Guaranteed Insurance – Hidden Traps and Best Companies

Those without access to traditionally underwritten insurance products can apply for guaranteed issue life insurance. It is specifically designed for high-risk individuals. To help answer the many questions regarding guaranteed issue insurance, and why it is priced higher than other products, we’ve asked several professionals to weigh in. We specifically asked them:

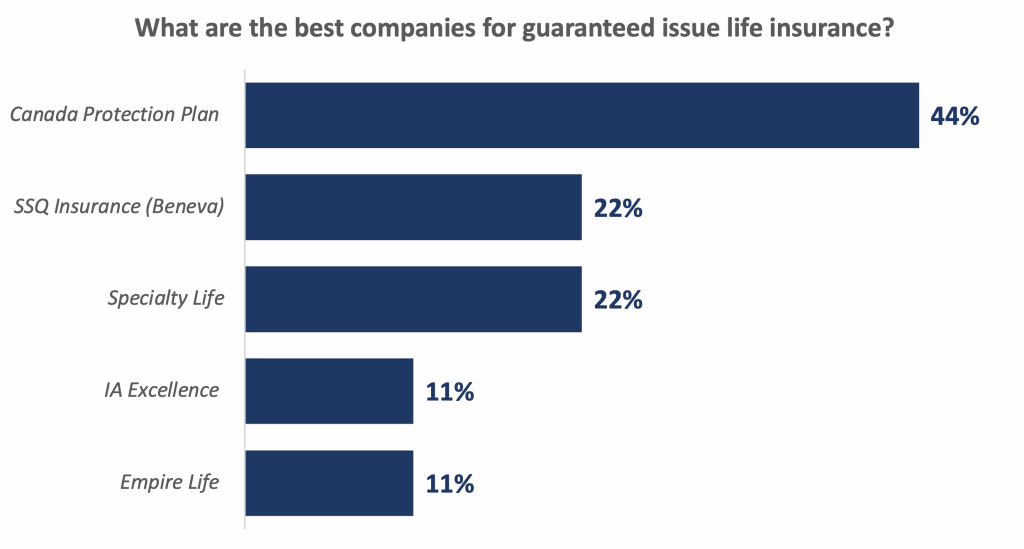

What hidden traps to look out for when getting guaranteed life insurance?What are the best companies for guaranteed issue life insurance?

A summary of their answers is below, and you can scroll down for more detailed explanations of their replies. Ready to learn more about guaranteed issue insurance? Let’s get started.

Question #1: What hidden traps to look out for when getting guaranteed life insurance?

The top three answers were:

Remember to consider the two-year deferralFully understand all questions and definitionsEnsure that it makes sense financially

Question #2: What are the best companies for guaranteed issue life insurance?

The top three answers were:

Canada Protection PlanSSQ InsuranceSpecialty Life Insurance

Please note that most life insurance companies offer guaranteed life insurance products, but only a few ones truly specialize in it. An insurance broker can guide you to these companies.

A number of industry experts and thought leaders weigh in on why life insurance is so important. Click on the thought leader’s picture below to explore their perspective.

Richard Parkinson’s Take on Guaranteed Life Insurance

Richard Parkinson

Richard Parkinson

(Independent life insurance broker)

Question #1: What hidden traps to look out for when getting guaranteed life insurance?

Virtually all guaranteed issue (no questions asked) plans are deferred for two years, which means if you become an angel in the first two years of the policy, from other than an accident, the insurance company will not pay the benefit. However, they will return the premium paid, with or without any interest.

A second consideration is, at what point does a guaranteed issue policy make no sense? You are an aged 75 non-smoking male, and due to medical issues only qualify for a guaranteed issue plan. The CPP rate for $25,000 of coverage is $449.33 monthly. When you do the math, $25,000 divided by $5,000 per year is five years. Most pensioners don’t have the income to support $449.33 monthly payments, but if they did, realize that your beneficiary receives $25,000 on your demise, but not the $5,000 per year premium you paid for them to get that benefit. When you consider the premiums paid, with a 3 per cent rate of return, investing the monthly premium into a Tax Free Savings Account (TFSA) has a breakeven of 28 months. The TFSA will have the equivalent of the death benefit minus the premiums paid in 28 months. Given these are deferred plans, unless the insured dies between month 25 and month 28, they are better off with a TFSA, with all of its advantages such as being able to reduce the deposits, stop them altogether – or assuming you live a long life, have much more for your family on your demise 10 plus years in the future.

