8 Tips for Buying Life Insurance

Life insurance is a vital part of securing your family’s financial future. While the topic can be a bit daunting to approach, here are eight tips to help guide you through the experience.

Photo by dominik hofbauer on Unsplash

Buying Life Insurance that Meets Your Needs & Budget

Life insurance is a vital part of securing your family’s financial future. While the topic can be a bit daunting to approach, here are eight tips to help guide you through the experience.

1. Determine if you need to buy life insurance

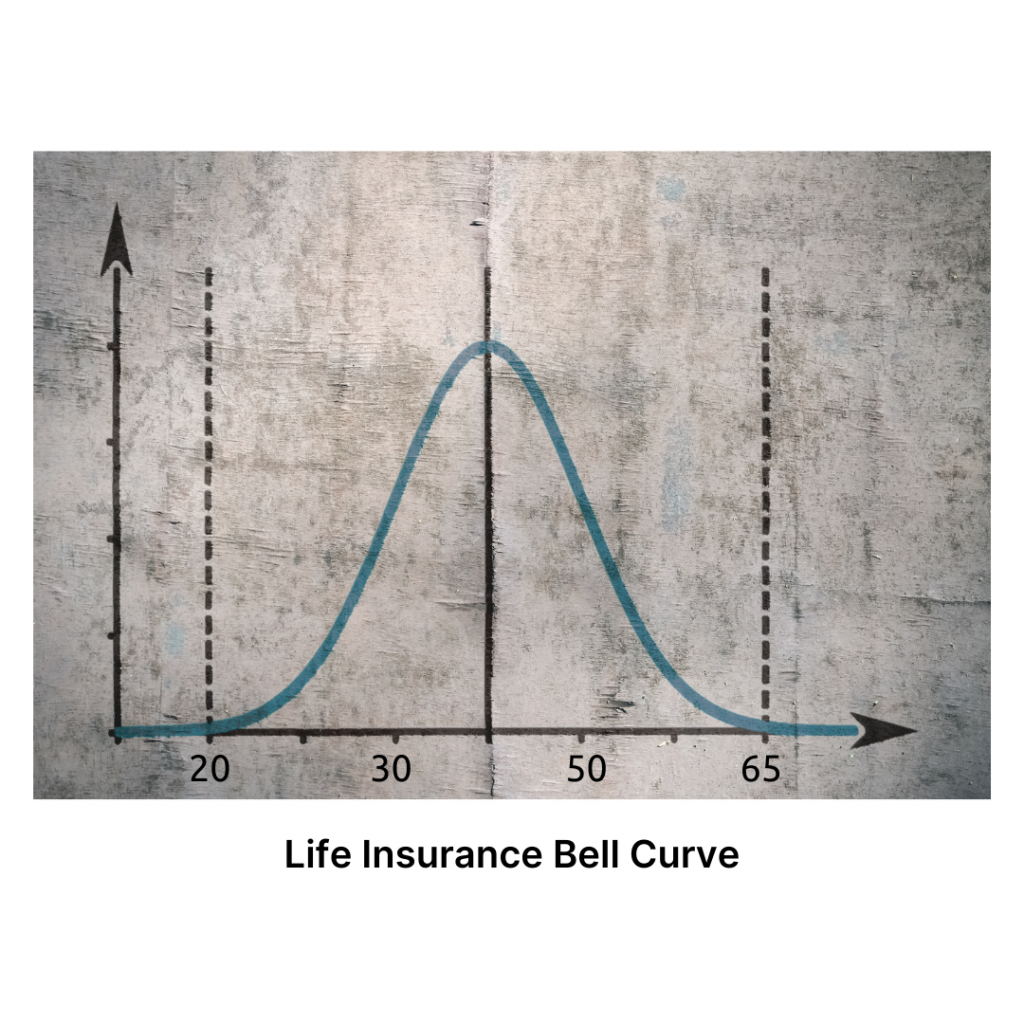

Life insurance is designed to provide financial protection for your family in the event of your death. Consider the need for life insurance as a bell curve.

Starting out in your early 20’s you likely don’t have a ton of financial assets, debt or a family to consider taking care of. But, as you age you might buy a house, get married, have children, be a single-family income household, possibly own a business with a partner or two. Typically, the peak of financial liability in life is around 40 years old.

After your 40’s your kids are getting older, possibly attending college. You are paying off more debt and your mortgage balance is decreasing. Your financial liability is overall decreasing.

By the time you retire around age 65 you are in a strong financial position. You have saved, paid your mortgage off or almost off and you’re in home financial obligations are minor.

When trying to determine if you should buy life insurance, first consider your financial obligations. Asking yourself, how would your spouse and children live without your income contribution to the household. If you have a business, would your spouse have the resources to buy out your portion of that business? Is there a plan in place for your business partners to be financially able to buy out your shares to continue the business?

The bottom line is, if you’re not independently wealthy with zero debt and enough cash to cover the answer to all the above questions, you are in need of life insurance.

2. Determine how much life insurance you need

One of the first steps in buying life insurance is determining how much life insurance you need.

One common benchmark says your death benefit should be about six to eight times your annual earnings, but there are a variety of factors to consider:

Other income sourcesThe size of your familyWhether your spouse works and his or her earning capacity now and, in the future.The number of people who are financially dependent on you and for how longThe death benefits your family will receive from Social Security and any life insurance plan through your employerAnd any special needs such as mortgages, college education funds and estate planning.

For more help determining the right amount of insurance for your needs, checkout our calculator at: How Much Life Insurance Do I Need?

3. Consider other benefits available when buying life insurance

There are different types of life insurance. Some of these policies include a savings feature that allow benefits beyond end-of-life benefits.

4. What type of life insurance meets your needs?

When buying life insurance, you have options. These options can assist you with obtaining coverage for a variety of reasons and budgets.

The basic life insurance policy type is a term policy. These policies have lower premiums and provide coverage for only a specific period of time. However, if you are looking for life insurance that lasts as long as you live, then you are looking at whole life or a universal policy which allows for the option to accumulate savings over time. Cash-value policies have a larger premium than that of a term policy.

5. Determine if you need any “riders” on your policy

Riders are policy add-on’s that are designed to add additional protection to your life insurance policy. The two most common riders you should consider adding to your policy are waiver of premium and guaranteed insurability.

Waiver of premium pays for the life insurance premium in the event that you become disabled during the policy term. Guaranteed insurability allows you to add to the death benefit without providing additional evidence that you are in acceptable health.

6. Work with an agent to determine your needs

There are many ways to save money when buying life insurance. An agent can help review your needs and budget and help you evaluate what type of coverage you might need now or in the future. They understand the market and can suggest a long-term plan for life insurance coverage that will work for your needs and budget.

7. Decide if you will pay your premiums monthly or annually

Just as with auto or home insurance, paying premiums annually can save you money overall. Discuss these discounts with your agent when looking at the various types of plans to see if you are able to save some money.

8. Document your life insurance coverage and share with your beneficiaries

It’s important to keep track of your final wishes, financials, deeds, etc in one place so that your loved ones have a plan in place in the event of your death. Once your new life insurance policy is issued, it’s important to add this policy information to your packet. There are several ways to store these packets so that they are easily accessed by your beneficiaries. A financial planner can also recommend ways that might work better for you in the new digital world.

Bancorp’s insurance agents are available to provide you with a free review and consultation of all your insurance coverages. Contact Us – Bancorp Insurance Call 800-452-6826

Disclaimer: This content is provided for general information purposes and is not intended to be legal advice or in place of consultation with an attorney. Changes may occur in this area of law over time.