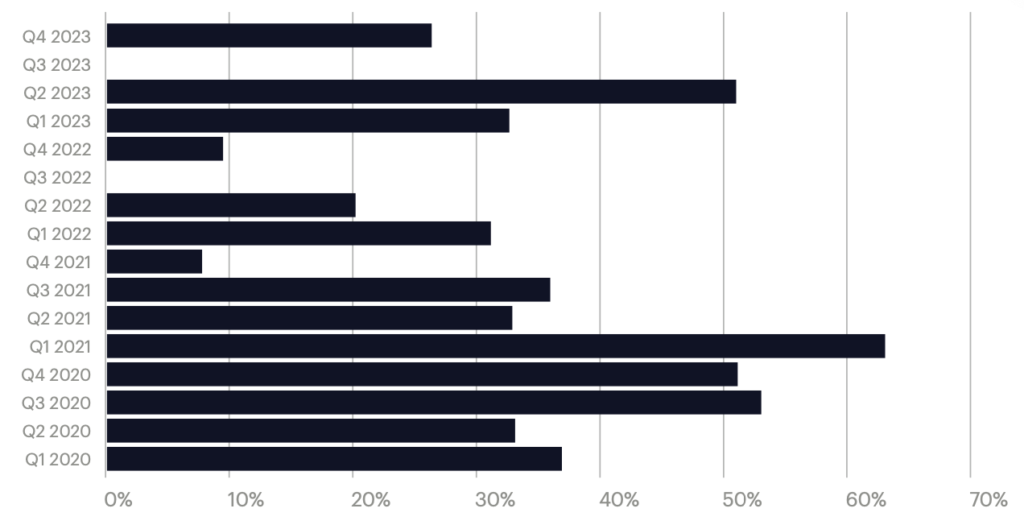

64% of cat bond tranches issued in Q4 ’23 upsized while marketing

During the fourth quarter of 2023, the majority of tranches of cat bond notes closed above their initial target size, resulting in an average increase of 27% for the period, according to Artemis’ data.

The Artemis Q4 and full year 2023 catastrophe bond and related insurance-linked securities (ILS) report shows that this is a stark contrast from the previous quarter when all tranches completed at their initial target size.

In total, Artemis has full issuance size data for 33 tranches of cat bond notes issued in the quarter, and 21, or 64% of these closed above their initial target size. 11 tranches of notes completed at their initial size, and just one tranche of notes closed below the initial target.

The Class B tranche of Nature Coast Re Ltd. (Series 2023-1) notes was the only tranche to shrink in size while marketing, from $75 million to $45 million. However, it’s worth noting that the Class A tranche of this deal increased in size by 100% to $150 million, with the overall size of the deal completing at $195 million, compared with the initial target of $150 million.

Alongside that Class A tranche of Nature Coast Re notes, the Class D tranche of Ursa Re Ltd. (Series 2023-3) notes also grew in size by 100% while marketing.

For the full year 2023, deals upsized by an average of 37.3%, which is above the 23.2% average increase seen in 2022.

The upsizing of deals is a sign of strong investor demand for insurance and reinsurance-linked returns, driven by the hard reinsurance market environment.

As the chart above shows, since the first quarter of 2020, deals have consistently increased in size on average in all quarters, with the exception of Q3 2022 and Q3 2023, which saw a 0% average size change.

All of our catastrophe bond market charts and visualisations are up-to-date, so include this latest quarter of issuance data.

We will keep you updated on all catastrophe bond and related ILS transaction issuance as 2024 progresses, and we’ll report on the evolving trends in the cat bond, insurance-linked securities (ILS) and collateralised reinsurance market.

For full details of fourth-quarter 2023 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of fourth-quarter 2023 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q4 2023 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.