How the Ramsey vs. 'Supernerds' 4% Spat Helps Retirees

More Skeptical View

A similar point of view was shared by Morningstar’s John Rekenthaler, director of research, in an in-depth response posted to the firm’s website and in supplementary comments shared with ThinkAdvisor.

“This is not much of a ‘debate,’” Rekenthaler suggests. “As my article states, Ramsey’s argument is based on the doubly false assumptions that stocks reliably return 11% to 12%, and that only average returns matter for portfolios that are funding withdrawals. In fact, as we all know, stocks have prolonged stretches where they make much less than that, and volatility strongly damages the ability of portfolios to survive under such circumstances.”

As fleshed out in his article, Rekenthaler says the tendency for failure with Ramsey’s approach is clearly demonstrated by the supernerds, but for the sake of argument he goes on to ask when such an approach could actually work. According to Rekenthaler, the “only obvious way to withdraw aggressively from an investment portfolio without depleting it is to die early.”

“While generally not regarded as a desirable solution, expiring quickly does permit retirees to follow Ramsey’s advice,” he writes. “Even with Morningstar’s conservative assumptions, investors can safely withdraw almost 10% annually, inflation-adjusted, over a 10-year period. Easy pickings.”

Rekenthaler says this response sounds glib — “and it is” — but the underlying point is serious.

“The only reliable method for achieving a safe portfolio-withdrawal rate that is also satisfyingly high is to assume a short time horizon. Otherwise, something has to give,” Rekenthaler warns.

Drawing a similar conclusion to other commenters, Rekenthaler says that the biggest reason retirement portfolios crater are “slow starts” coupled with excessive early withdrawals. These two forces can quickly wreck an otherwise sound income plan, whether it starts from a 4% withdrawal rate or something higher.

‘Performance Art’

Stepping back, Rekenthaler says he views Ramsey’s statements as “performance art.”

“Which, to judge from the size of his audience, he does very well,” Rekenthaler says.

“Are Ramsey’s comments helpful? Maybe,” he continues. “They certainly are not helpful for retirees with long time horizons who take his advice to heart. But I wonder how many really do? Somehow, I just can’t see many 65-year-olds saying, ‘Yes, good idea, I will put all my money into equities and spend aggressively.’ I would guess that even Ramsey’s audience realizes that he is playing a part.”

As Rekenthaler and others conclude, the silver lining in this entire discussion is that Ramsey has brought attention to a set of complex and evolving issues relating to withdrawals from portfolios and funding retirement spending.

“If you listen to Ramsey’s statement, you will realize two things,” Rekenthaler writes. “First, nobody has ever been as certain of anything as Ramsey is about the accuracy of his counsel. … Second, he is deeply wrong. His argument relies on the overwhelmingly false assumption that stocks will consistently and regularly deliver double-digit returns.”

A Supportive Take

Asked for his perspective on the matter, Hopkins, the director of private wealth management at Bryn Mawr Trust, told ThinkAdvisor he was not surprised to see so much debate and discussion on social media.

“I think this situation underscores a few things, starting with the fact that Dave Ramsey has a huge following,” Hopkins says. “He is one of the more influential people out there in the world of planning and financial services. So, when he speaks, a lot of people listen — both advisors and consumers.”

As Hopkins notes, one can look back in the historical record and see that there have indeed been time periods during which an 8% starting withdrawal could have worked. There have also been times when even a 4% annual distribution would have been risky.

“As others have noted, 8% is not a super safe starting withdrawal level, but if you get into the details and you assume, for example, that a person will use their home equity and that they will have a pension to complement their income, 8% can be a good place to start,” Hopkins says. “It also obviously matters a lot what happens with the markets early in the retirement period.”

Hopkins says the experience of people who retired early in the last decade shows this is true.

“These people were lucky enough to retire into a period with essentially no inflation and very consistently high stock market returns during that retirement red zone where sequence risk is the most concerning,” Hopkins says. “If you look at the numbers, withdrawing something like 6% to 8% of the portfolio during this period might very well have been a sustainable rate.”

The key thing to realize, Hopkins concluded, is that people should (and in fact do) revisit and evolve their spending approach over time. Additionally, portfolio depletion late in life may not be such a bad thing as people assume.

“There is an argument to be made that it is perfectly rational to take those 8% withdrawals in order to have a higher standard of living for the first 15 or 20 years of retirement,” Hopkins said. “When you actually work with that elder client group, they tell you this. They say yes, you should absolutely live that best 15 or 20 years you can. Otherwise, the portfolio is just going to be depleted by health care at the end of your life, anyway.”

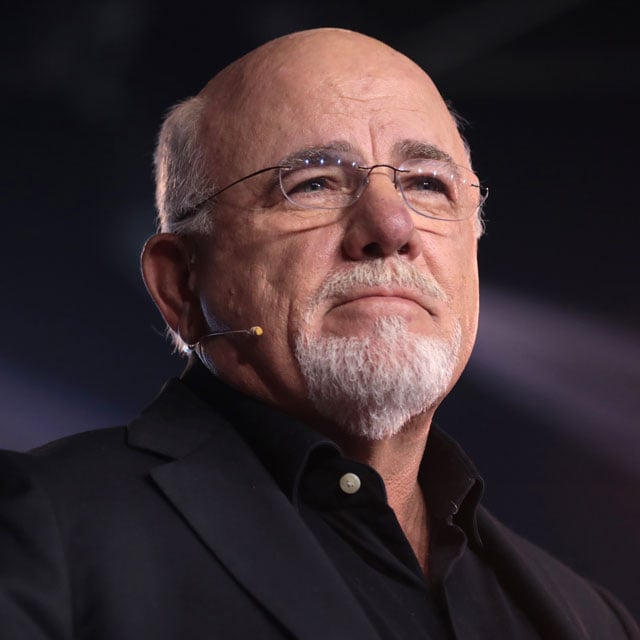

Pictured: Dave Ramsey