7 Ways AI Can Help Advisors With Wealth Management

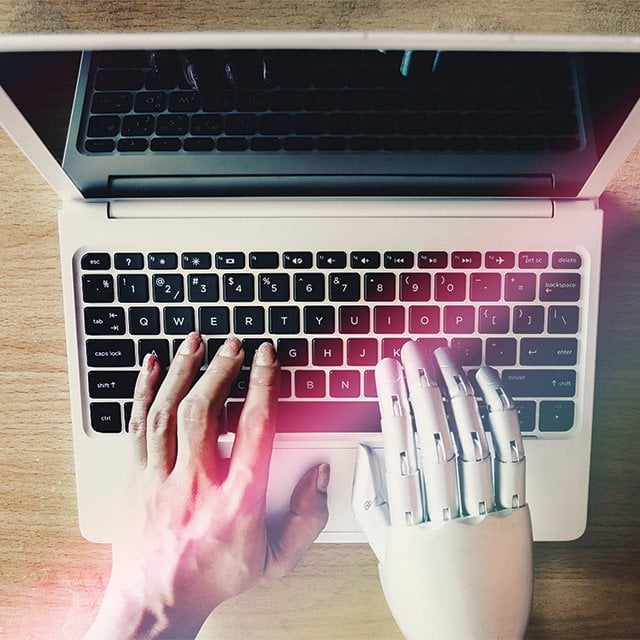

While artificial intelligence may seem ubiquitous, not all AI solutions are created equal. Nor are they all riddled with harbingers of societal doom. In reality (our reality), AI can be highly effective in supporting financial advisors, maximizing their ability to serve clients and helping them build their books of business.

As the founder of a wealth technology firm that works with and advocates for AI every day, I’ve seen its capabilities evolve tremendously. I can see where it’s headed, and I’m incredibly excited about the potential that AI holds for all of us, particularly advisors.

I believe that AI will offer a number of advantages for financial advisors. It’s essential to use these technologies thoughtfully and ethically, considering factors like transparency, data privacy and regulatory compliance to ensure that clients’ best interests are prioritized.

As AI becomes more prevalent in the financial industry, adopting its tools and technologies will give financial advisors a competitive edge. Clients will come to prefer advisors who use advanced AI for better financial planning and investment management.

Here are seven areas I see affecting AI’s ability to enhance the wealth management industry:

1. Data Driving a Revolution

With roughly 4.66 billion active internet users worldwide, data continues to experience exponential growth across all industries and sectors. When we compound user-generated data with the explosion of the Internet of Things and sensors in our everyday lives, it’s difficult to wrap our heads around the vast quantities of data being produced.

By 2025, global data volume should reach 175 zettabytes, which will allow us to train AI models to solve very specific problems.

In the world of wealth management, data strategy has been a part of most firms for the past decade. From investing in cloud platforms, custodial integrations, customer relationship management systems and other software-as-a-service solutions, the amount of proprietary wealth management data has never been greater.

This will accelerate the production of wealth-specific AI solutions, allowing models to be trained in shorter time frames and generate more accurate and personalized results.

2. New Models Proving to Be a Game Changer

The number of models available for addressing business problems has exploded in the past year alone. Since late 2022, large language models have risen to prominence, with AI offerings like ChatGPT and Bard garnering millions of users.

To date, nearly 16,000 open-sourced models have been uploaded to Huggingface, a leading forum for machine learning developers, and hundreds of new LLMs are being announced every week.

For wealth management firms, this translates to a lower barrier to entry for the development of solutions. Whether it’s through AI-centric wealthtech vendors bringing innovative products to market, or in-house developers building solutions for specific firm needs, the accessibility and potential applications of AI are more widespread than ever.

3. More Than Just Chatbots

When we talk about AI, chat assistants often steal the headlines. However, the use of “precision AI” in wealth management can deliver stronger results for advisors, specifically by using supervised learning models to solve specific business needs.

When you start with the outcome in mind and use the latest models to tap into proprietary firm data, you’re able to mine this data for correlations and extract valuable, actionable intelligence that drives growth.