Investor confidence in global specialty re/insurance returns building: ICMR

With rates remaining higher and performance improved, capital market investor confidence in the global specialty insurance and reinsurance sector is returning, according to Insurance Capital Markets Research.

Looking at its (Re)Insurance Specialty Index (RISX), an equity benchmark for the global specialty re/insurance sector based on publicly listed companies with underwriting subsidiaries in Lloyd’s of London, and comparing it to other market sectors, the analysts at Insurance Capital Markets Research (ICMR) say it’s evident that returns are strong, while also exhibiting lower correlation.

The RISX Index offers a benchmark for investing at Lloyd’s and is a lead indicator of Lloyd’s pro-forma annual accounting performance, through accumulating underwriting data from the component companies’ financial statements.

As such, it provides a good insight into how attractive investments into the Lloyd’s specialty insurance and reinsurance market might be, but also provides another signal for the attractiveness of investments directly into the underwriting of such companies via insurance-linked securities (ILS) as well.

In 2023, the annual returns of the RISX equity index of listed companies with Lloyd’s businesses was strong, but with lower correlation when compared to other comparable sectors, ICMR explained.

“As a sector. Global specialty (re)insurance registered a favourable return in 2023, particularly when compared against the basket of broader investment market sectors,” the analysis highlights.

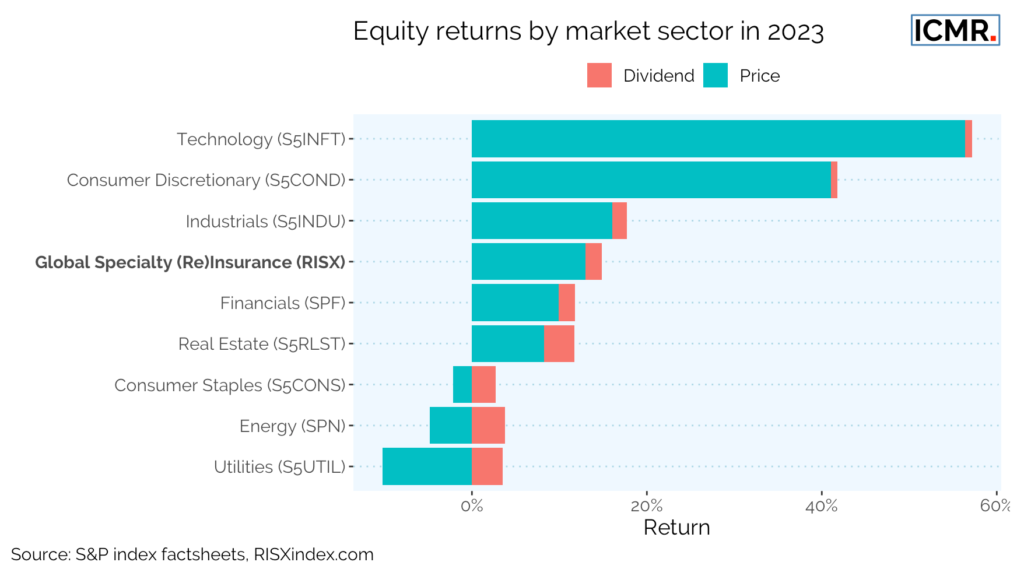

The chart above shows that the global specialty re/insurance sector, as measured by the RISX index, returned mid to high teens in price, with perhaps a couple of points extra for dividends as well.

With the catastrophe bond market having returned around 20% for an investment that takes on none of the financial or market risk of the reinsurance industry, it drives home just how attractive the ILS market’s performance was in 2023.

