A guide on how to start an insurance company

A guide on how to start an insurance company | Insurance Business America

Guides

A guide on how to start an insurance company

Launching an insurance business requires careful planning and preparation. Here’s a step-by-step guide on how to start your own insurance company

With the insurance industry’s future shaping up to be a robust one, it also presents a huge opportunity for those wanting to venture into the insurance business. But just like with any type of enterprise, starting your own insurance company entails careful planning and preparation.

If you’re among those aspiring to become a successful insurance entrepreneur but not quite sure where to begin, then you’ve come to the right place.

In this article, Insurance Business will give you a step-by-step walkthrough on how to start an insurance company from scratch. We will also discuss the different factors you need to consider to ensure that your business is profitable. Find out what it takes to build a successful insurance company in this guide.

An insurance company creates products that give individuals, families, and businesses financial protection against the risks and losses they face.

To offer suitable coverage, insurance companies evaluate these risks and draft policies detailing the terms and conditions. They then sell the policies in exchange for insurance premiums.

Ownership of an insurance business comes in two major structures:

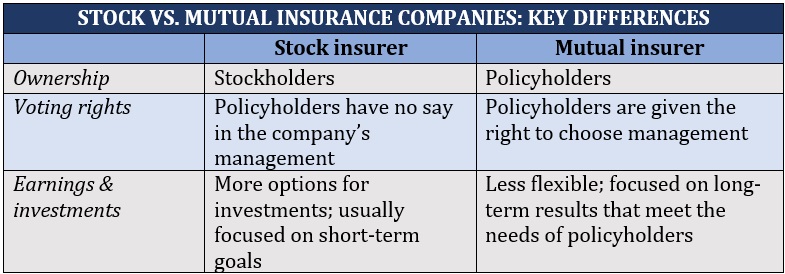

1. Stock or proprietary insurance company

This type of insurance company is owned by its shareholders, with the profits and losses distributed among the owners. To operate, these businesses must meet a minimum capital set by state regulators.

There are additional requirements if the owners plan to publicly trade the company’s shares. Some prominent proprietary players in the industry include Berkshire Hathaway, MetLife, and Allstate.

2. Mutual insurance company

A mutual insurance company is owned by its policyholders, who have the right to vote on the company’s management. These companies’ assets are held and managed for the benefit of the policyholders.

The executive management and board determine how much dividends are paid to the policyholders each year. Among the largest mutual insurers in the US are State Farm, New York Life, and Northwestern Mutual.

Mutual insurance companies can become stock insurers by undergoing demutualization.

Here’s a summary of the key differences between a stock insurer and a mutual insurer.

What comprises an insurance company?

If you want to start an insurance company, you must also understand the different roles needed to keep your operations going. Here are some of the professionals comprising an insurance business:

Insurance agent

Often considered the frontliners of an insurance company, agents are responsible for selling your policies. They represent your company and serve as intermediaries, informing potential clients about your company and its offerings. Insurance agents also have the power to bind coverage.

Insurance broker

Insurance brokers have a role like an insurance agent with a few key differences. Unlike agents, brokers represent the insurance buyers and can offer policies from different insurance companies. They also don’t normally have the power to bind coverage.

Claims adjuster

Claims adjusters and investigators are tasked to assess and investigate claims to determine how much you should pay for the damages and losses. These professionals are also responsible for ensuring that claims aren’t fraudulent.

Insurance actuary

An insurance actuary’s job involves pricing policies. They also give you advice on how your company can meet regulatory compliance and help you balance your capital.

Actuaries are tasked to maintain daily communication with clients and implement risk management tools.

Account manager

Account managers are responsible for supervising client relationships. Their duties include addressing the concerns of policyholders and ensuring that they’re satisfied with the service they receive.

Account managers also explain insurance coverage and pricing to your clients and work with agents to boost sales.

Risk manager

Risk managers oversee your company’s insurance program. They help evaluate potential risks and advise you on how these can be mitigated or prevented.

Customer service representative

Customer service representatives or CSRs act as frontline support for your clients. They often provide customers with useful information by answering their queries. CSRs also respond to complaints to ensure that policyholders are satisfied with a product or service.

What makes an insurance business an appealing venture is the strong growth potential that comes with it. But establishing your own insurance company requires meticulous planning and preparation.

Here are the steps you need to take when starting an insurance company from scratch:

1. Have a sound business plan.

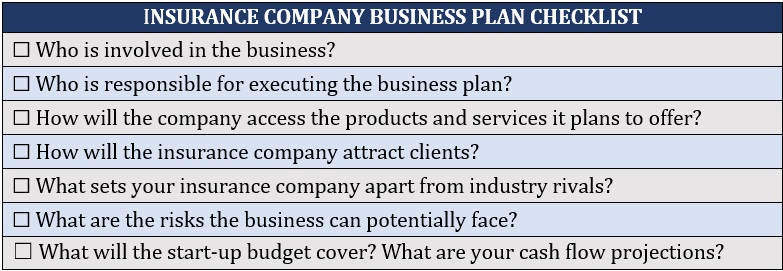

The first step to establishing any type of business is gaining a strong understanding of how companies run. This includes having a sound business plan.

A business plan outlines your goals for the company and the steps you intend to take to achieve them. Having a reasonable business plan can also help you identify key markets and secure funding for your insurance company.

Here’s a checklist of what a typical business plan includes:

You should also choose a business structure. This will determine how your profits will be taxed and if business assets will be treated separately from your personal assets. Your insurance company can be structured as a:

sole proprietorship: Owned and managed by one person

partnership: Two or more individuals share ownership

limited liability company (LLC): Protects owners against personal liability for the company’s debts and claims; can be managed by the owners or an outsider

limited liability partnership (LLP): Works like an LLC but managed exclusively by the owners

S corporation: Gives businesses the same legal protections as a C corporation but are taxed as a pass-through entity

C corporation: The owners and the company are taxed separately

Each business structure comes with its own share of benefits and risks.

