Turkey earthquakes industry loss estimate raised 26% to US $6.2bn

The insurance and reinsurance market industry loss estimate for the Kahramanmaras Earthquake Sequence that struck Turkey in February 2023 has been lifted by a significant 26%, by PERILS, to reach TRY 117 billion, which would have been US $6.2 billion at exchange rates when the disaster struck.

The increase brings PERILS industry loss more into line with the figures that some in the reinsurance market have been working off for some months now, as a US $6 billion estimate had been widely discussed for this industry loss event in the latter weeks of 2023.

This compares to the previous estimate of TRY 92.8 billion, which would have been US $4.9 billion at exchange rates when the disaster struck, that PERILS released six months ago.

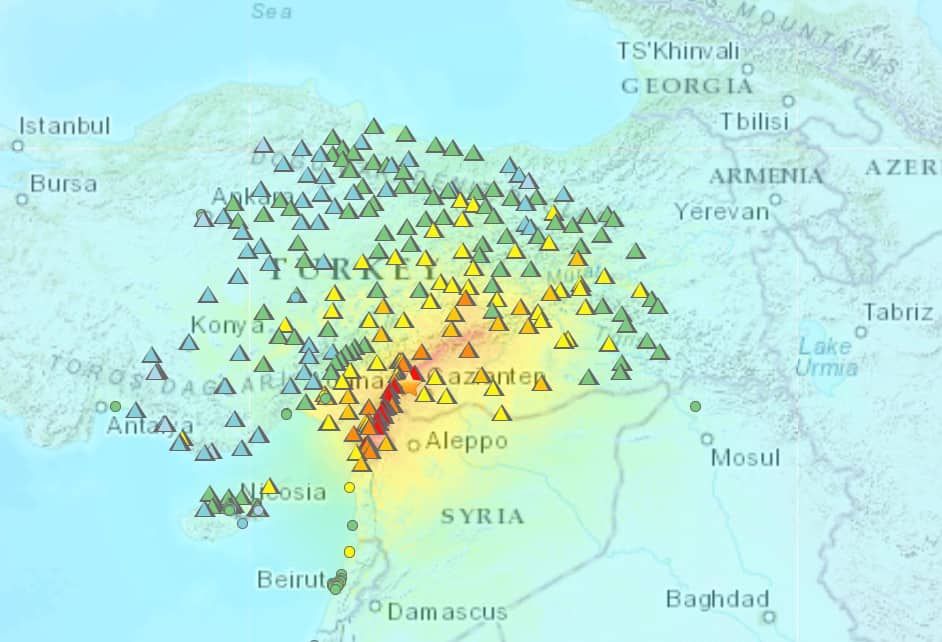

PERILS had initially reported in March that the series of earthquakes, which caused widespread devastation across parts of the Republic of Türkiye and the Syrian Arab Republic on February 6th 2023, were estimated to have caused TRY 65.4 billion of property insurance market losses, equating to US $3.5 billion on the date of the quakes.

Then, the estimate was lifted by a significant 32% to TRY 86.4 billion, which on the day of the earthquakes US $4.6 billion.

It was then taken to the US $4.9 billion estimate last August, and now to US $6.2 billion today.

Global reinsurance firm Swiss Re had set its own reserves for the Turkey earthquakes based on an industry loss of US $5.3 billion.

Catastrophe risk modeller Moody’s RMS previously said the losses would likely be above US $5 billion.

But global reinsurer Hannover Re had estimated the quakes were a EUR 3.5 to 4 billion industry loss event.

PERILS estimate only covers the property line of business and does not include any losses from Syria.

Because of the scale of the earthquakes in Turkey, PERILS has said that it warrants a rare fifth loss estimate, which will be released in another six months time, so there could be more loss creep to come with this event.

Luzi Hitz, Product Manager at PERILS, commented, “Earthquake insurance is a challenge in many earthquake- prone countries. Take-up rates are often low, often driven by people’s conflicting financial priorities, affordability and a fatalistic attitude towards earthquakes. These factors contribute to the significant protection gap often observed after large earthquake disasters. In order to facilitate the more widespread availability of earthquake insurance solutions, it is imperative that we elevate our understanding of the risk. In this sense, every disaster is also a chance to learn and improve, and this is where we hope our industry loss data can contribute.

“In our daily work as an insurance data collector and aggregator, it is important to acknowledge the tragedies that underpin these numbers. The Kahramanmaras Earthquake Sequence was by far the deadliest and most devastating event in 2023. One year on, the impact of this tragedy is still being felt, and it will take years to rebuild what has been destroyed. Our sympathies go out anew to those affected in the Republic of Türkiye and the Syrian Arab Republic.”