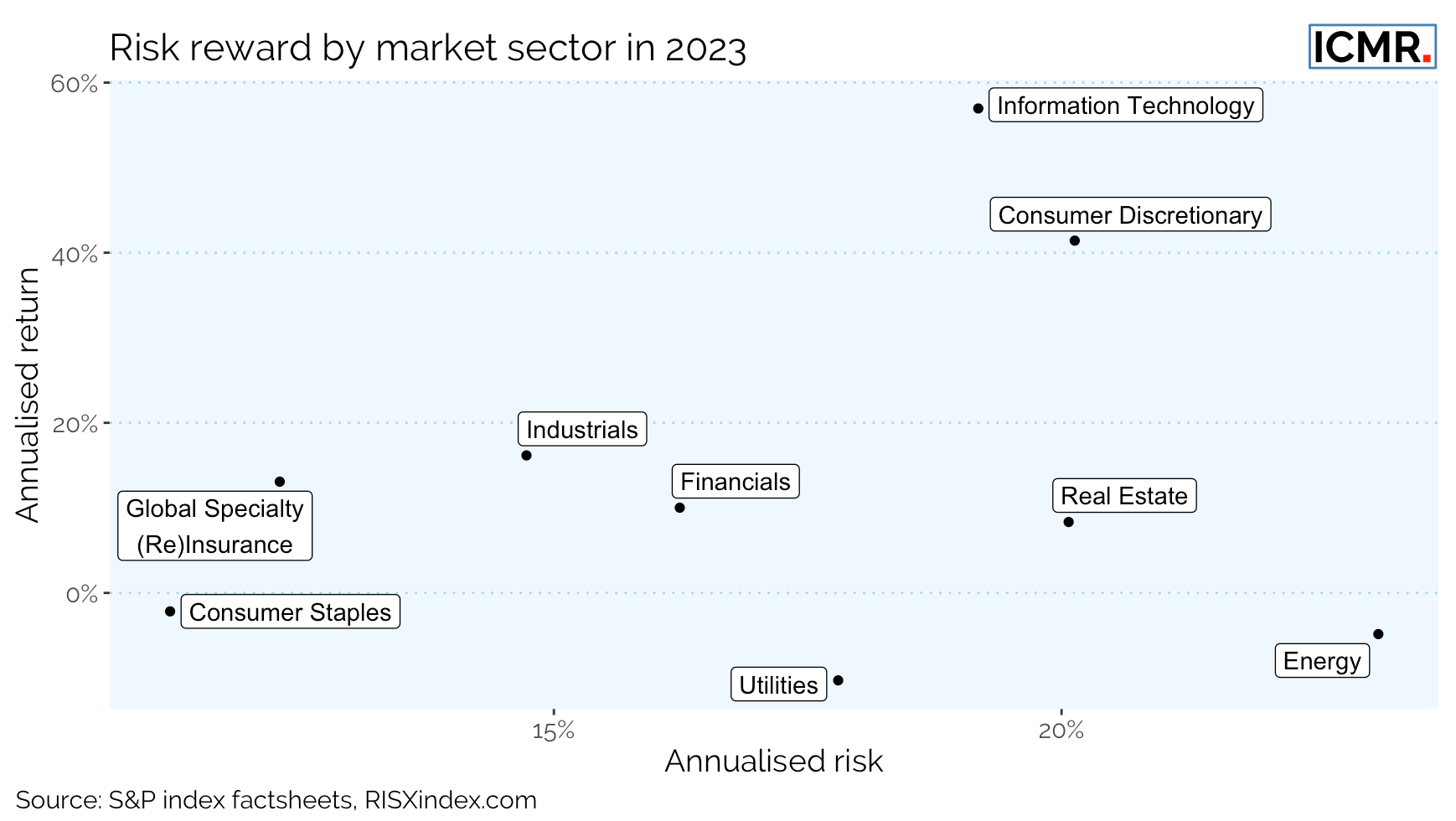

However, driving home the attractiveness of the insurance and reinsurance sector, the ICMR analysis also looks at how much risk is being taken on, in each sector seen above.

The chart below shows that the while the RISX index suggests an investment in Lloyd’s was not the best-performing choice, among these market sectors, it was one of the lowest risk.

ICMR’s analysts explain, “This won’t tell us much about the underlying insurance and reinsurance risks being underwritten, but it does suggest capital markets’ confidence in the sector. Despite the uncertainties facing the world during 2023 and into 2024, confidence in consistent returns from the sector appears steady.”

Adding, “This is further reinforced by the sector, as proxied by the Global Specialty (Re)Insurance ‘RISX’ index data, having the lowest maximum drawdown of any of these sectors in 2023, which occurred around the collapse of SVB and Credit Suisse in March of last year.”

Positively, the analysts believe that the capital markets appetite for global specialty insurance and reinsurance is returning, which always reads-across well for the ILS market.

The ICMR analysis closes by saying, “This would suggest that capital markets are perhaps starting to price in some of the underlying rate improvements sustained over the last few years, as well as the impact of higher risk free rates on the asset leverage specialty (re)insurers enjoy on their balance sheets. And this should augur well for any IPOs planned over the coming quarters.”

Whenever we see higher appetite for equity investments into insurance and reinsurance, especially in terms of new start-ups, IPO’s and supporting growth investment rounds, we also tend to see higher interest in insurance-linked securities (ILS) as well.

The cross-over between capital markets appetite for investments into the equity of the re/insurance market and the appetite to invest more directly in the risk of the sector, is a strong one and this recovery in appetites augurs well for continued investor interest in the ILS space and additional capital flows over time.