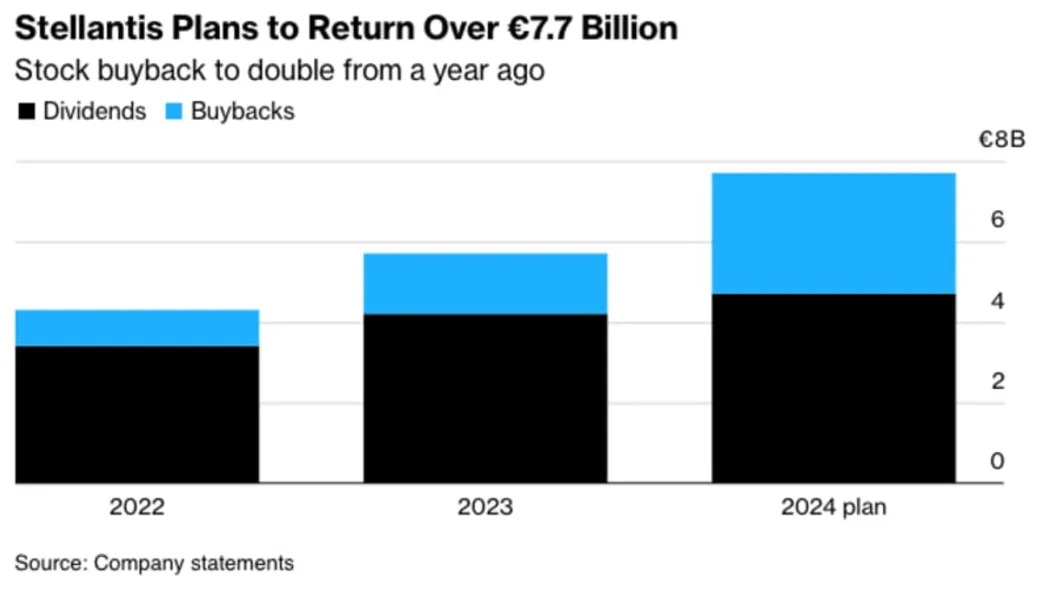

Whether these models fare well in the market or not, shareholders are making out nicely. Stellantis spent over 50% more on dividends and buybacks in 2023 and plans to double repurchases in 2024.

One automaker that hasn’t bothered to shower shareholders with cash is Tesla. The company has never declared a dividend and tells investors it doesn’t anticipate paying one for the foreseeable future.

While Elon Musk flirted with the idea of a buyback in 2022, when shareholder unrest over his acquisition of Twitter was at its peak, Tesla’s board didn’t pull the trigger on the $5 billion to $10 billion repurchase that the CEO said was possible. (For a well-thought-out weighing of the pros and cons for Tesla, see Liam Denning’s latest Bloomberg Opinion column.)

GM, Ford and Stellantis have fared well the last few months as an industrywide EV growth slowdown set in. GM shares have soared 35% since the company announced its buyback and dividend plan in late November. Ford is up 21% in that span, while Stellantis is trading at an all-time high.

But while Tesla’s warning of “notably lower” growth has taken some of the wind out its sails, it’s still a $638 billion company that Detroit can’t afford to take for granted. Don’t take my word for it — ask Ford CEO Jim Farley.

“The ultimate competition,” Farley said during Ford’s earnings call this month, “is going to be the affordable Tesla and the Chinese.”