Everything you need to know about getting an insurance producer license

Everything you need to know about getting an insurance producer license | Insurance Business America

Guides

Everything you need to know about getting an insurance producer license

Obtaining an insurance producer license requires sufficient training and preparation. Find out what it takes to get one

An insurance producer is a collective term given to industry professionals involved in selling policies. Before they can do so, however, the law requires them to secure the proper licenses.

If you feel like a career in insurance sales is a great fit but don’t know where to start, you’ve come to the right place. Here, Insurance Business will give you a walkthrough on how to get your insurance producer license.

We’ll go over the different types of licenses you may need and how long licensing takes. Read on and find out everything you need to know about obtaining your insurance producer license.

The National Association of Insurance Commissioners (NAIC) defines an insurance producer as an industry professional who “sells, solicits, or negotiates insurance in the United States.” The term includes insurance agents and insurance brokers.

The association notes that all insurance sales professionals in the country must be licensed as a producer. They must also comply with the various state laws and regulations governing their activities.

According to NAIC’s latest data, there are more than two million individuals and 236,000 business entities licensed to provide insurance products and services to clients across the nation.

These industry players are administered by state insurance departments that provide a “comprehensive regulatory framework designed to protect insurance consumer interests in insurance transactions.”

What is the difference between an insurance producer and an insurance agent?

An insurance producer is a broad term given to someone whose job is to sell insurance. This includes insurance agents.

Insurance agents serve as intermediaries between the insurers and insurance buyers. They represent one or multiple insurance companies and provide potential clients with information about their partner insurers and the products they offer.

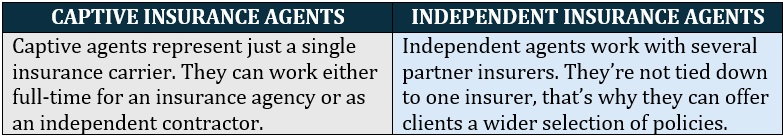

There are two main types of insurance agents:

Regardless of whether they’re captive or independent, all insurance agents have the power to bind coverage. This means that they have the authority to confirm coverage even if the policy hasn’t been finalized. This is what separates them from insurance brokers.

What is the difference between an insurance producer and an insurance broker?

As mentioned, an insurance producer refers to all industry professionals involved in the sale and provision of insurance products and services. This covers insurance brokers.

Just like an insurance agent, an insurance broker acts as an intermediary between insurance buyers and the insurers. The main difference is who they serve.

Insurance brokers serve the interests of their clients. They assist individuals and businesses in finding coverage that matches their unique needs. These industry professionals can work independently or as part of an insurance brokerage firm.

Because they’re not bound to a single insurer, brokers can offer customers more coverage options compared to agents who work directly for insurance companies. This also gives them the freedom to place policies with different providers depending on the market conditions. This, in turn, allows them to access the best possible protection for their clients.

If you wish to practice as an insurance producer, the first step is obtaining a license from your state’s insurance regulation department. To be eligible, you must:

be at least 18 years old, the minimum age you’re allowed to get a license in most states

successfully complete a background check

not owe federal or state income taxes

be free of any felony or fraud charges

not have past-due child support

Meet these requirements and you’re ready to get your insurance producer license. Getting one, however, is no simple feat and involves these steps:

1. Completing pre-licensing coursework.

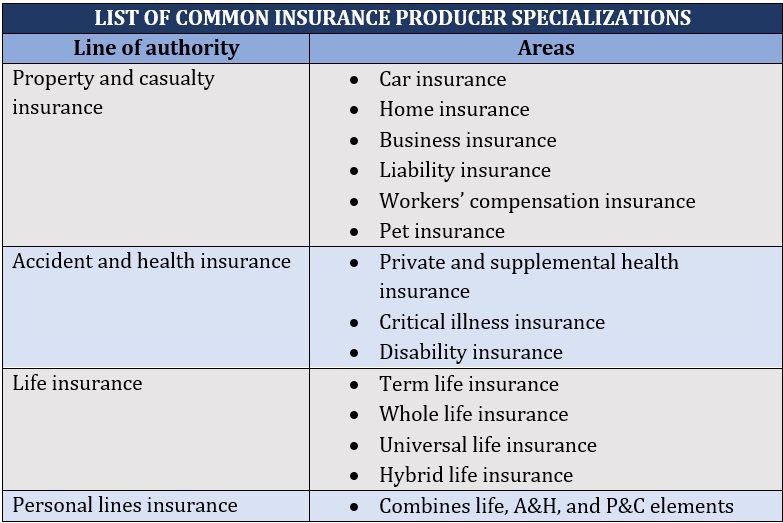

Pre-licensing courses are designed to prepare you for the state licensure examinations. That’s why almost all states will require you to complete certain hours based on your chosen line. Here’s a list of insurance lines, also called lines of authority, you can choose to specialize in:

You can take the courses online or in a classroom setting, depending on your preference. Pre-licensing coursework covers a range of topics, including policy types, industry regulations, and ethics. Each subject comes with minimum mandatory hours:

life insurance: 20 credit hours

health insurance: 20 credit hours

life, accident, and health (LA&H) insurance: 40 credit hours

property and casualty (P&C) insurance: 90 credit hours

personal lines insurance: 40 credit hours

If you want to get an insurance producer license for different lines of authority, then you must take all required courses. This will allow you to branch out and sell insurance policies in different lines.