2. Build your insurance expertise.

You can’t start an insurance company without a solid understanding of how the industry works. Several years of experience as an insurance professional can help build the necessary expertise to run an insurance business. These can also give you a clear direction of which insurance lines to pursue.

If you’re an insurance agent or broker, you can also use these years to build your network of insurance providers. These insurers can play a vital role in helping you access different insurance products. They can also help expand your client base, who in turn will serve as your insurance company’s lifeline.

3. Raise your startup capital.

Setting up your own insurance company often requires heavy financing. The actual amount you need, however, depends on a range of factors. These include the business structure, where you intend to start your company, and the types of policies you plan to offer.

On average, aspiring insurance business owners will need a startup capital of $50,000 to $500,000, possibly even more. This amount will cover the company’s daily operational expenses. These include office rent and equipment, licensing and registration costs, tech expenses, and insurance coverage.

You will also need enough funds to maintain a positive cash flow in the first few years.

If you don’t have the means to meet the required financing, you can take out a business loan, look for grants, or turn to crowdfunding.

4. Meet licensing and other requirements.

With funding ready, it’s now time to launch your firm. For your insurance business to legally operate, there are several registration and licensing requirements you must meet. The requirements may vary depending on where your insurance company is located, but typically includes:

Registered name

You need to register the name of your business. Keep in mind that some states prohibit or restrict the use of certain terms to avoid misleading the public. You will also need to pay a registration fee.

Tax identification number

The Internal Revenue Service (IRS) requires all partnerships and corporations to use their federal employer identification number (FEIN) when filing their taxes. Sole proprietorships or single member LLCs may use the owner’s social security number.

State registration

Insurance companies are required to register as a “resident business entity” through their state insurance commissioner’s office.

Business permits and licenses

Depending on your location, you may need to secure a general business permit or license to operate legally. You can find the complete list of permits and licenses you need in the Small Business Administration’s (SBA) business licenses and permits tool.

5. Purchase proper business insurance.

It would be ironic if your insurance company operated without the necessary coverage. Ideally, any business would benefit from having the following insurance policies:

General liability insurance: This protects your company against claims of bodily injury or property damage resulting from your business activities. These include reputational harm and copyright infringement.

Workers’ compensation insurance: This pays for medical expenses if an employee becomes sick or injured while performing their jobs. You may be legally required to take out coverage, depending on the number of employees you have and where the business is located. Check out how workers’ compensation insurance works in this guide.

Health insurance: If your insurance company employs more than 50 full-time staff, you’re required to take out health insurance for your workers under the Affordable Care Act (ACA). If you have fewer than 50 employees, you can take out ACA’s Small Business Health Options Program (SHOP) as coverage.

Professional liability insurance: This protects your insurance company from work-related claims such as mismanagement, sexual harassment, and discrimination. This policy is also called malpractice or errors and omissions (E&O) insurance.

Commercial property insurance: This policy pays for damage to your company’s premises, as well as lost equipment, fixtures, office furniture, inventory, and supplies.

Commercial auto insurance: This type of policy covers the cost of repairing or replacing your company’s vehicle if it is accidentally damaged or stolen. It also pays for the cost of damage to other people’s property caused by the vehicle.

Cyber liability insurance: This protects a business from the legal costs and expenses related to a cyberattack. These include fines, penalties, systems restoration, and notification costs.

Business interruption insurance: This protects your insurance business from loss of income and additional expenses if you’re forced to shut down because of an unexpected event.

Find out how the right coverage can help your company navigate challenging times in this comprehensive guide to business insurance.

There are two ways insurance companies generate earnings:

1. Underwriting revenue

Underwriting revenue comes from the total premiums your insurance company has collected for the year, minus the amount you have paid out in claims.

For example, if your insurance business has written $5 million in premiums for the year but paid out only $3 million in claims, the remaining $2 million is considered your revenue.

2. Investments

Insurance companies typically invest a good portion of the premiums they collect in various assets to boost their earnings.

Starting an insurance company is just the first step. The real challenge is keeping your business profitable.

To keep clients coming and cash flow running, you must have a clear vision of how to maintain revenue growth. Here are some practical steps you can take to sustain your insurance company’s profitability.

Set goals.

Setting goals is crucial in giving your business a clear picture of where it wants to go, how to reach these targets, and what new products and services it can offer. It also plays a key role in keeping you and your employees motivated. If set correctly, your business goals can help you measure how successful your insurance company is.

Generate and nurture fresh leads.

Success in the insurance market means having to continuously drive leads. There are several strategies that can help your agents tap new leads, including targeted marketing and multi-channel lead generation.

Find your niche.

As clients’ needs evolve constantly, so does the demand for different insurance products. This presents an opportunity for your insurance company to find a niche that will help it grow. While the road to discovering your business’ niche market takes plenty of time and effort, it can also reap dividends in the long run.

Take advantage of the latest technology.

Industry experts believe that the only way for the insurance sector to move forward is to embrace technological innovation. This is reflected in the increased adoption of AI, blockchain, cloud computing, IoT, and telematics to reduce costs, mitigate risks, and keep clients engaged.

Keep your employees engaged.

Another way to ensure the success of your insurance company is to take care of your most important asset – your employees. A great insurance employer offers the best work environment that paves the way for staff to thrive and grow. A positive workplace culture is also one of the biggest factors contributing to an engaged workforce. This is key to reducing turnover, boosting productivity, and maintaining profitability.

Do you agree with the steps we laid out on how to start an insurance company? Feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!