Resilient Building Council launches bushfire resilience app in Australia

Resilient Building Council launches bushfire resilience app in Australia | Insurance Business Australia

Technology

Resilient Building Council launches bushfire resilience app in Australia

Insurance industry welcomes new app

Technology

By

Roxanne Libatique

The Resilient Building Council (RBC) has teamed up with IT consultancy Endava to unveil a bushfire resilience app tailored for Australians.

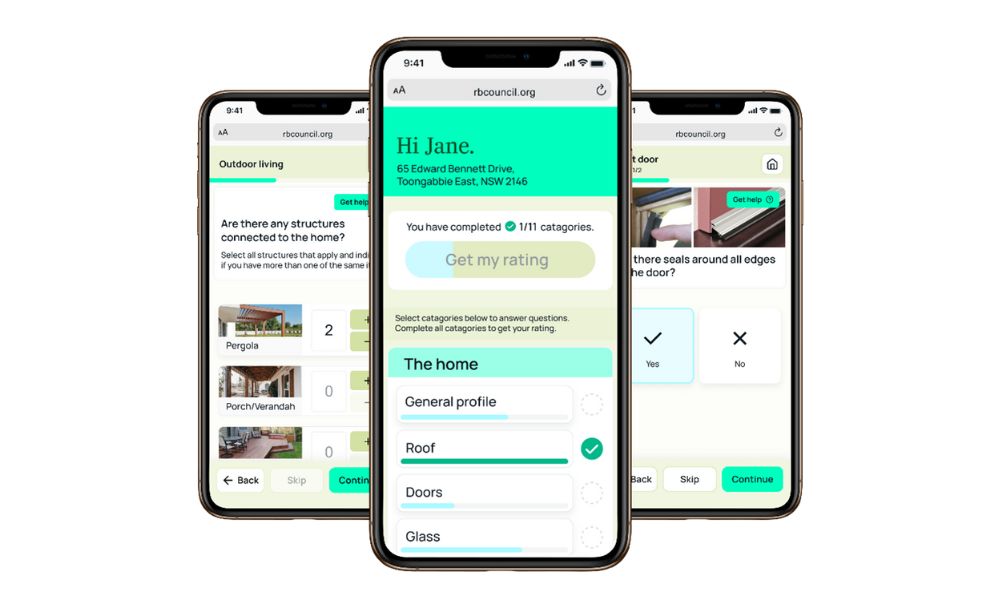

The RBC’s Bushfire Resilience Rating Self-Assessment app, a result of extensive testing and co-designing with over 1,200 households, marks a significant step in enhancing home protection against bushfires.

The tool empowers users to evaluate their homes and gauge their preparedness for a bushfire event. Since its launch, more than 5,000 Australians from 242 Local Government Areas (LGAs) have used the app, with over 4,000 completing their home assessments and receiving tailored action plans. The app boasts an 80% completion rate, with an average of 1,000 users per week engaging in assessments.

“It was essential to build a robust product that could perform multiple calculations and recommendations but was also easy to use. The path to resilience needs to be intuitive, informative, practical, and customised to each home. Our aim was to assure homeowners that implementing small changes could immediately enhance their home’s resilience, and we’re immensely proud to be the technology partner for this transformative climate initiative,” said Shelley Beeston, partner at Endava and venture lead.

Trials conducted before the national launch indicated an average 67% reduction in the likelihood of homes igniting during a bushfire when users followed the app’s guidance.

Resilience Ratings system

The app adopts a holistic approach to bushfire resilience. Covering building construction, landscaping, and ongoing maintenance, it stands as the first scientific system measuring the bushfire resilience of homes.

Responding to calls from various stakeholders, including governments, insurers, banks, and the 2020 Australian Royal Commission into National Natural Disaster Arrangements, the Resilience Ratings system provides an independent measure of a building’s resilience and energy efficiency.

“One of our biggest challenges was to build a tool that would be simultaneously precise and reflect all the knowledge behind our rating system, but that would be easy to use and generate concrete results. The app Endava helped us to create manages to do exactly that. It has proved to be highly successful in the trials, and we’re thrilled to put this innovation in the hands of every Australian, for free,” said RBC CEO Kate Cotter.

In a strategic partnership with the Australian government, NSW government, and Insurance Council of Australia (ICA), the RBC plans to expand its Resilience Ratings program by mid-2024. This expansion will include an integrated professional home assessment addressing multiple climate impacts, such as floods, storms, cyclones, heatwaves, and energy efficiency.

Industry welcomes app

The ICA has welcomed the development of the Bushfire Rating App, emphasising the tool’s role in reducing bushfire risk.

“The Insurance Council of Australia congratulates the Resilient Building Council for the development of the Bushfire Rating App. This app is an important tool for homeowners in recognising and reducing bushfire risk. It seeks to make it easier for insurers to recognise and make reductions in insurance premiums based on retrofitting to high-risk households, informed by the app’s recommendations,” said ICA CEO Andrew Hall. “The ICA is also pleased to have partnered with the Resilient Building Council to deliver the Multi-Hazard Resilience Ratings program, which will help insurers, and other industries, recognise effective actions taken by households.”

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!