Life Insurance made f*cking fun: Say hi to Clearly Surely’s Financial Discovery Platform [2 of 7]

![Life Insurance made f*cking fun: Say hi to Clearly Surely’s Financial Discovery Platform [2 of 7]](https://www.cheapsr22.us/wp-content/uploads/2022/02/1644596777_Life-Insurance-made-fcking-fun-Say-hi-to-Clearly-Surelys.png)

Part 2: Platform Walkthrough

On to the platform proper: The Tutorial

You are going to be welcomed by Candy the Corgi, who is going to be your guide throughout this entire experience.

The tutorial serves both as a quick way to introduce the site, and also create your account at the same time.

Pro-tip: You need to think really really hard about setting your humor – since this is the only time it can be selected.

As real as it gets

After you enter a 6 digit OTP and verify your email as well, you’re in!

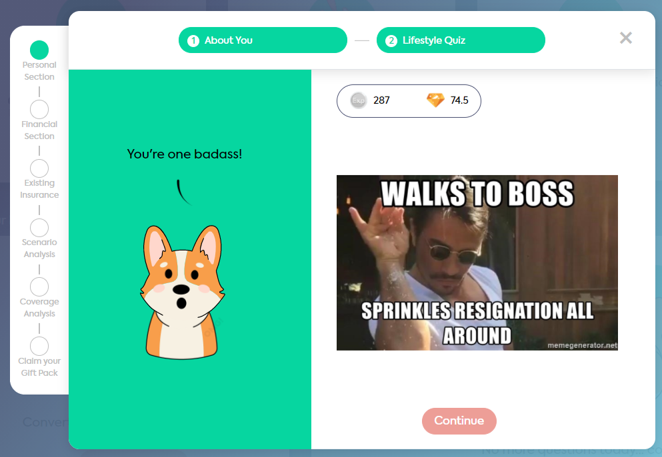

The Personal Section

We begin by understanding more about you as a person, and here is where you get to taste the level of personalization that the site has to offer.

For different answers given, there will be different meme responses shown.

Notice the gems and experience points collected along the way – they will come in handy later!

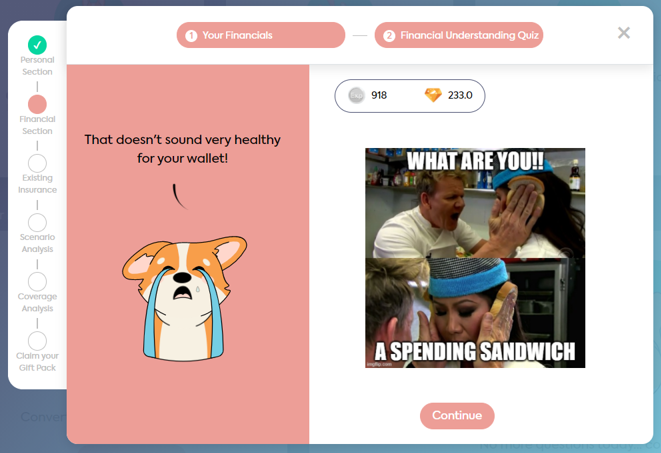

Next up: The Financial Section

This being a Financial Discovery Journey, we then proceed to ask you about your finances, about your spending habits, your planned expenses, your loans, and also your assets.

Don’t feel bad if you cannot state them with 100% accuracy! Truth is, no one can. But it’s good to take stock ever so often.

Then we dial into your: Existing Insurance

Leaving the financials behind, we next help you to consolidate all your existing insurance policies, to dissect what sort of cover you have, how much cover you have, and how long it lasts.

A cutie asking you all the right questions

You can either choose to fill in the information yourself, you can just upload the policy documents for our cute canine assistants to do the heavy lifting for you.

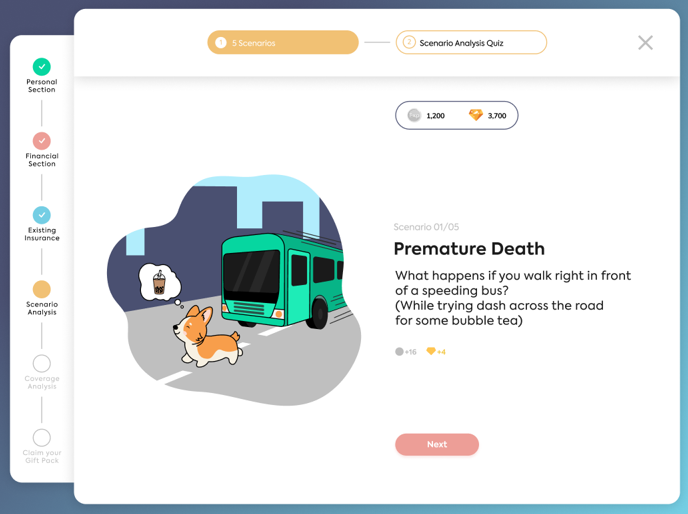

Which then brings us to: Scenario Analysis

One of the highlights of your journey is here!

This is where you get to see how 5 different scenarios can impact you financially, calculated from your prior answers to the previous sections.

Will you sink or will you float?

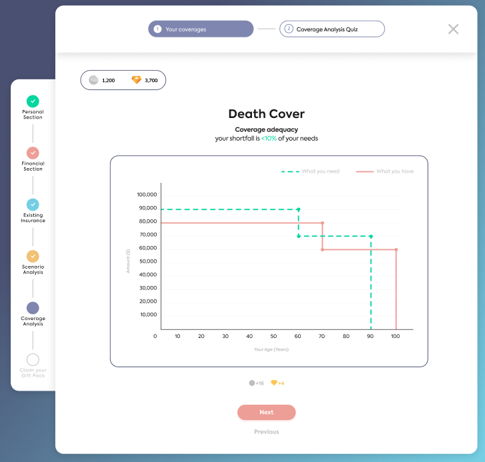

And finally: Shortfall Analysis

Here is where we answer the age-old question – how much insurance coverage do I really need? VS How much insurance cover do I already have?

And more importantly, we show you how your needs change with the passage of time, so that you have a complete overview.

Will you like what you see? Only one way to find out.

More of the fun stuff: Quizzes and a claimable gift pack

Along the way, as you complete each section, there is also a quiz tagged to that section that helps you understand more about what you are doing.

Also, upon completion of the journey, you will be eligible to receive a gift pack, which we will talk about more in Part 4 of the guide.

And just like fine wine, there is an art of savoring the platform to bring out maximum enjoyment. See you in the next installment!

Part 3: How to maximize your experience

Part 1: Introducing our newest creation

Part 2: Platform Walkthrough

Part 3: How to maximize your experience

Part 4: Rewards

Part 5: Random Delights and Surprises

Part 6: How you can contribute

Part 7: Frequently Asked Questions

www.ClearlySurely.com is a refreshing new way to approach Life Insurance – with humour and fun, bound together by imagination.

Our Financial Discovery Platform provides hours of entertainment while providing an overall view of your insurance adequacy.

If you’re curious about how we can make a dry subject nearly as wholesome as Keanu Reeves, join our community today.

We have been eradicating the knowledge gap between consumers and Life Insurance since 2015, and have a vision that one day, every Man, Woman, and Child will be properly insured.