How Tesla can win the EV wars even if its rivals outsell it

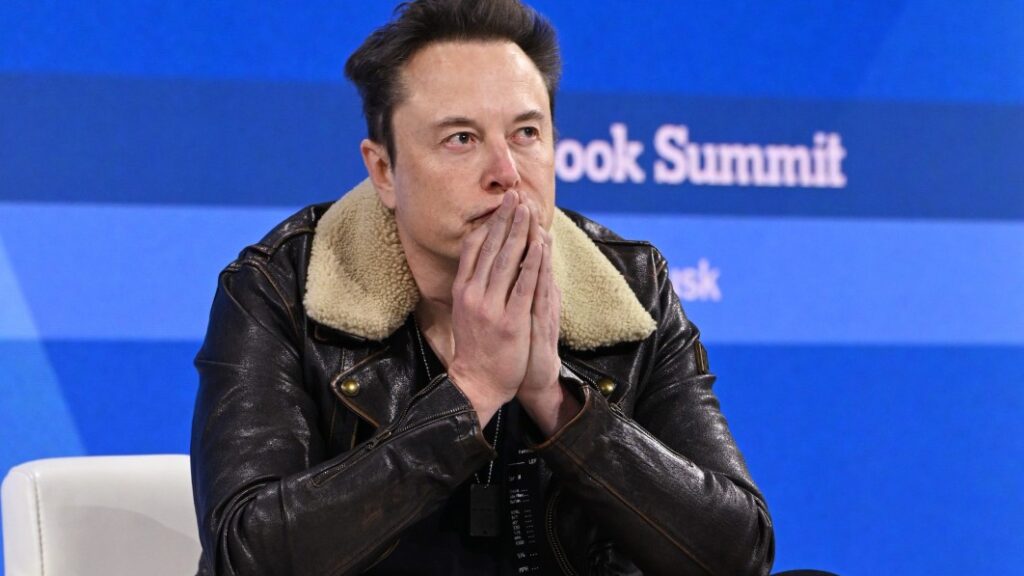

Elon Musk has called the strike action from Swedish workers “insane.” Slaven Vlasic/Getty Images

Tesla will likely soon lose its spot as the world’s most popular EV maker to Chinese rival BYD.

But Tesla doesn’t have to sell the most vehicles to win the EV wars, said one Wall Street analyst.

Elon Musk’s company could still come out on top if it leverages its strengths to fix profit margins.

The Chinese automaker BYD is expected to surpass Tesla as the top-selling EV company in the world in the coming days.

But Tesla doesn’t have to sell more EVs than other automakers to win the EV war, said George Gianarikas, a managing director at Canaccord Genuity, on CNBC Wednesday.

Gianarikas said that right now, Tesla is a lot like Apple was when the smartphone industry first started.

“Apple kind of had 100% market share because they were the first one to market with a true smartphone. Same thing for Tesla,” he said. “Asian competition came into the smartphone market, and the same thing is happening in the EV market, and eventually, Tesla will likely be overtaken from a unit perspective.”

But Gianarikas, who has a buy rating on Tesla and a $267 price target, said that investors shouldn’t get too hung up on Tesla selling the most EVs. Tesla’s stock closed on Wednesday at $261.44.

“What’s most important, and we think Tesla will win over time, is the profit share battle,” Gianarikas said. “Today, Apple doesn’t have the most unit market share on smartphones, but it overwhelms the market in terms of profit share and we think ultimately, that will be what’s most important for Tesla, and we think that’ll happen.”

Tesla is expected to deliver about 1.82 million vehicles in 2023, a 37% increase from 2022, according to a Reuters report that cited analyst polling by LSEG. However, the EV maker cut prices on its vehicles throughout the year to help it reach that milestone. And those price cuts have taken a toll on its profit margins.

Tesla posted profit margins of 17.9% in the third quarter of this year, compared to 25.1% a year ago.

But Gianarikas said he believes Tesla has a strategy to get the company back on track.

“This year was the tale of Tesla cutting prices, impacting their gross margins. We think there was an intent to that, and then over time, they expect to sell a lot of full self-driving, FSD software, to people who already own their vehicles. That’s a big key to the story because, right now, their profit margins have suffered. We think that’s the long-term plan in place: to sell FSD software the same way Apple sells services,” Gianarikas said.

“So ultimately, we think it’s through FSD software and through the vertical integration that Tesla’s the best in the world at, it will ultimately result in higher than average gross margin and profits for their EVs relative to anyone in the marketplace,” he continued.