$900m of Hannover Re’s gross large losses relate to ILS fronting & Ian

Hannover Re, a major player in insurance-linked securities (ILS) market facilitation through its fronting and risk transformation activities in collateralised reinsurance and catastrophe bonds, booked a $900 million piece of its gross loss from hurricane Ian related to that business.

Speaking today during an analyst call, Hannover Re’s CFO Clemens Jungsthöfel explained that the ILS business means Hannover Re can sometimes book more of a gross loss than might be anticipated, for major catastrophe loss events.

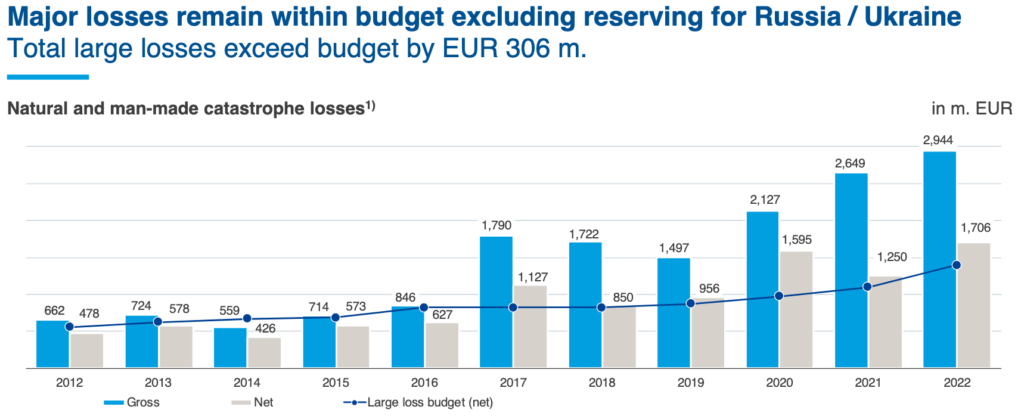

On a net basis, Hannover Re recorded large losses of EUR 1.7 billion for 2022, above budget for the sixth year in succession, as we reported this morning.

But the figure for gross major losses was much higher, at just over EUR 2.94 billion, which was the highest level on-record for Hannover Re.

The chart above shows the trend in large losses, so catastrophe and man-made losses, at Hannover Re and it’s an interesting trend, particularly the jump in 2017, which was around the time the reinsurer began to more significantly expand its activities in the insurance-linked securities (ILS) market.

The collateralised fronting and risk transformation services Hannover Re provides have been steadily growing ever since and, due to the fact the reinsurer puts its balance-sheet to work in writing business it then has collateralised by investors and ILS funds, it means the gross loss figure reported includes losses attributed to some of the ILS business.

CFO Clemens Jungsthöfel explained that, in 2022, the major catastrophe loss from hurricane Ian included a significant component related to Hannover Re’s ILS business.

“You might wonder why the gross loss has increased remarkably compared to our nine-months reporting, while the net loss has only changed moderately in response to loss development in the fourth quarter,” he told the analyst call.

Explaining that, “Hannover Re is a leading player in partnering with capital markets in the ILS space. We structure cat bonds and are active in the area of collateralized reinsurance market.

“Hurricane Ian was a very large loss in the main market for this type of business, so within the EUR 2.9 billion gross loss, we are reporting here, around EUR 900 million is connected to the Ian loss and our activities in the ILS market.

“As we don’t write these risks for our own balance sheet, this number only affects the gross loss.”

As a result, the gross loss figure is inflated by Hannover Re’s growing ILS fronting business, making the calculation of a retrocession recovery far more challenging as well, as this must be considered when extrapolating from the gross loss total to the net.

Also read:

– Hannover Re’s Q1 cat loss budget eroded by Turkey quake and NZ weather: Althoff.

– Hannover Re gets P&C reinsurance profit for 2022 despite over-budget losses.