Also look for extra exclusions, e.g. most medically underwritten plans only specify suicide in the first two years as a reason not to pay an otherwise legitimate claim. Many guaranteed issue plans also exclude death if due to driving under the influence, declared or undeclared war, air crash other than on a commercial airline, committing a criminal offence, and a few more.

Question #2: What are the best companies for guaranteed issue life insurance?

Best is a relative term as it depends on the criteria you consider:

size of the company, is bigger better?maximum coverage available?does the policy have cash values should you wish to cancel early?does it have reduced paid up coverage should you wish to stop paying premiums?reputation of the company providing the plan?

Canada Protection Plan is probably the most well known for guaranteed issue/simplified issue no medical plans. They have a good range of solutions in all three categories: guaranteed issue, simplified issue, and medically underwritten, so they are most often a starting point for most brokers. Plus their application process is quite fast and easy.

Mike Liem’s take on Guaranteed Life Insurance

Michael Liem

Michael Liem

(Canada Protection Plan Regional Vice President)

Question #1: What hidden traps to look out for when getting Guaranteed Life Insurance?

Most, if not all guaranteed issue plans have a two-year waiting period where if the client passes away, all the premiums are returned to the beneficiaries but the face amount is not paid unless the death is accidental. Accidental death is paid out within the first two years and has no waiting period. The advisor plays a crucial role in helping the client get the best possible coverage based on each client’s individual situation. People sometimes pay more than they should because they answered incorrectly and could have received cheaper or better coverage.

Amir Eny’s take on Guaranteed Life Insurance

Amir Eny

Amir Eny

(Independent life insurance broker)

Question #1: What hidden traps to look out for when getting guaranteed life insurance?

When exploring guaranteed issue plans, there are a few stipulations with which to be aware. First, the rates for guaranteed issue plans will be significantly higher than traditionally underwritten or simplified issued products, as the health questions asked are minimal. In this regard, coverage will typically be restricted to maximum of $50,000. Guaranteed issue plans also have a two-year waiting period. Moreover, if you were to die within the first two years due to non-accidental death, your beneficiary would only get back the premiums you had already paid.

Question #2: What are the best companies for guaranteed issue life insurance?

Canada Protection Plan is one of the leaders in offering guaranteed issue policies where you cannot be denied a plan regardless of medical history or lifestyle. IA Excellence also has a similar guaranteed issue product along with SSQ, who recently came out with their own guaranteed issue product.

Jack Bendahan’s Take on Guaranteed Life Insurance

Jack Bendahan

Jack Bendahan

(Independent life insurance broker)

Question #1: What hidden traps to look out for when getting guaranteed life insurance?

Read the questions and if there is any confusion in a question or definition, get the broker to obtain a confirming email from the underwriting team.

Question #2: What are the best companies for guaranteed issue life insurance?

Canada Protection Plan, Empire Life, and SSQ.

Zale Goldstein’s Take on Guaranteed Life Insurance

Zale Goldstein

Zale Goldstein

(Independent Life Insurance broker)

Question #1: What hidden traps to look out for when getting Guaranteed Life Insurance?

Read the questions and if there is any confusion in a question or definition get the broker to obtain a confirming email from the underwriting team.

Unlike a traditional whole life insurance policy, guaranteed issue life insurance generally doesn’t build a cash value or have a savings component. You simply make monthly payments in exchange for a fixed amount to be paid out upon your passing. Guaranteed issue insurance most often will come with a two-year limited death benefit (return of premium for non-accidental death within the first two years).

Question #2: What are the best companies for guaranteed issue life insurance?

My go-to provider is Canada Protection Plan. They are a leading provider of guaranteed issue life insurance in Canada.

Eugene Shafronsky’s Take on Guaranteed Life Insurance

Eugene Shafronsky

Eugene Shafronsky

(Vice President of Sales, Distribution and Product Development at Specialty Life)

Question #1: What hidden traps to look out for when getting guaranteed life insurance?