2. Passing your state licensure exam.

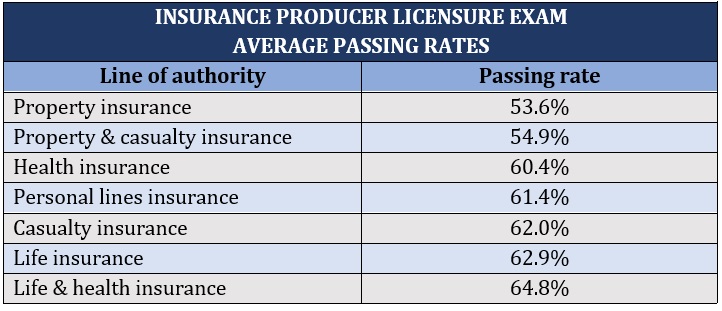

The state insurance licensure exam is among the most difficult tests to pass because of the range of topics it covers. The test has a passing rate of around 60%, according to the latest data from NAIC. Here’s a breakdown of the passing rates per line of authority:

Just by looking at the figures above, you will know why passing your state licensure exam requires ample preparation.

Once you’ve completed the pre-licensing coursework, you should be all set for the licensure exam. The test is generally divided into two parts – LA&H and P&C. Each test consists of 50 to 200 items and must be finished within two to three hours.

You’re only required to take the licensure exam for the insurance line you plan on specializing in. If you wish to sell policies in both lines, then you must also pass both exams.

You must get at least 70% of the items correctly to get a passing mark. The passing scores, however, may vary depending on where you’re taking the test.

The test results are often valid for two years, but this also depends on state regulations. There are some states that impose a 12-month timeframe. You must apply for your insurance producer license within this span. Failure to do so will invalidate the test results. If you still want to obtain a license after this, you must retake and pass the licensure exam again.

3. Applying for your insurance producer license.

Let’s say you’ve passed the licensure test with flying colors. This means you can now apply for an insurance producer license. You can do so in the insurance regulation department in your state. It’s advisable, however, to wait at least 48 hours after the scores have been released to give the agency sufficient time to process the test results.

The insurance regulation department doesn’t have a set timeframe for reviewing license applications as each applicant comes with a different set of circumstances. If something comes up from the background check, the agency contacts applicants to provide clarity, which can delay the process.

You can find out if your application has been approved or rejected through the department’s website. Once approved, you can ask the agency for a copy of your insurance producer license. Some states don’t send out printed licenses for security reasons. You may need to download your license and print it yourself.

You can also contact the department for clarifications if you feel that the processing of your license is taking too long, or your application has been erroneously denied.

As an insurance producer, you need to be licensed before you can legally provide a product or service. The licensing requirements vary depending on the jurisdiction and the lines of authority you choose to specialize in. Here’s a list of some insurance producer licenses you may need:

Resident insurance producer license: this allows you to sell insurance within state lines.

Non-resident insurance producer license: you will need this type of license if you plan on selling insurance in different states. Some states have reciprocity agreements, allowing out-of-state producers to apply for licenses without the need to take the states’ licensure exam.

Policy-specific insurance producer license: this enables you to sell insurance under a particular line. You can choose to specialize in different lines of authority, but you will need to obtain the necessary licenses for each.

You will also need to pay a licensing fee, which varies between states. If you’re applying for a license in multiple lines, you will need to pay the corresponding fees.

The entire process of getting an insurance producer license can take between two and eight weeks, depending on your pace. Most of your time will be spent completing your pre-licensing coursework and studying for the licensure test.

Once you have your license, you must take a minimum of 24 hours of continuing education (CE) credits during a two-year term. CE is designed to keep your skills updated.

Selling insurance policies or providing services without the necessary licenses can result in a felony charge. You can also be subjected to substantial financial and legal penalties, including:

fines, which vary depending on the state

blocked commissions

suspension or revocation of your insurance producer license

Similarly, insurance agencies need the right licenses to operate. Getting caught doing business without proper licensing can lead to serious legal and financial consequences. If you plan on starting an insurance sales business, these are the different types of insurance agency licenses you may need.

While a college degree is not a requirement for getting an insurance producer license, it can help build a solid foundation for your career. Some colleges and universities offer insurance and risk management courses.

Studies focused on financial services, economics, business administration, marketing, accounting, and business law can also provide you with useful insights into the insurance industry. Communications, psychology, and sociology courses, meanwhile, can help you gain knowledge on how to build strong relationships with clients.

Additionally, internships with insurance companies can provide valuable learning and experience for aspiring insurance sales professionals. Some insurers give students the chance to observe first-hand how they operate. If you’re a high-performing intern, you may have job opportunities waiting for you within the firm.

Where can you find the best companies to start a career as an insurance producer?

Our Best in Insurance Special Reports page is the place to visit if you want to find the best companies to start your insurance sales career with. The insurers featured in this page are nominated by their peers and vetted by our panel of experts as respectable and dependable market leaders.

Here, you can find Insurance Business’ five-star awardees for the Best Insurance Companies to Work for in the US. These are the firms that provide a positive work environment, competitive compensation, and resources to keep employees engaged. These insurers also go above and beyond to make each workday both challenging and rewarding.

If you’re looking for insurance companies that share your values and provide the opportunity for professional growth, this list is a good place to begin your job search.

Do you think getting an insurance producer license is worth it? What are the benefits of pursuing a career as an insurance producer? Share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!