8 Life Events that Affect Your Insurance Needs

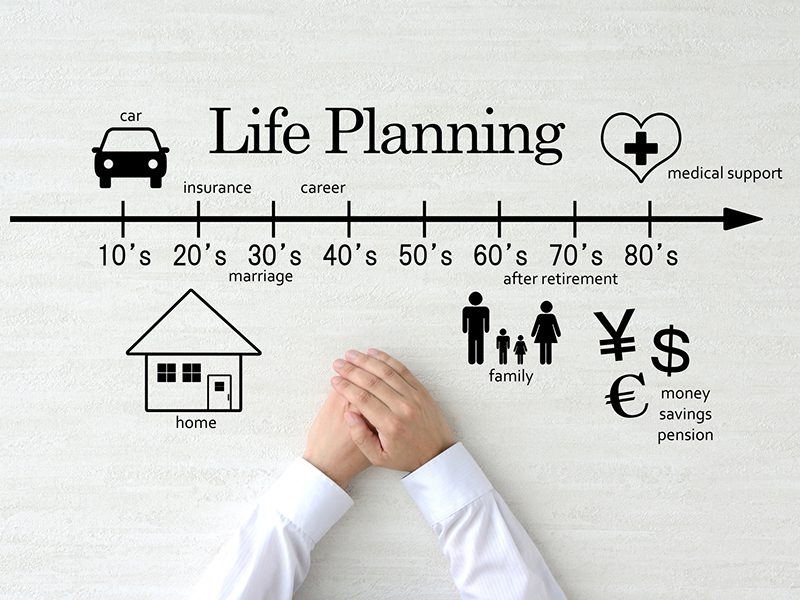

As we age and reach different milestones in our lives, our insurance needs change. In order to ensure adequate coverage, contact your insurance advisor if you’re affected by any of the following 8 life events:

New home ownership— Purchasing a new home is a big investment—one that you’ll want to protect. After purchasing a home, ensure that you have homeowners insurance to protect against things like fire, weather damage, theft, vandalism and accidental damage. This advice also holds true if you’re buying a new condo or vacation home.

Home renovations—Once you own a home, you may want to make updates to create a better living space. Be sure to report major home improvements to your insurance company to protect any increased value to your home.

New children—Having or adopting children is not only a huge life change, but it’s also a major financial commitment. As such, it’s important to purchase the right policy to secure your child’s future. Add your child as a beneficiary on any life insurance policies, and make sure your coverage is sufficient.

Teenage drivers— Teen drivers often carry the highest risk of auto accidents. While you want your teen driver to remain safe on the road, costly accidents can happen without warning. Consider adding your teen driver to your auto policy, as it’s generally less expensive than purchasing a separate policy.

Retirement—When you retire, you may change residences. If you have more than one home, this is a good time to let your insurance provider know where you plan to spend your time.

Valuable purchases—A standard homeowners policy has limited coverage for highly valuable items. Supplement purchases and gifts that exceed the policy’s limits with a floater or a rider—which is a separate policy that provides additional insurance.

Marriage—When your marital status changes, so do your insurance needs. Marriage typically leads to the combination of households, vehicles and other property, so it’s critical to update your insurance policies accordingly. What’s more, life insurance is vital to married couples as it can ease the financial burden in the event of an untimely death of a partner. Ask about discounts on car insurance for married policyholders.

Purchasing or selling a business—If you’re an entrepreneur, there will likely come a time when you’ll either buy or sell your business. During these times of major change, the proper coverage is crucial.

@coverlink_insurance

Curious how your recent accomplishment affects the amount of insurance you need? Give CoverLink a call at 937-592-9076. #insurancetiktok #agent

♬ Level Up – Ciara

We can help.

Insurance is critical for nearly every stage of life and any of these 8 life events should serve as a reminder to review your coverage. Seeking coverage should be an active process, and individuals shouldn’t assume their insurance needs remain steady over time. Contact your insurance advisor today to better understand your insurance, and your future needs. Or, if you don’t have an advisor, give us a call. We can help.