All guaranteed (or simplified deferred) plans include a two-year moratorium (benefit for a natural cause of death is not paid until year three; only return of premiums for that period). In most cases, the realization that one can only qualify for a guaranteed issue policy arises after simplified issue questions trigger a “yes” answer. When dealing with carriers offering the static simplified issue process, it’s vital to understand the medical questions simplified applications are asking. The applicant must understand the question, and make sure it’s not an all-inclusive or unclear question. Furthermore, watch for timelines, usage of medical impairments from a different group of conditions (e.g., cardiovascular & respiratory, etc.), combinations of words such as “treatment,” “had, told you have or were investigated for…,” connective words like “and,” “or” etc. These can be vital to understand the true meaning of every question. Some of the above can disqualify the applicant from the desired plan (either guaranteed or a deferred plan). In more challenging situations, it may impact the claim adjudication on the grounds of misrepresentation. The market space is currently transitioning to more reflexive and AI no medical underwriting assessment systems, which allow more than just “yes” or “no” answers, with more disclosure options available for applicants. This, in return, allows much safer claim environment.

Other areas to understand are related to premiums structure and benefit definitions. For guaranteed issue products, the market space currently offers either level premiums or shorter-term premiums (e.g. five years). Depending on the applicant’s age or medical condition, each option may provide an economic advantage (paying lower premiums for the same benefit) or having the ability to qualify for a better plan in a few years.

When it comes to the benefit, other than a deferred period, another common rule to check and understand is a pre-existing condition clause. This clause typically applies to living benefits plans (like critical illness). This clause typically means that the benefit payout may be impacted by some pre-existing conditions during the first 24 months but will have no impact after that. On the other hand, offerings with this clause usually offer more robust coverage for more conditions and have a much easier qualification process.

Question #2: What are the best companies for guaranteed issue life insurance?

No matter what plan is selected, the most crucial aspect to focus on is the plan’s safety (i.e., claim adjudication). Always consult with more than one person or company, and make sure provided consultation is given by an expert on the matter versus a salesperson (wholesaler).

I also suggest checking some of the newest market space offerings, such as SLi. Its recently launched Evolution, powered by Jenie, is the first of its kind, a real-time virtual underwriter that uses the most current underwriting guidelines and incorporates advanced medical knowledge. Jenie will automatically select the most suitable and tailored intuitive underwriting sequence for every applicant and provide an instant decision upon completion without any additional requirements. Jenie’s unique logic flow allows it to assess an applicant more accurately than any other no medical questionnaire by asking a combination of behavioural and detailed, specific condition-related questions. This approach allows for more precise underwriting evaluation and, compared to other current static, no medical applications and systems, virtually eliminates any possible issues at the time of claim.

Barry Rubin’s take on Guaranteed Life Insurance

Barry Rubin

Barry Rubin

(Director, Business Development at Beneva)

Question #1: When is it best to look into a guaranteed issue plan?

Due to the limited amount of coverage a client can get under a guaranteed issue policy, the best time to look into this product would be when your clients may have trouble getting traditional insurance, or who are in poorer health (as acceptance is guaranteed).

Question #2: What tips can you give you give to see if you qualify for lower rates?

Before jumping to guaranteed issue, I would suggest working with a broker who has experience in the hard-to-insure market. You want to first determine if there is a possibility of qualifying for traditional insurance coverage. As an example, many people assume if they have a medical condition such as diabetes, that it would be an automatic rating/decline, which is not the case. In the library of SSQ’s illustration software, we provide our brokers with an underwriting guidelines document that outlines various medical conditions and based on the product applied for, whether the client could be standard, rated or declined. For more complex situations, we can also submit an inquiry to an underwriter to get a preliminary opinion to determine, based on the client’s conditions, if they would qualify for traditional insurance and if so, what type of rating to expect (if any).

Question #3: What tips can you give you give to see if you qualify for lower rates?

I would say the most common “fine print” to look for with a guaranteed issue product is the waiting period, which is commonly two years in case of non accidental death.