7 Analytical Tools to Improve Your Bottom Line

MMA brings added value to your organization through thoughtful analytics. We believe what gets measured, gets better managed. By embracing data and applying analytic tools, we are able to help organizations better understand their performance, set goals for improvement, and aid in decision-making for program structure and risk tolerance. These insights also allow us to create impactful strategies when negotiating rate and collateral to produce the best outcomes.

Why are analytics useful?

Provide insight as to which program structure and deductible level is best suited for your organization.

Benchmark your individual coverage, limits, deductibles, and rates against your peers to compare with others in your industry.

Quantify the probability and severity of large loss events and identify appropriate limits.

Identify optimal program structure and financing solutions to lower your overall cost of risk.

Measure the financial impact and value creation of implementing risk management strategies

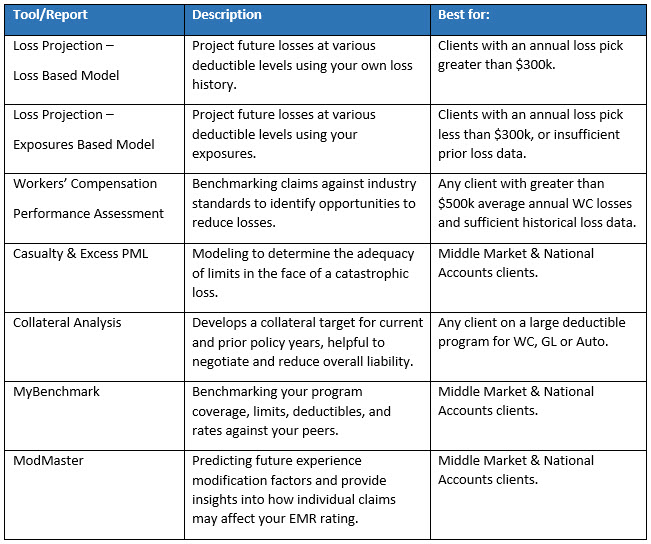

A few of our most widely used tools are summarized below:

If you would like more information on any of these tools, or to learn more about how we apply them to your program, please reach out to your MMA representative today.

Related Resources:

Related Pages:

ABOUT THE AUTHOR

Stephanie Ohrt

Stephanie Ohrt is a Vice President at Assurance who focuses on the staffing and PEO industries. Stephanie’s breadth of insurance knowledge and over 15 years’ experience in the industry is vital to her role in delivering exemplary service and protecting client assets. Stephanie views her primary responsibility as finding creative and cost-effective risk management solutions for clients through outside-the-box thinking and program structuring that fits individual needs. Stephanie is a proponent for educating clients regarding coverage, new laws and market conditions to help them understand Assurance’s business and value. She holds Illinois Property & Casualty and Life & Health Producer licenses, as well as several insurance designations, including Certified Risk Manager (CRM) and Certified Insurance Counselor (CIC).