Utilization management for biosimilars

When we think of utilization management (e.g., prior authorizations, step edits), we often think payers only use these for higher cost branded products including biologics. Generic drugs should have low cost sharing and limited utilization management. One question, however, is whether payers’ utilization management practices for biosimilars mirror those of biologic products, or small-molecule generics, or somewhere in between.

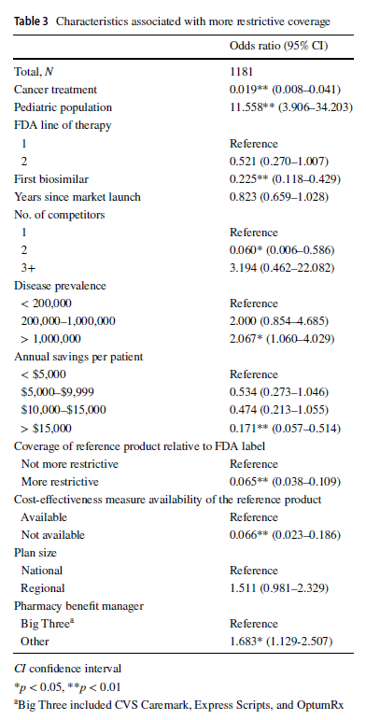

A paper by Yu et al. (2023) aims to answer this question. The authors used data from the Tufts Medical Center Specialty Drug Evidence and Coverage (SPEC) database covering 19 commercially-available biosimilars corresponding to 7 reference products. These products were used for 28 unique indications. The authors find that:

Compared with reference products, health plans imposed coverage exclusions or step therapy restrictions on biosimilars in 229 (19.4%) decisions. Plans were more likely to restrict biosimilar coverage for the pediatric population (odds ratio [OR] 11.558, 95% confidence interval [CI] 3.906–34.203), in diseases with US prevalence higher than 1,000,000 (OR 2.067, 95% CI 1.060–4.029), and if the plan did not contract with one of the three major pharmacy benefit managers (OR 1.683, 95% CI 1.129–2.507). Compared with the reference product, plans were less likely to impose restrictions on the biosimilar–indication pairs if the biosimilar was indicated for cancer treatments (OR 0.019, 95% CI 0.008–0.041), if the product was the first biosimilar (OR 0.225, 95% CI 0.118–0.429), if the biosimilar had two competitors (reference product included; OR 0.060, 95% CI 0.006–0.586), if the biosimilar could generate annual list price savings of more than $15,000 per patient (OR 0.171, 95% CI 0.057–0.514), if the biosimilar’s reference product was restricted by the plan (OR 0.065, 95% CI 0.038–0.109), or if a cost-effectiveness measure was not available (OR 0.066, 95% CI 0.023–0.186).

One interesting finding was that large PBMs actually had less restrictive policies over biosimilars. Why?

… it has been posited that the bargaining power of larger PBMs may be so significant that biosimilar manufacturers may sometimes raise list prices, and hence rebates, to obtain a place on the formularies of large PBMs. This would leave smaller PBMs with higher list prices but

smaller rebates due to their relatively smaller bargaining power, in which case the biosimilars bring less value to them.

https://link.springer.com/article/10.1007/s40259-023-00593-7

You can read the full paper here.